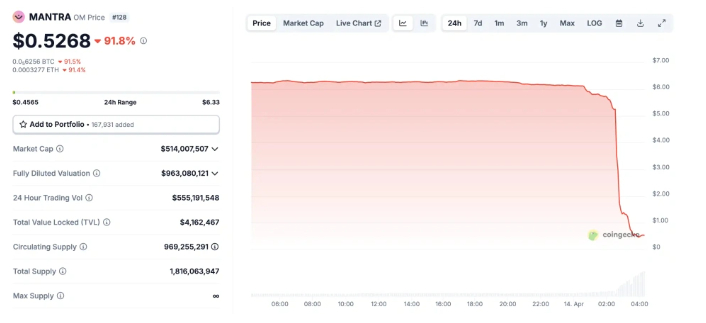

The cryptocurrency market never lacks drama, but OM (Optimism)'s "rollercoaster" movement in the early hours of April 14, 2025, stands as a textbook case of extreme volatility. Within hours, OM crashed from 6to0.5—a 90% plunge erasing 5.5billioninmarketvalue—beforeviolentlyrebounding40058 million in contract liquidations in its wake. This storm not only exposed structural risks in crypto but also revealed the capital games behind price fluctuations.

I. Four Hours of Terror: From Cliff Crash to Pump

00:30-01:00 UTC: OM entered freefall without warning. The price nosedived from 6to0.5, with on-chain data showing coordinated whale dumps:

Laser Digital deposited 1.7M OM ($11.49M) into Binance;

A mystery address withdrew 776K OM ($5.84M) from staking contracts to exchanges;

Another whale transferred $20M OM to OKX 23 hours before the crash.

01:00-02:30 UTC: Panic spread. Rumors of "OM exit scam" and "team dumping" flooded social media, triggering cascading liquidations—89% of the $58M liquidations were long positions.

03:00-04:30 UTC: Plot twist. OM surged from 0.5to2.1, with exchange depth charts showing concentrated buy orders at 0.5−1. On-chain tracking revealed a market maker accumulating 3M OM at the bottom, then pumping the price alongside "community rescue" narratives, completing a 400% rebound in 30 minutes.

II. Behind the Scenes: Whale Games and Contract Carnage

Whale Dumping Triggers "Death Spiral"

24 hours pre-crash, 4 of OM's top 10 holders dumped 4.5M OM (7.2% of circulation). With a small float (620M tokens), the sell-off shattered liquidity.Leverage Amplifies Volatility

OM contracts on major exchanges offered 50-100x leverage—a 2% drop could liquidate positions. During the crash, the OM/USDT long/short ratio on one exchange plummeted from 1.8 to 0.3, turning stop-loss orders into fuel for bears.The "Long-Short Slaughter" Rebound

Market makers orchestrated the slaughter: crushing longs first, then squeezing shorts. During the rebound, a quant fund profited $1.2M via flash loans on DEXs, while retail FOMO trading exacerbated swings.

III. Survival Guide: How Retail Investors Can Avoid Being Prey

Beware Low-Float Tokens

OM's pre-crash market cap was 370M—easilymanipulated.Prioritizetop−50coinswithdailyvolumesexceeding100M.Tread Carefully with High Leverage

83% of liquidated users used 20x+ leverage. Beginners should start with ≤5x leverage and set hard stop-losses (≤10% of capital).Monitor On-Chain Activity

Use tools like Nansen and Arkham to track whales. Sudden exchange transfers from top holders signal dump risks.

This nightmare night reaffirms crypto's jungle law: information asymmetry, capital power, and psychological warfare dictate survival. OM's 90% crash and 400% rebound are mere appetizers on the whales' menu. For retail, the only path is to stay sober in chaos and defend principles amid volatility.

No comments yet