Although Treasury Secretary Bessent repeatedly claimed that the Trump administration was indifferent to the stock market, noting that Trump's core voter, the bottom 50% of Americans, does not hold stocks, he has become increasingly worried as the situation worsens. On Sunday, amid escalating concerns, Becente flew to Florida to meet Trump in an emergency to try to convince him to resolve the stock market turmoil.

The Federal Reserve has suspended interest rate cuts, and the "safe-haven" attributes of the US dollar and Treasury bonds both declined

The U.S. stock market plummeted about 20%, and the market showed "abnormal" behavior: not only the US dollar, as a conventional safe-haven asset, is weakening, but the bond market, which provides investors with protection for stock decline, has also sold out during the same period.

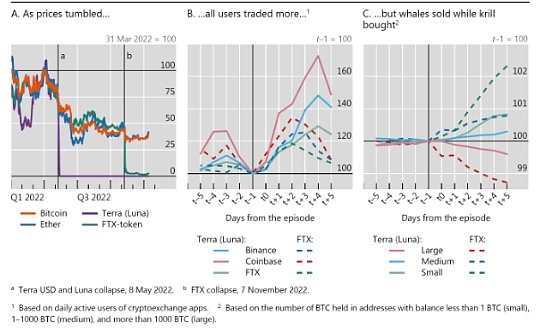

The market is deeply concerned about the inflationary pressure caused by tariffs. Powell also said in his recent speech that the Fed mayTemporarily suspend interest rate cuts,Emphasize the need for a comprehensive understanding of the broader economic impacts of these tariffs – these effects remain uncertain. In the crypto space, BTC’s real volatility began to decline, which made selling puts and call options more attractive.

US stocks fell and market value evaporated severely, Trump suspended interest rate hikes in some countries

Although the United States has no substantive discussions with any other country (and Japan, South Korea, the United Kingdom and Vietnam may release anti-sanctions information in the near future), Trump has announced a 90-day suspension of tariffs on countries that have not taken retaliation measures.

The continued tariff tensions have caused economic risks to escalate. American consumers will gradually reshape the new consumption system in the face of increased cost of living, increased investment risks and more potential economic risks. The tariff suspension reflects Trump and Becente’s concerns over the secondary impact of the stock market decline (market value has evaporated by nearly $15 trillion), and the potential consequences of the ongoing sell-off of U.S. bonds.

BTC currently has strong support levels, and reasonable operation of bearish and call options can explore profit margins

BTC has strong support at $73,000. This is also reversed as BTC’s actual low of $74,437 in the recent turbulent week. Although the risk/reward ratio is slightly improved at these levels, there is little chance of a significant parabolic breakthrough. BTC may remain within a wider trading range, making strategies such as selling puts and call options particularly attractive.

Currently, $90,000 is the core upward resistance level of BTC, very close to the key 21-week moving average. The 21-week moving average usually determines whether BTC is in a bullish or bearish zone. Meanwhile, during the current uncertainty fluctuation period, it is beneficial to the option seller.

Disclaimer: The market is risky, so be cautious when investing. This article does not constitute investment advice. Digital asset trading can have great risks and instability. Investment decisions should be made after careful consideration of personal circumstances and consulting a financial professional. Matrixport is not responsible for any investment decisions based on the information provided on this content.

No comments yet