Author: Fairy,

Edit: TB,

“It’s even harder than LUNA.”

In the early morning of this morning, Beijing time, a sudden plunge made many crypto investors sleep all night. MANTRA token OM fell about 10% in just one hour, then directly from $5.21Cliff-style plunge to $0.50, a drop of up to 90%.

There was an uproar, and the community commented: "There are still a lot of people who are storing OMs to pay interest, and they don't even have time to run away, which is even fatal than the LUNA flash crash that year."

This sudden plunge is not just a technical problem, but also a thunder that has been buried for many years has finally exploded.

There are many "black history"? Uncovering the controversial past of MANTRA

In the Web3 world, it is not uncommon for project valuations to deviate from fundamentals, but when a DeFi protocol TVL has only $4 million but can have a full dilution valuation (FDV) of up to $9.5 billion, it is difficult not to raise market doubts about its rationality.

The collapse of MANTRA may not be without traces, and in recent years it has been full of controversial and disgraceful past:

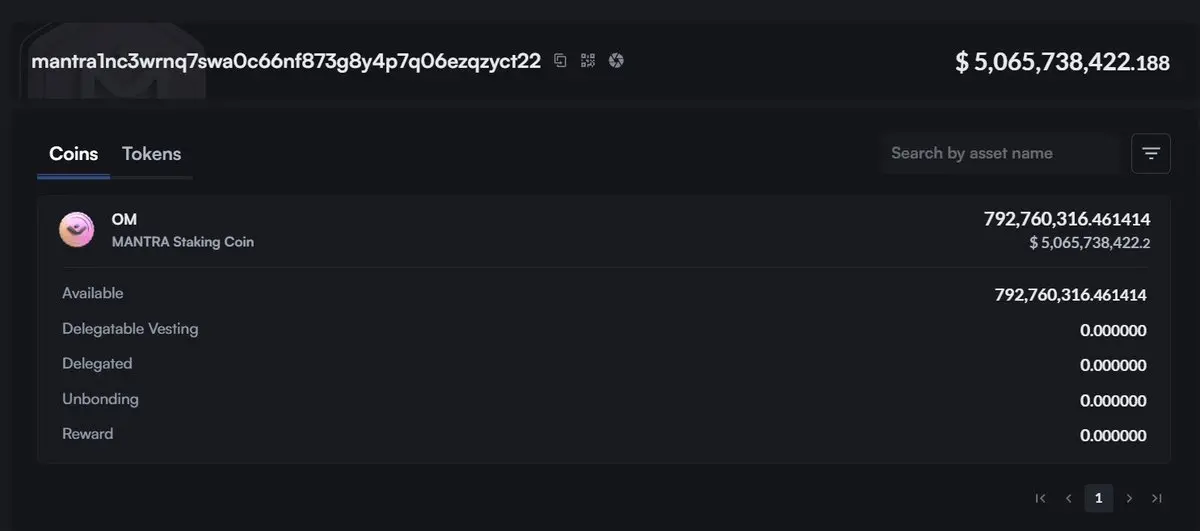

The project party is highly controlled.Crypto analyst Mosi said MANTRA controls most of the flow of $OM. The project party controls market prices and circulation by storing up to 90% of $OM (7.92 million) in a single wallet address.

A token relay game with infinite loops.encryption KOL Rui points out that the underlying logic of the OM project is more like a carefully packaged OTC funding game. It is said that over the past two years, OM has raised more than $500 million in total through ground-pushing OTC sales. Its operation method is to take over the previous round of investors' selling pressure by continuously issuing new OTC tokens, forming a cycle of "new connections with old and old, new out of new". Once liquidity is exhausted or unlocked tokens can no longer be absorbed by the market, the entire system may collapse.

The project team itself will also "withdraw cash" in every round of rise, and obtain additional profits by opening contracts and cooperating with the market pull-up.

Middle East Capital Acquisition Project Shell。In 2023, OM's FDV fell to less than $20 million, and the project was almost abandoned. Subsequently, with the help of the middleman, a Middle East Capital acquired the OM project, retaining only the original CEO, and all the remaining teams were replaced. The capital has abundant real-world assets (such as luxury homes, resorts, etc.) that packages OM as an RWAfi concept project. With the popularity of RWA theme and high control techniques, OM achieved an increase of more than 200 times in 2024.

Involved in legal disputes and was accused of misappropriation of assets.According to the South China Morning Post, the Hong Kong High Court had asked six members of MANTRA DAO to disclose relevant financial information, which was caused by the project party being accused of misappropriating DAO assets.

A large amount of committed fees and tokens are defaulted.Crypto KOL Phyrex said that he participated in the investment in the project in his early years, but never received the promised token. Even after winning the lawsuit in 2023, the MANTRA team has not enforced a court decision on the grounds that it has "already moved from Hong Kong to the United States." He accused: "I have never given any dimes to the money and tokens I owe."

Airdrop operation has been criticized.According to Bingfrog, the MANTRA project party has frequently modified the rules since the early stage of passing the airdrop activity and gradually postponed the token unlocking timetable, which eventually led to users' expectations of airdrops being repeatedly disappointed. During the airdrop distribution stage, the project party lacks transparency, always takes cold measures to deal with community questions, and even introduces a "witch trial" clearance mechanism, depriving users of empty investment space on a large scale on the grounds of the so-called "Sybil attack", but never discloses specific judgment criteria or data.

CrashTruth disassembly: Forced storm and big fleeing

After the OM price experienced a cliff-like plunge and quickly triggered panic and doubts in the community, the MANTRA team made an emergency statement within hours, trying to clarify that the project party has no direct relationship with the violent market fluctuations. Around this plunge, a variety of analysis and speculation have spread in the market. The causes can be roughly summarized as follows:

Forced closing of positions triggers market fluctuations

According to MANTRA co-founder JP Mullin, the drastic volatility in the OM market is triggered by reckless forced closing of OM account holders by centralized exchanges. He noted that closing positions in these account positions occurred very suddenly and did not receive sufficient warnings or notifications in advance.

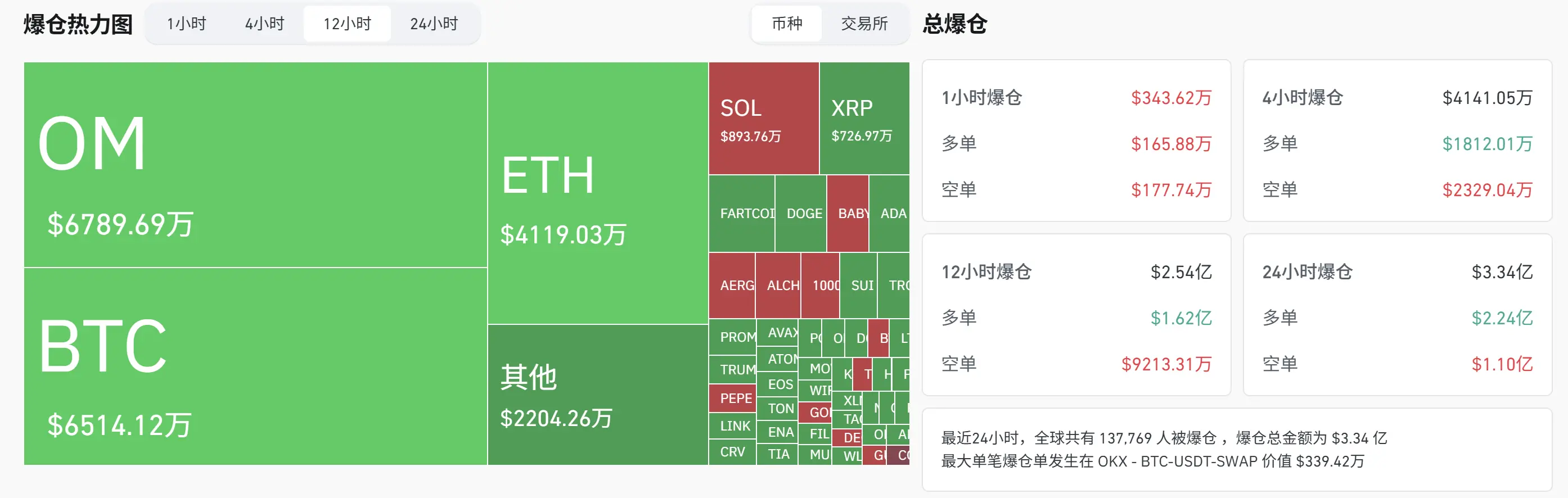

Data shows that over the past 12 hours, the OM crash has resulted in more than $66.97 million in forced closings, with 10 positions clearing more than $1 million.

Strategic investors fled in large amounts

According to Lookonchain monitoring, at least 17 wallets transferred 43.6 million OMs (then worth about $227 million at the time) to the exchange, accounting for 4.5% of the circulating supply. Among them, two wallet addresses are associated with Laser Digital, a strategic investor of MANTRA.

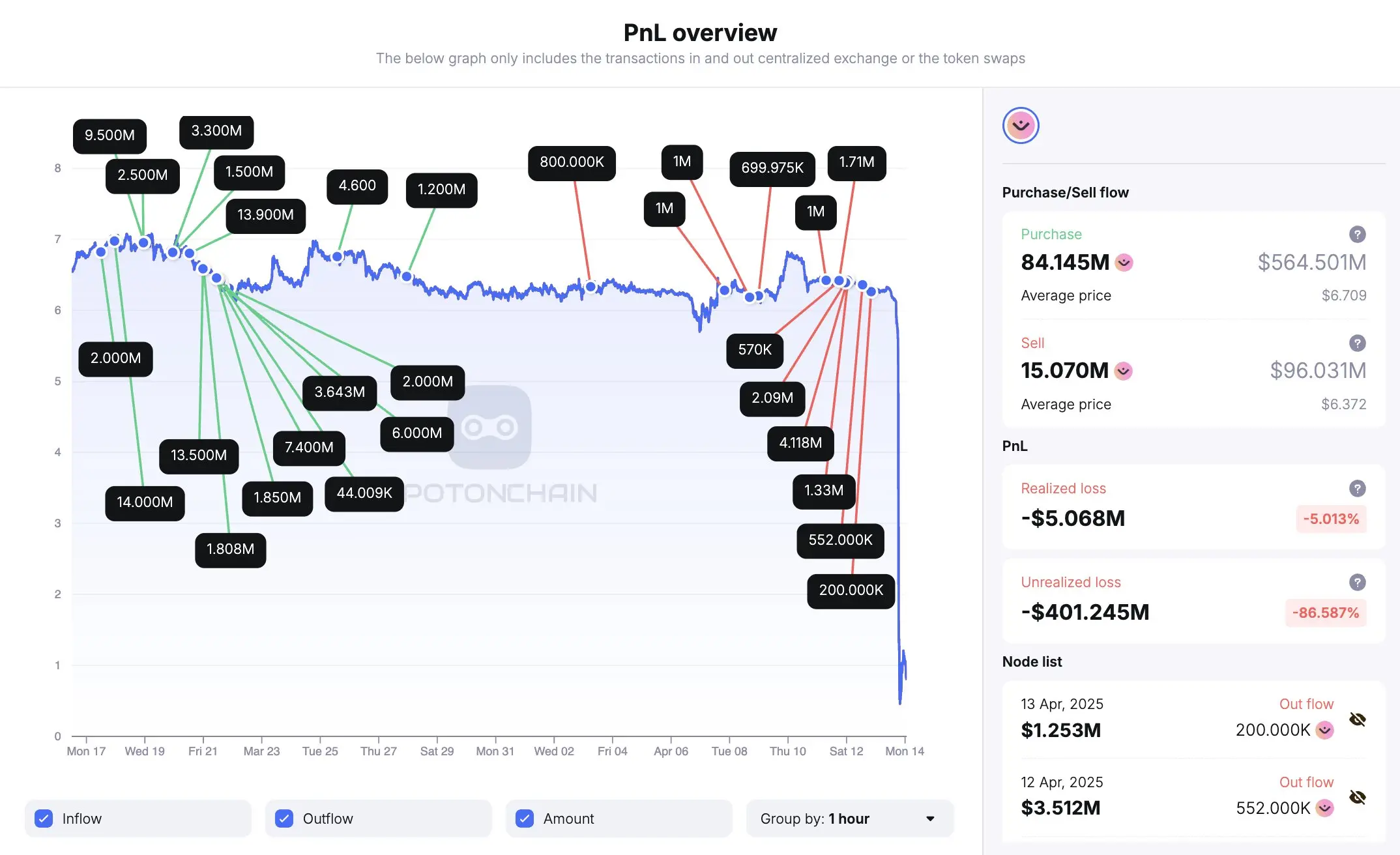

In addition, according to Spot On Chain's monitoring, 19 wallets suspected of belonging to the same entity transferred 14.27 million OMs (about $91 million) to OKX at an average price of $6.375 within three days before the OM crash. Back in late March, the wallets had purchased 84.15 million OMs from Binance, which cost about $564.7 million, with an average price of $6.711. These wallets may have hedged some positions on other platforms, and these operations have exacerbated the plunge.

The 90% plunge of OM once again verifies the cruel reality of the "harvest logic" in the crypto market. OM is not the first project to encounter this fate, nor will it be the last one. In the crypto industry, the coexistence of the air and bubbles. Only by maintaining alertness and rational investment can we move forward steadily in the complex and changeable market environment.

No comments yet