Has the decline stopped this time? Is there a violent rebound and a new bull market next?

Let’s put a picture to let everyone experience the previous bear market and duration of the US stock market. As the Fed develops, they are dealing with crises faster and faster.

Judging from the market yesterday and today, the current situation is more like a temporary pause and rebound, with short sellers taking profits.

Back to the beginning, let’s take a look at the main reasons for this decline:

1⃣️deepseek repricing of AI and computing power, while the new seven sisters have had too much impact on the Nasdaq, which has brought the first callback.

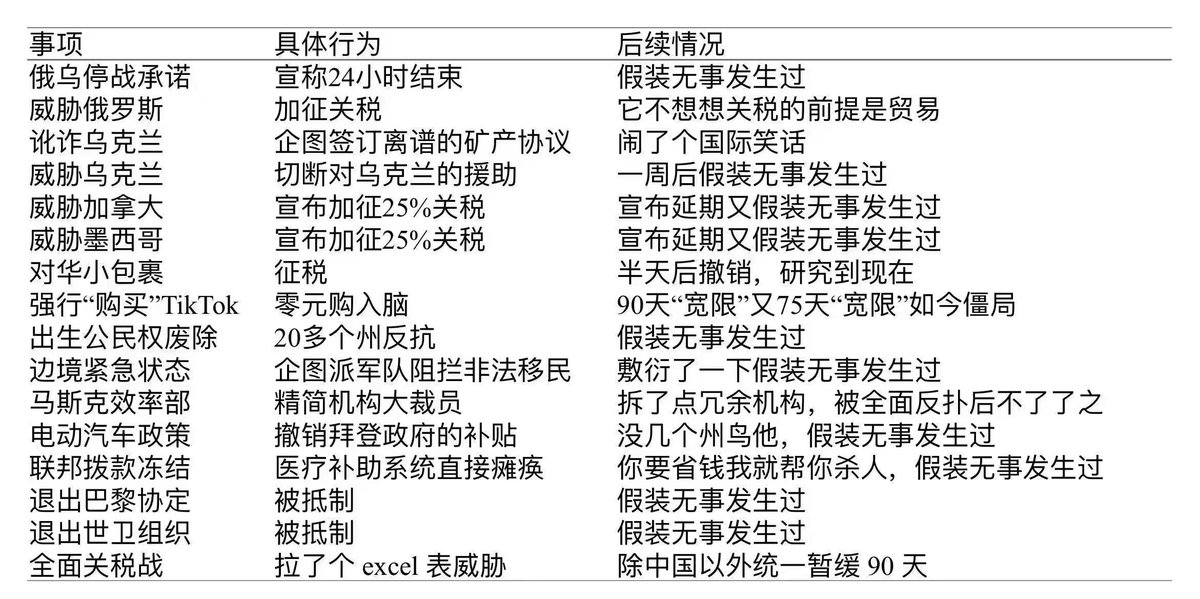

2⃣️The real main reason is that the new tariff war launched by Trump has a huge impact on the world trade order and economic development, as if it dropped an atomic bomb on the calm lake.

—————————————————————

I think the first point is gradually being digested by the market, and the main impact is the AI stocks that have surged in the past few years. Today we will talk about the "tariff war", where is the climax and where is the end?

The starting point of the tariff war is to wave Trump's banner and blow the horn of launching the war. The next step is actually to see how countries fight back? Is it a compromise and renegotiation or a direct countermeasure?

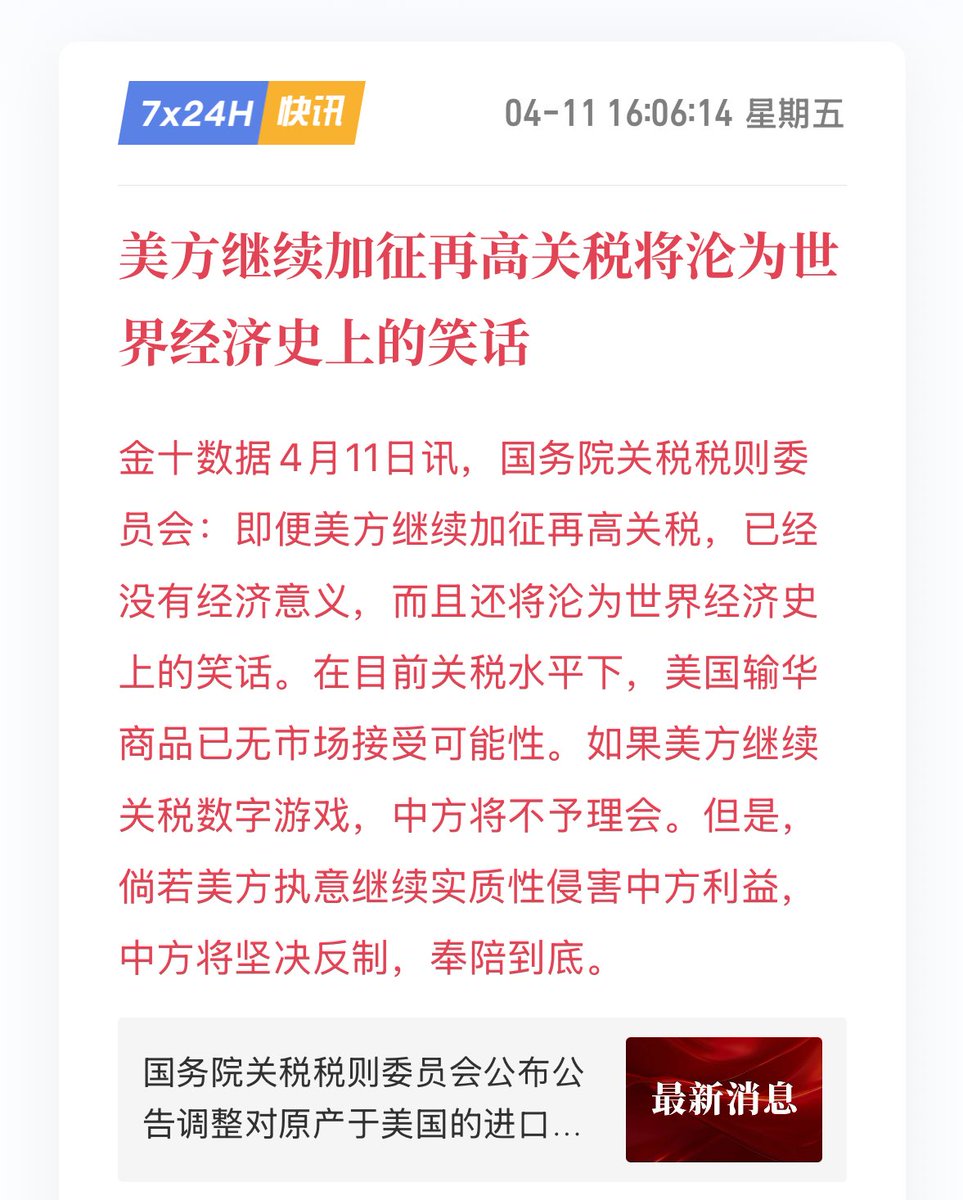

Let’s talk about Dongda University first. After all, China and the United States are the two largest economies in the world. Dongda University’s countermeasures are also the toughest at present. The predecessor imposes a 34% tariff on US imported goods, giving you a complete equality.

At the same time, export restrictions are imposed on key resources such as rare earths. He also did not forget to file a lawsuit with the World Trade Organization, accusing the United States of its tariff measures of violating international trade rules.

The EU has also taken countermeasures against the US's "reciprocal tariff" policy. The first batch of countermeasures focused on US steel and aluminum products, with an amount of 26 billion euros involved and will take effect in mid-April. The EU has also launched an "anti-coercive mechanism". European Central Bank President Lagarde warned that the EU is reducing its dependence on the United States in several areas.

Indian tariff countermeasures: 26% tariffs are imposed on US goods

Japan and South Korea are still discussing.

Australia does not counterattack and criticizes with its mouth.

Vietnam seeks renegotiation…

We can see the fall apart and rebirth of the world trade pattern. But whether the new pattern is a confrontation between two parties, a three-legged stalemate, or a harmonious relationship after a quarrel, we still need to track the development of the incident. From this perspective, this matter is not over and it is still early.

—————————————————————

In addition to the reactions of various countries, the reaction of the Federal Reserve is also crucial. Will interest rate cuts be reduced?

Chairman Powell stressed: "The Fed will remain patient and wait until the situation is clear before considering whether to adjust its policy stance."

To put it bluntly, we still have to wait for the data to come out: employment, inflation. The April data will not be available until May before we can see how employment and CPI will perform in the end.

So I think the variables in the next two months are still very large, but the worst result should be in everyone's imagination.