Original title: "sUSD Deank 16%: Is the stablecoin myth broken or a good opportunity to buy at the bottom? 》

Original author: Oliver, Mars Finance

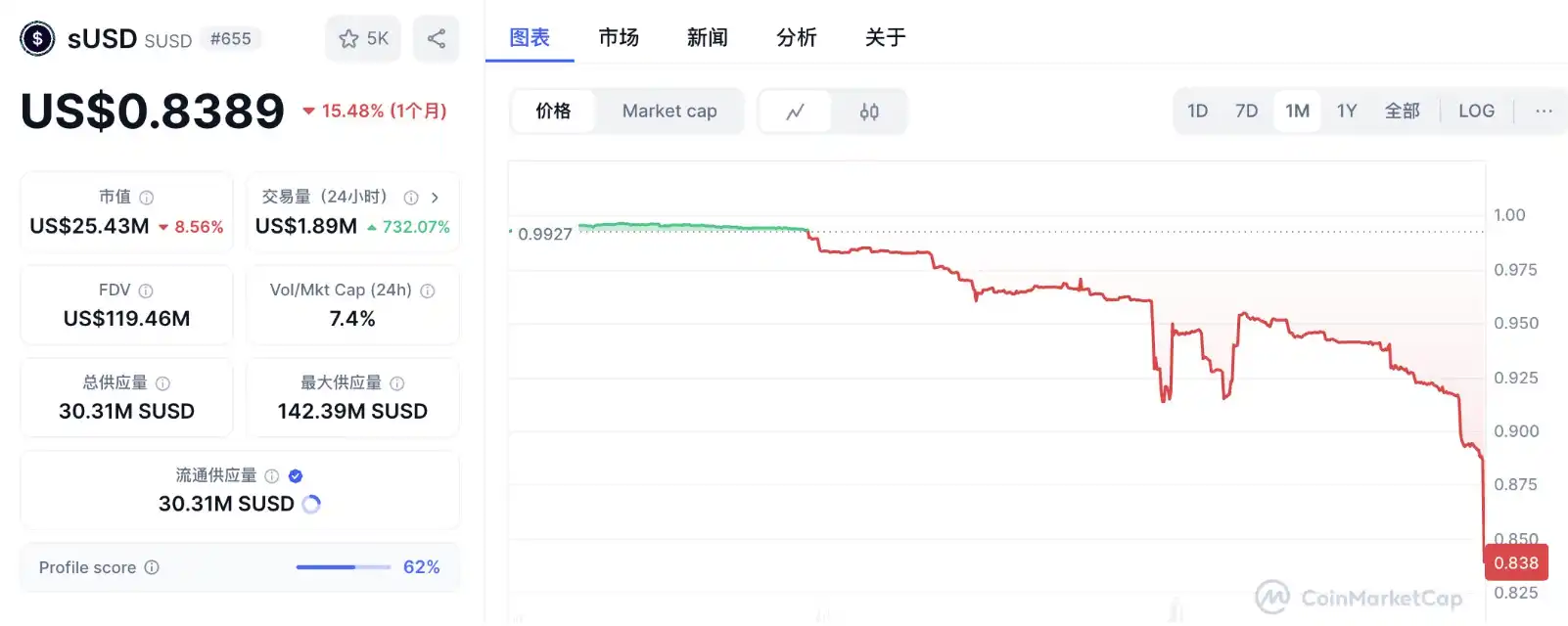

The core stablecoin of the Synthetix ecosystem, sUSD, has been deeply trapped in the quagmire of anchorage recently. As of April 9, 2025, its price fell to approximately $0.8388, a deviation from the theoretical anchor value of $1 by more than 16%, which attracted high market attention. The crisis has been around for more than 20 days since its inception on March 20, and the anchor delamination continues to expand. Meanwhile, Synthetix native token SNX rose against the trend, with a single-day increase of 7.5%, showing complex market sentiment. Synthetix founder Kain Warwick (@kaiynne) attributed the deaning to the transitional pain of mechanism adjustments and revealed that the agreement has sold 90% of its ETH position and increased its position in SNX to deal with it.

Events: The gradual deterioration of deanchoring

The deaning of sUSD does not occur overnight. On March 20, 2025, its price showed a slight deviation for the first time, and did not initially arouse widespread vigilance. However, over time, volatility gradually evolved into a trend decline. By April 9, CoinMarketCap data showed that the sUSD quote had fallen to $0.8388, down more than 16% from the anchorage. This deanknive, which lasted for more than 20 days, not only exceeded expectations in the time span, but also far exceeded the market's conventional tolerance for stablecoins, showing the deep complexity of the problem.

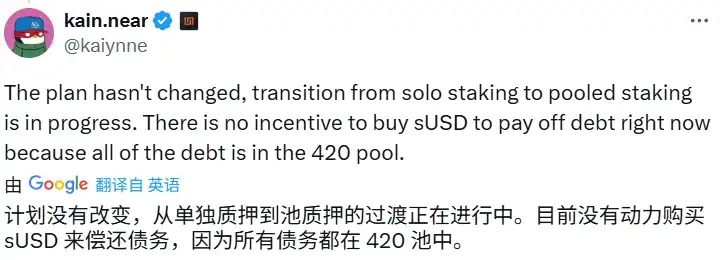

Kain Warwick explained this on the X platform, saying that deaning is an expected side effect of the implementation of the SIP-420 proposal. The proposal aims to optimize SNX staking mechanisms and capital efficiency by introducing a centralized debt pool (i.e., "420 Pool", but the alternation of new and old mechanisms has led to the temporary failure of the anchor repair capability of sUSD. He bluntly stated that at the current stage, "there is no incentive for users to buy sUSD to repay debts", and the imbalance in supply and demand has become a direct driving force for price declines. In addition, the strategy of a deal to sell 90% of ETH positions and increase SNX, although intended to strengthen internal support, may weaken the liquidity and external stability foundation of the system, adding more uncertainty to the market.

The root cause of deanchoring: the superposition of mechanism transformation and market feedback

The cause of this deaning is not a single one, but a result of the interweaving of mechanism adjustments and market behavior, presenting multiple dimensions of challenges.

The implementation of SIP-420 is the core trigger point of the crisis. Synthetix's stablecoin mechanism relies on SNX's over-staking, and users mint sUSD by pledging SNX and bear the volatility risks of the system's debt pool. Under the old mechanism, mortgage rates up to 750% and debt repayment incentives jointly maintain the stability of sUSD. However, SIP-420 has shifted the individual staking model to a centralized debt pool in an attempt to increase the staking appeal of SNX. This transformation theoretically injects long-term potential into the ecology, but disrupts the original balance during the transition period. Warwick admitted that the new mechanism is not yet fully mature, and the old anchor repair function has been temporarily shelved, so sUSD has lost the grasp of self-regulation.

Feedback from market behavior further amplifies the deaning effect. Information from the X platform shows that some users centrally exchange sUSD as USDT or USDC on decentralized trading platforms such as Curve, and the selling pressure quickly exhausted the balance of the liquidity pool. Taking Curve's DAI-USDC-USDT-sUSD pool as an example, the proportion of sUSD increased abnormally for a while, reflecting the decline in market confidence in stability. The market capitalization of sUSD is only US$25 million, and its liquidity is weak. Any centralized selling may trigger significant slippage, causing the price to further deviate from the anchor value.

The protocol-level adjustments also brought unexpected side effects. The decision to sell 90% ETH and increase its holdings in SNX, although strengthening SNX's dominance in the ecosystem, reduces the diversified support of the system. As a widely recognized collateral in the market, its exit may weaken external trust in sUSD, while SNX's volatility increases risk concentration. This strategy may boost confidence when SNX prices rise, but in the context of continuous deaning, it casts shadow on the repair process.

Historical comparison

This is not the first time sUSD has deaned. Looking back on May 16, 2024, sUSD fell to $0.915 due to a whale selling sBTC-exchanged sUSD, with an anchor dean of about 8.5%. At that time, the insufficient liquidity of the Curve pool was superimposed by the sniping of the MEV arbitrage robot, causing the price to be temporarily out of control. Synthetix acted quickly to boost confidence by adding collaterals such as ETH, BTC, USDC, and provide liquidity incentives in Velodrome and Curve, successfully back to $1 after 11 days. That deaning time was essentially an external impact, the mechanism itself was not damaged, and the repair path was clear and efficient.

By contrast, the 2025 deansity presents very different characteristics. The crisis stems from the internal mechanism adjustment of SIP-420 rather than a single external sell-off, and the complexity of the problem has increased significantly. The dean in 2024 lasted for 11 days, a drop of 8.5%, while it has been more than 20 days, a drop of more than 16%, showing the severity and durability of the problem. In addition, the response in 2024 relies on liquidity incentives and collateral diversification, while the strategy in 2025 is more inclined to internal adjustments (such as selling ETH to increase holdings in SNX), and the short-term effect has not yet been shown. This shows that the experience in 2024 is difficult to apply directly, and the repair is much more difficult than before.

Feasibility analysis of bottom-buying sUSD

The current sUSD price hovers around US$0.84. For investors, is it feasible to buy at the bottom and wait for the anchor to return? The 2024 experience provides some revelation. At that time, sUSD rebounded from $0.915 to $1, and bottom buyers received about 9% gains in two weeks. The key to success is the rapid incentives and the transientity of external shocks. Today the price is lower ($0.84), the potential returns are higher (about 19%), but the risks are amplified.

Favorable factors cannot be ignored. SNX's 7.5% increase reflects that market confidence in Synthetix has not collapsed, and the team's active statements and debt relief plans have also injected hope into the recovery. sUSD has a small market value and low demand for funds. If an incentive is introduced for an agreement, small-scale buying can push up the price. However, the risk is equally significant. The anchoring has been deaned for more than 20 days, and the duration is unknown. If the debugging of the new mechanism is delayed, the repair may be delayed for several months. The selling pressure has not diminished, the Curve pool imbalance may further lower prices, and the loss of user confidence may also weaken demand.

Take $100,000 as an example. Buy about 119,000 sUSD at $0.84. If you return to $1, you can make a profit of $19,000 and a 19% yield. But it is recommended to set a stop loss line (such as $0.75) and keep an eye on the agreement announcement. If Synthetix launches incentives similar to 2024, the chances of winning at the bottom will increase significantly; if the price stabilizes and SNX continues to rise, small positions can be built. Compared with the low-risk window in 2024, this opportunity has a higher return, but it has to bear greater uncertainty.

Market reaction and SNX's abnormal movements

Despite sUSD’s deep dilemma, SNX recorded a single-day gain of 7.5% on April 9, a remarkable contrast. Market optimism may stem from expectations of long-term positive for SIP-420. If the new mechanism is successfully implemented, it may enhance SNX's pledge income and ecological status and promote Synthetix's competitiveness in the DeFi field. The "Debt Jubilee" debt relief program mentioned by Warwick may also inject confidence into investors, suggesting that the cleanup of historical debt will reduce the burden on the system.

Community responses are polarized. On the X platform, some users are worried that sUSD may fall into a "death spiral" and question the rationality of mechanism adjustment; while others believe that sUSD with a market value of 25 million is limited, and the rise of SNX is the true reflection of market confidence. Professional analytical agencies such as The Merkle News pointed out that the transitional risk of SIP-420 is underestimated, but SNX's performance shows that Synthetix still has the potential to turn the tables.

summary

From an industry perspective, the impact of deaning the anchor of sUSD is relatively limited. Its market value of 25 million is insignificant in the stablecoin market, far less than the size of USDT or USDC, and has a smaller chain reaction to the DeFi ecosystem. However, for Synthetix internally, continuous deaning may shake user trust. If liquidity pool funds continue to flow out, the practicality of sUSD will be limited, further weakening its position in synthetic asset trading.

In the short term, intensified deaning will likely lead to more selling and prices may be under further pressure. But SNX's firmness has bought a window of time for the agreement. If the new mechanism can be stable in the next few weeks and cooperate with the debt relief plan, sUSD still has the possibility of back-up. In the long run, Synthetix needs to learn from this crisis, optimize the design of stablecoin to avoid similar pains. The success of the mechanism adjustment will determine whether it can gain a foothold in the highly competitive DeFi market.

Unlike the external shocks in 2024, the endogenous nature of this crisis makes its repair path even more tortuous. The Synthetix team needs to take a two-pronged approach to mechanism optimization and market confidence reconstruction to save risks. For investors, the $0.84 sUSD is both a risk exposure and a potential opportunity. Whether it is buying at the bottom or waiting and watching, closely following the subsequent updates of the agreement will be the key. In this storm of anchor dean, the future direction of Synthetix is worth keeping track.

No comments yet