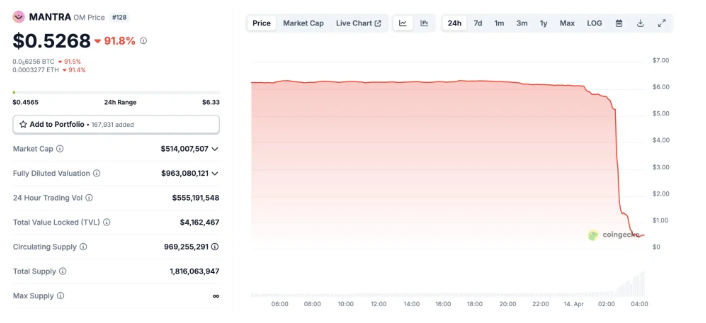

Dear crypto community, today we dissect a shocking black swan event—OM token's 90% flash crash at dawn. This storm not only exposed the fatal risks of highly manipulated projects but also revealed the hidden "whale game" rules in the cryptocurrency market.

I. Event Recap: $5.5B Evaporated in 15 Minutes, Liquidation Tsunami Hits

On April 14, 2025, the price of RWA sector star project MANTRA (OM) plummeted from 6to0.5, a 90% collapse, wiping out 5.5Binmarketcapwithinminutes.Thecrashtriggered58M in leveraged liquidations, with extreme cases showing single addresses losing nearly $1.5M.

Key Timeline:

1:00 AM: OM price began to fluctuate abnormally, with on-chain data showing whales transferring tokens to Binance and OKX;

1:15 AM: Price dropped below $1, sparking chain liquidations and panic selling;

4:30 AM: MANTRA team claimed the crash was due to "irrational liquidations," denying involvement;

5:00 AM: Price briefly rebounded to $1.2, suspected to be whales hunting short positions.

II. Binance’s Response & Market Controversy: Who’s to Blame?

Binance quickly stated that "market mechanisms functioned normally," but community skepticism persists:

Whale Dumping: Laser Digital and other institutions deposited 1.7M OM ( 11.49M)intoBinancepre−crash;awhalewithdrew776KOM(5.84M) from staking contracts;

OTC Discount Rumors: 50% discounted OTC deals allegedly triggered panic selling;

Project Manipulation Evidence: Analysts revealed MANTRA controlled 792M OM (90% supply) via a single wallet, with real circulation at 88M tokens.

III. The "Triple Play" of Highly Manipulated Projects

The OM incident exemplifies a classic manipulation playbook:

Supply Control & Pump: Lockup/staking mechanisms reduce circulation, while community hype inflates prices (OM surged 400% in six months);

OTC Exit: Early investors cash out via discounted OTC channels, then funds recycle to attract retail;

Precision Dump: Exploit on-chain monitoring gaps and execute bulk exchange trades to trigger panic.

Risk Alert: Such projects often flaunt "pump-and-dump" labels, with valuations detached from fundamentals (OM's FDV hit 10Bdespite4M TVL).

IV. Investor Lessons: How to Avoid Being "Harvested"?

Beware Abnormal Supply: Avoid projects where top 10 wallets hold >80% tokens;

Avoid High Leverage: 40x leveraged OM positions were liquidated on Binance;

Monitor On-Chain Data: Use Arkham/Nansen to track whale movements;

Shun Opaque Projects: OM repeatedly altered airdrop rules, extending unlocks from 1 month to 3 years.

V. Industry Reflection: Urgency for Regulation & Transparency

The crash highlights systemic risks:

Exchange Accountability: Implement large-trade s and volatility circuit breakers (e.g., Binance's "abnormal volatility pause");

Project Compliance: SEC intensifies scrutiny on token issuers, demanding disclosure of controllers;

Investor Education: Promote tools like "MCAP/FDV ratio" and "on-chain holder distribution."

Conclusion

The OM crash is a wake-up call for investors chasing "get-rich-quick" fantasies. In crypto's treacherous waters, only those who see through illusions and master the rules survive. Remember: When whales hold all the chips, retail’s odds are predetermined to zero.

No comments yet