Today, MANTRA's native token OM on the Binance platform crashed by more than 90% within just one hour, marking another major event following the successive collapses of tokens like ACT, TST, MASK, and LEVER.

According to Coinglass data, in the past 12 hours, OM’s liquidation volume across the network reached $68 million, with $49 million in long liquidations and $19 million in short liquidations, surpassing Bitcoin’s liquidation volume in the same period. Notably, between 02:28:32 and 02:29:20 (UTC+8), 10 bottom positions worth over $1 million in OMUSDT were liquidated on Binance and Bybit.

This crash led to a market capitalization loss of over $5.5 billion, with numerous investors suffering massive losses. The crypto community is in an uproar, and the reasons behind the event have drawn widespread attention.

The Crash Unraveled: From Wallet Movements to Market Collapse

AltCryptoCast founder AltCryptoGems provided a detailed breakdown of the event, revealing the triggers and chain reactions behind the crash.

The Trigger: Massive Token Deposits to Exchanges

The event originated from a wallet address believed to be linked to the MANTRA team, which suddenly deposited 3.9 million OM tokens (about 0.4% of the circulating supply) to OKX. The MANTRA team controls nearly 90% of OM’s total supply, a highly centralized token distribution that had long been a hidden risk. The community widely believes this high-control model means a few individuals hold absolute control over the price.

A Brewing Trust Crisis

Over the past year, the MANTRA project has repeatedly sparked community skepticism:

1. Allegations that the team artificially inflated prices through market makers, concealing opaque tokenomics.

2. Promised community airdrops were repeatedly delayed, causing dissatisfaction.

3. The tokenomics model was reportedly altered quietly without full disclosure.

4. These issues eroded community trust, with investors growing increasingly wary of the project’s opaque operations.

OTC Trading Fuels Panic

Market rumors suggest MANTRA struck private OTC deals with some investors, selling tokens at 50% or even higher discounts. When news of massive token deposits to exchanges spread, investors feared an imminent large-scale sell-off, leading to immediate selling pressure. Worse still, OTC buyers faced rapid losses due to the price crash, and their panic selling further intensified market turbulence.

Chain Reaction: Liquidations and Collapse

1. The sell-off triggered a domino effect:

2. Stop-loss orders were activated, and leveraged positions were liquidated in succession.

3. Market liquidity dried up rapidly, with the price plummeting 90% in one hour.

4. Panic spread, as retail and institutional investors rushed to exit, leading to a complete market breakdown.

Data Tracking: On-Chain Clues Emerged Early

Signs of the OM crash were detectable in advance.

Lookonchain Monitoring: Before the crash, at least 17 wallets transferred 43.6 million OM (worth about $227 million, 4.5% of circulating supply) to exchanges. Two addresses were linked to MANTRA’s strategic investor, Laser Digital.

Spot On Chain Disclosure: Nineteen wallets, suspected to belong to the same entity, transferred 14.27 million OM (about $91 million) to OKX at an average price of $6.375 in the three days before the crash. These wallets had previously purchased 84.15 million OM at an average price of $6.711, with some positions possibly hedged on other platforms, further intensifying selling pressure.

Crypto KOL Phyrex Revealed: Early MANTRA investors never received promised tokens, and even after winning a lawsuit in 2023, the team refused to comply, citing a move from Hong Kong to the U.S. He angrily stated, “Not a single cent or token was ever paid.”

Crypto Analyst Mosi Noted: MANTRA concentrated 90% of OM (about 792 million tokens) in a single wallet, a highly controlled model that laid the groundwork for the crash.

KOL Rui Argued: OM’s business model resembled a “carefully packaged OTC funding game.” Over the past two years, MANTRA raised over $500 million through aggressive OTC sales, using newly issued tokens to absorb selling pressure from old investors. Once the market could no longer absorb unlocked tokens, the system collapsed rapidly.

Community Reaction: Anger and Disappointment Intertwined

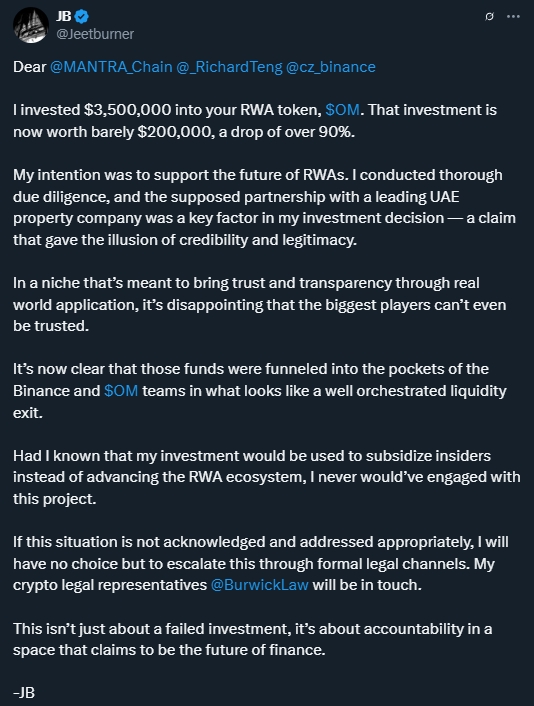

The crypto community is in an uproar, with many users reporting significant losses. User @Jeetburner posted to MANTRA_Chain, Binance executives Richard Teng, and CZ, stating he invested $3.5 million in $OM, now worth only $200,000, a loss exceeding 90%.

Jeetburner had hoped to support RWA (Real World Assets) development, investing based on due diligence, particularly MANTRA’s supposed partnership with a leading UAE real estate firm. However, he believes Binance and the $OM team orchestrated a liquidity exit, funneling funds to insiders rather than advancing the RWA ecosystem. He expressed disappointment, noting that a sector meant to bring trust and transparency has proven unreliable, even among major players. If unresolved, he plans to pursue legal action and has engaged crypto legal representative BurwickLaw. He emphasized that this is not just an investment failure but a matter of accountability in an industry claiming to represent the future of finance.

Project Background: From Lows to Surge to Collapse

OM’s history is dramatic:

1. 2023 Low: OM’s fully diluted valuation (FDV) once fell below $20 million, with the project nearly abandoned.

2. Middle Eastern Capital Takeover: That year, a Middle Eastern fund acquired MANTRA, retaining only the original CEO while replacing the entire team. Repackaged with luxury properties, resorts, and other RWA assets, MANTRA was rebranded as an RWAfi (Real World Asset Financialization) concept project.

3. 2024 Surge: Riding the RWA wave and high-control operations, OM achieved over 200x gains, attracting hordes of investors.

4. 2025 Collapse: Highly centralized token distribution, opaque operations, and OTC model risks finally surfaced, leading to a complete collapse of market trust.

Industry Response: A Wake-Up Call

Exchanges and Industry Leaders

Regarding the OM crash, CZ posted a response, reminding everyone: “Don’t chase narratives. Stick to fundamentals—projects with users, revenue, and profits. Stay safe!” He noted that the post was advice for investors amid events undermining trust in the crypto industry, helping them make informed strategic decisions.

On users’ interest in CZ’s take on OM, he replied patiently: “Like everyone else, ‘What happened to it?’ I only learned about this project minutes ago.” He added, “The team providing no information for so long is not a good sign.”

Users concerned about spotting risks in projects like OM asked CZ for tips on evaluating fundamentals. CZ suggested that a project’s user base is often a strong indicator.

OKX CEO Star stated that this is a major scandal for the crypto industry, with all on-chain unlocks and deposit data publicly available. Collateral and liquidation data from major exchanges may face scrutiny, and OKX is preparing all reports.

MANTRA Official Statement

OM is the native token of the MANTRA project. The MANTRA community issued a statement claiming that today’s abnormal OM fluctuations were caused by “disorderly liquidations” unrelated to the project itself, emphasizing that the event was not caused by the team: “MANTRA Community—We want to assure everyone that MANTRA’s foundation is solid. Today’s events were triggered by reckless liquidations, unrelated to the project itself. To clarify: this was not our team’s doing. We are investigating and will share more details soon.”

According to MANTRA co-founder JP Mullin, the extreme volatility in the OM market was due to reckless forced liquidations of OM account holders by centralized exchanges. He noted that these liquidations occurred abruptly, without sufficient prior warning or notification.

Lessons and Advice

The OM crash sounds a warning bell for the crypto market. AltCryptoGems summarized the following investment cautions:

1. High-Control Risk: When a few control most of the token supply, prices are easily manipulated, with a high risk of collapse.

2. Transparency Matters: Projects with opaque operations or repeatedly delayed promises warrant extra caution.

3. Beware Abnormal Price Behavior: Overly stable or “too good to be true” prices often hide risks.

4. Thorough Research Is Essential: Before investing, comprehensively analyze a project’s fundamentals, tokenomics, and on-chain data.

Conclusion

The OM crash is not just a price collapse but another test of trust in the crypto industry. From high-control models to OTC funding games and opaque operations, the issues exposed by MANTRA deserve deep reflection from every investor. Choose the right exchange to avoid many issues, such as Xbit DEX. Amid the frenzy of chasing trends, staying rational and focusing on fundamentals may be the best path to avoiding such tragedies.

No comments yet