The US government Bitcoin audit scheduled for this Saturday will reveal the exact cryptocurrency holdings across federal agencies. This first-ever comprehensive accounting of government-held Bitcoin comes at a time when crypto markets are experiencing quite significant volatility and investors are actively seeking greater transparency about US Bitcoin holdings.

Also Read: Top 3 Cryptocurrencies That Could Take Top Charts In April

How the US Bitcoin Audit Impacts Markets, Prices, and Regulations

The Department of Treasury will be disclosing their Bitcoin and also other digital assets on April 5, following President Trump’s executive order. This unprecedented assessment of government crypto reserves could actually explain recent Bitcoin price fluctuations and perhaps even shape future crypto market regulation in the coming months.

A March 6 executive order essentially mandated the government’s Bitcoin audit and established a Strategic Bitcoin Reserve and also a Digital Asset Stockpile. All federal agencies must report their crypto holdings to the Treasury within a period of 30 days from the order.

David Bailey, CEO of BTC Inc, was clear about the fact that:

“Depending on what we learn, might answer many of the open questions about the recent price action.”

The government is currently creating two specialized offices to manage these assets. The Strategic Bitcoin Reserve will primarily hold Bitcoin that the government acquired through forfeitures as a sort of ‘digital Fort Knox’ with a strict no-selling policy going forward.

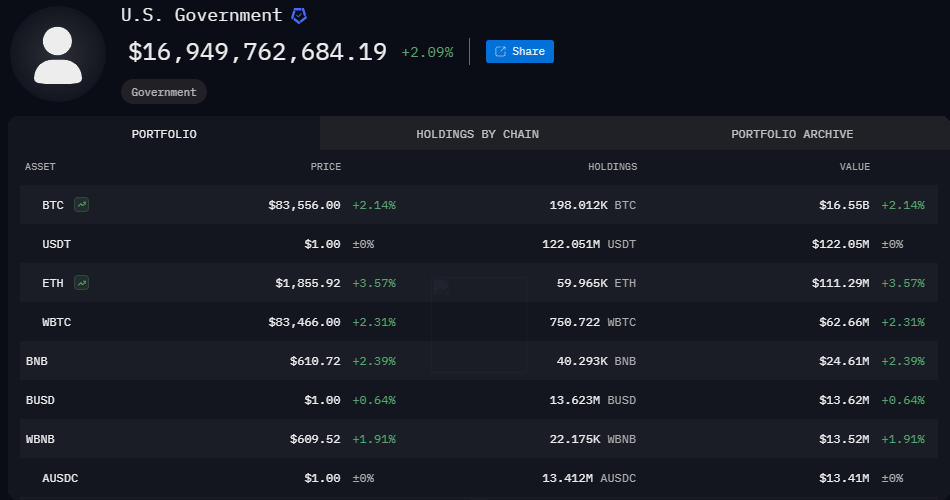

According to the latest Arkham Intelligence data, the US government Bitcoin audit will assess approximately 198,012 BTC worth around $16 billion.

Also Read: Shiba Inu Prediction: AI Sets SHIB Price For April 5, 2025

David Sacks, the White House’s crypto czar, mentioned:

“The government previously held approximately 400,000 Bitcoin through civil and criminal asset forfeitures over the past decade.”

About 195,000 BTC were sold for just $366 million. Had these assets been retained until now, their value today would certainly exceed $17 billion—highlighting the numerous challenges in government crypto management and long-term asset strategy.

Significant Step in Formalizing Crypto Market Regulation

By accounting for digital assets across all federal agencies, the government is essentially signaling a more structured approach to cryptocurrency management going forward.

As the disclosure rapidly approaches, officials and investors as well anxiously wait for findings that could reshape our understanding of the government’s role in cryptocurrency markets and provide valuable context for recent price movements in this increasingly mainstream asset class.

Also Read: Ripple (XRP) Bullish Price Prediction For April 2025

No comments yet