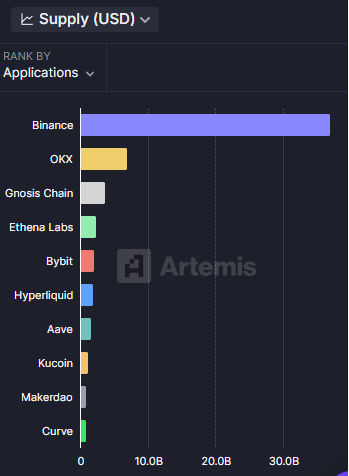

Binance keeps drawing higher stablecoin deposits, reaching a record level of ERC-20 reserves. The exchange leads leveraged trading, where stablecoins are key to building new positions.

Binance remains the leader for stablecoin reserves, as most traders picked the market operator as their main trading venue. Inflows of stablecoins boosted derivative markets, setting up the stage for peak available liquidity.

The inflows of stablecoins into Binance went vertical in the last months of 2024, but slower growth continued in the first quarter of 2024. Despite the market slowdown, the supply of stablecoins remains high, and the assets are waiting on the sidelines for an opportunity to trade. Stablecoins expanded as a way to lower risk. During this market cycle, the supply of stablecoins is growing, even as the crypto market suffers a 30% drawdown from the peak.

The stablecoin inflows mostly reached derivative exchanges, with the supply peaking at over 47B tokens. Spot exchanges attracted a much smaller share of stablecoin turnover, as most of the activity depended on leveraged positions for BTC and ETH.

Stablecoin inflows boost derivative trading

The total supply of stablecoins on exchanges reached 45B tokens of various types, with USDT and USDC still the most common. Binance carries over 33B tokens, including its centrally controlled FDUSD. Binance has a total of $3.38B in USDC, $29.4B in USDT, and another $1.5B in FDUSD. The exchange also carries the most active trading pair for USDT, with $1.67B in 24-hour volumes.

The exchange reflects regional limitations, boosting the usage of regulated USDC tokens in the Euro Area, while discontinuing USDT products. The shift has not affected the general inflow of tokens. Binance still achieves over $17B in daily trading volumes, boosted by the value of the native BNB token and multiple stablecoin markets.

The market is also carrying 5.34% of all USDC trading, having the most active trading pair against BTC. The recent inflow of stablecoins mostly boosts the liquidity of derivative BTC markets, as well as spot markets. The inflow to centralized exchanges follows the general expansion of stablecoins to over 229B tokens, depending on which assets are counted. Most of the stablecoins are dollar-pegged, with around $2B in alternative currencies.

Stablecoins are one of Binance’s key reserve assets. The exchange carries over $133B in total assets, based on its transparency report. USDT reserves are at 104% of user claims. The USDC market is even more over-supplied, with 161% of user claims. The excess reserves grow with fees, liquidation fees, and other user-based payments.

Binance also remains the leading centralized exchange by assets, carrying the most significant share of derivative open interest.

BNB Smart Chain carries 7B in stablecoins

The decentralized Binance ecosystem carries over 7B in bridged or native stablecoins. The chain is the fourth-largest network with a growing stablecoin supply.

Over 53% of all stablecoins are still on Ethereum. ERC-20 stablecoins are also the ones most often deposited into Binance. TRON carries over 28% of the total supply, while Solana has over 10B in USDC, or 5.4% of the total supply.

The three major stablecoins, USDT, USDC, and FDUSD on BNB Chain make up around 5.9B of the supply, up over 2.2B in the past 12 months. The remaining balance is for other smaller bridged stablecoins.

BNB Smart Chain is used for simple transfers and payments through stablecoins. USDT transfers make more than $4.5B, around $500M moves through USDC, and FDUSD has daily transfers of around $60M. Most of the senders on BNB Smart Chain prefer USDT, the main source of liquidity for payments or decentralized swaps.

For now, the growth of the BNB Smart Chain decentralized ecosystem lags behind the success of Binance’s derivative market.

Cryptopolitan Academy: Tired of market swings? Learn how DeFi can help you build steady passive income. Register Now

No comments yet