The crypto world is changing rapidly, and the word "stability" of stablecoins often faces many tests.April 10th, the stablecoin sUSD in the Synthetix ecosystem has significantly deaned its anchor, with the lowest price falling to $0.834 and now at $0.860, a deviation of about 14% from the $1 anchor. This fluctuation quickly sparked heated discussions in the community, and many people were worried that this was a signal of a new round of stablecoin crisis.

Mechanism upgrade leads to short-term anchor delamination

After the incident, Synthetix founder Kain Warwick explained the whole story through the X platform and revealed that he had sold 90% of his ETH holdings and increased his position in SNX. Warwick said that the sUSD deankation is not a sign of a systemic crisis, but a temporary "side effect" caused by Synthetix when upgrading key mechanisms.

This should be the second dean event in sUSD history. Last time it wasMay 17, 2024, but the reasons vary. According to analysis by blockchain security agency Chaos Labs, the main reason for the deaning last year may be the sudden withdrawal of a large sBTC/wBTC liquidity provider and the large-scale selling in the relevant Curve liquidity pool after obtaining sUSD through Synthetix's spot synthetic redemption mechanism.

The anchoring of sUSD has long relied on a complex debt management mechanism: users mint sUSD by pledging native token SNX, while the system maintains its 1:1 peg to the US dollar through high collateral rates and debt adjustments. With the adjustment of Synthetix's strategic direction, this old mechanism has been gradually removed and replaced by a new, more efficient and decentralized system - the "420 Fund Pool" under the SIP 420 proposal. The alternation of new and old mechanisms inevitably brings the pain of the transition period, and the short-term dean of sUSD is a manifestation of this process.

Specifically, under the old mechanism, when the sUSD price falls below $1, the pledger can make a profit by repurchasing sUSD at a discount and destroying debts, which will naturally drive the price to rebound. However, with the abandonment of the old mechanism and the new mechanism has not yet been fully in place, the excess sUSD liquidity in the market has temporarily lost effective means of regulation, resulting in price pressure. Warwick stressed that this volatility is only temporary and that the long-term stability of sUSD will be significantly improved as the deployment of the new debt management system is completed. Warwick repeatedly reiterates the nature of sUSD's collateralized stablecoins. Its value is supported by crypto assets such as SNX, rather than relying on complex algorithms to regulate supply and demand, which is fundamentally different from the algorithmic stablecoins that once collapsed.

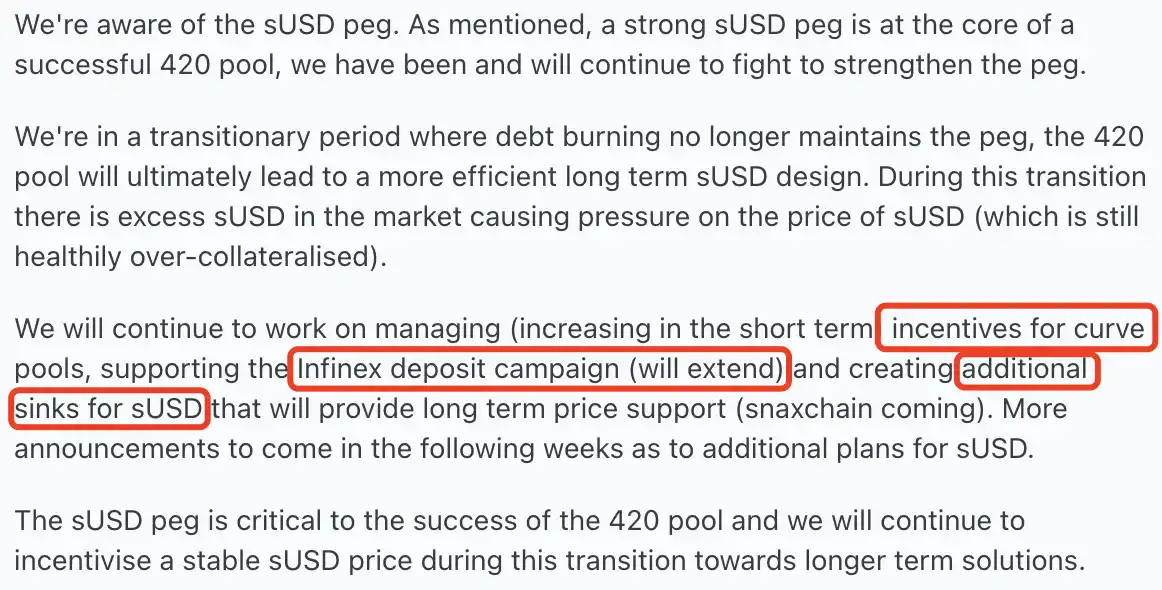

For SNX holders and sUSD users, the team also developed detailed plans for the transition period. Synthetix official further supplemented the response measures through Discord, including strengthening incentives for Curve's fund pool in the short term, extending the support period for Infinex deposit activities, and building a long-term price support system for sUSD.

"Antique Stablecoin" is deansted to the anchor to attract attention. What has Synthetix done in recent years?

To further understand the current situation of sUSD, we might as well first review the development history of stablecoins. The origins of stablecoins can be traced back to 2014, a year that saw the birth of the first stablecoins: USDT of Tether, bitUSD of BitShares, and Nubits. Although bitUSD and Nubits failed to withstand the test of time and faded out of the historical stage one after another, USDT has survived with its first-mover advantage and strong market adaptability to this day, becoming the world's largest stablecoin for trading volume. The success of USDT was not smooth either, with its price significantly decoupled in 2017. But to this day, USDT is still firmly in the top spot in stablecoins.

2018 is another key node in the development of stablecoins. This year, DeFi began to rise, giving birth to the emergence of a number of iconic stablecoins. MakerDAO's DAI, Synthetix's sUSD and Terra's UST were unveiled one after another. At the same time, the CeFi field has also ushered in a second wave of stablecoin boom, including Circle's USDC, TrueUSD (TUSD), Gemini's GUSD and Paxos' PAX. These projects have their own characteristics: DAI achieves decentralized anchoring through over-collateralized ETH, sUSD relies on SNX's high mortgage rate to support the synthetic asset ecosystem, while USDC uses redeemable fiat currency reserves as its selling point. In this history, different types of stablecoins have gradually differentiated into two main paths: collateral and algorithmic. The mortgage-type stablecoins are supported by physical assets as value, and are relatively stable, but they are easily affected by fluctuations in the price of collateral. Algorithmic stablecoins maintain anchoring by adjusting supply and demand through smart contracts. Although they are theoretically more capital efficient, they are easily out of control when the market fluctuates violently.

In 2021, DeFi projects generally recognized the strategic value of their own stablecoins, and many agreements began to vigorously develop the stablecoin ecosystem. However, Synthetix chose to gradually marginalize sUSD, which is undoubtedly a major mistake today. The SIP 420 proposal adopted in early 2025 brings new opportunities to sUSD, with the new mechanism reducing the mortgage rate to 200% by introducing a collective fund pool model and planning to exempt $62 million of historic debts within 12 months, significantly improving capital efficiency and system security. The old debt destruction mechanism has failed, and the new stability module has not been fully in place. This time the dean is caused by the transition period.

Looking at the moment, competition in the stablecoin field is still fierce. Although sUSD is still the third "long-lived" stablecoin in the cryptocurrency field, and although its status is much worse than before, survival time (i.e., the Lindy effect) gives it unique resilience. Today's mechanism adjustment may be just another upgrade on its evolutionary path.

No comments yet