ProShares has amended its filing to indicate that its XRP futures ETF is expected to launch on April 30. While the date confirms the product is ready, the market has not yet passed the acceptance. The fund will focus on the futures and swaps linked to XRP but will not invest directly in the tokens.

ProShares first proposed the ETF in January. In 2021, Bitcoin futures ETF established ProShares as the market leader for traditional financial instrument exposure to such assets. The BITO ETF managed to attract a great amount of capital when it was launched but was deemed disfavored by getting approval later than spot products. Analysts now believe that the wait for a spot-based version of the XRP ETF to come to the market may be much shorter.

Nate Geraci, the President of the ETF Store, claimed that a possible spot XRP ETF approval will arrive “sooner rather than later” as the interest among the investors and issuers rises.

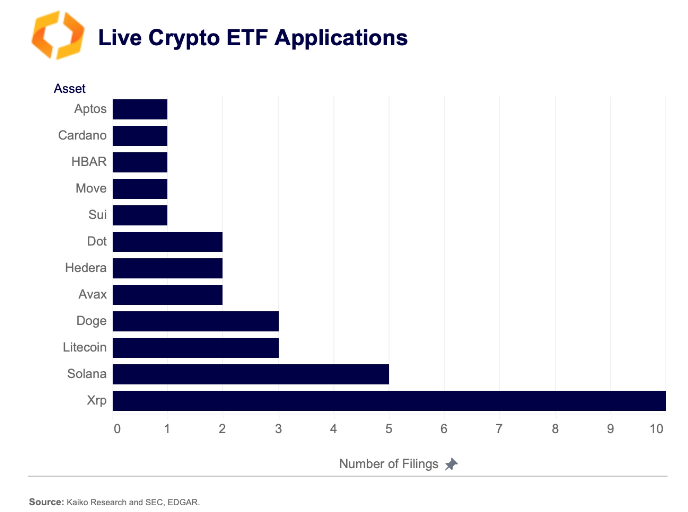

XRP leads the pack in spot ETF prospects

Kaiko’s recent market report indicates that XRP has surpassed Solana in the race to achieve spot ETF approval. This edge can be attributed to increased market depth, renewed listings on the U.S exchange, and fresh leveraged ETFs.

Kaiko also pointed out that the launch of 2x leveraged XRP ETF by Teucrium makes a strong case for the overall XRP ETF market.

“It’s hard to argue against allowing a spot product when there’s already an active ETF like this, which is highly levered and riskier than a vanilla spot ETF.”

~ Kaiko’s Adam Morgan McCarthy.

XRP’s spot volume has risen to its highest since the end of 2020, when the SEC lawsuit started, leading to the mass delisting of the token. The coin is now in the fourth rank based on market capitalization and has regained interest from both institutional investors as well as fund issuers.

Kaiko also pointed out that XRP has high liquidity in trading, and the SEC has approved exposure products that operate indirectly on the Ripple network before its competitors. However, Solana-based funds remain strong candidates, and regulatory history and trading volume for XRP make the case for near-term spot ETF approval strong.

Grayscale, Bitwise, 21Shares, CoinShares, and Canary Capital have all submitted their applications for spot XRP ETFs. These moves signal higher institutional engagement with digital commodities other than Bitcoin and Ether.

The SEC has been reluctant to approve spot crypto ETFs in the past, which has been a source of criticism, including from SkyBridge Capital’s Anthony Scaramucci. He earlier attributed the delay in approving a spot Bitcoin ETF to the commission’s old-fashioned methodology.

However, as the regulatory standards change and more tokens achieve greater liquidity on an exchange, market players think that the path to obtaining an XRP ETF may be shorter. If approved, XRP would be the first altcoin to be listed in the US after Ethereum.

As of this writing, XRP is trading at $2.08, with an increase of over 13% in the last week. XRP has remained on the uptrend, despite being slightly below its 2018 levels of $3.40, but came near the peak early this year in January.

Since the election victory of Donald Trump in November 2024, there has been a significant increase in investment in XRP, which has seen its price appreciate by more than 300%.

Cryptopolitan Academy: Want to grow your money in 2025? Learn how to do it with DeFi in our upcoming webclass. Save Your Spot

No comments yet