Futures Morning Peak-Audio Version

Female Mandarin Version

Macro News

1. People familiar with the matter said that the U.S. demand for Ukraine to repay aid appeared to be eased during negotiations between the two countries on a mineral agreement. After a round of negotiations in Washington last week, people familiar with the matter saidThe Trump administration has estimated the aid the U.S. has provided to Kiev since the Russian-Ukrainian conflict broke out in full swing.$300 billion has been reduced to about $100 billion.

2. Data from the China Passenger Car Branch showed that from April 1 to 13, the national passenger car market sold 515,000 vehicles, an increase of 8% year-on-year compared with the same period in April last year and a decrease of 14% from the same period last month. The cumulative retail sales this year have been 5.642 million vehicles, an increase of 6% year-on-year.

3.Ministry of Foreign Affairs responds to US's additional bid for China245% tariffChina has repeatedly stated its solemn position on the issue of tariffs. This tariff war was initiated by the United States. China has taken necessary countermeasures in order to safeguard its legitimate rights and interests and international fairness and justice, which is completely reasonable and legal. There are no winners in tariff wars and trade wars. China is unwilling to fight, but it is never afraid of fighting.

4. The National Bureau of Statistics released data, preliminary accounting, in the first quarter,China's GDP31875.8 billion yuan, a year-on-year increase of 5.4%. Since the beginning of this year, facing the more complex and severe domestic and international environment, China's economy has faced difficulties, achieved a good start, and high-quality development is new and improving.

5. Sheng Laiyun, deputy director of the National Bureau of Statistics, said at a press conference of the State Information Office that the operation of China's prices has obvious phased and structural characteristics.We must take multiple measures to promote a reasonable price recovery and keep the price level within a reasonable range.On the one hand, we must expand domestic demand, and on the other hand, we must coordinate the relationship between deepening supply-side structural reform and expanding domestic demand. In addition, it is necessary to regulate market order and promote the construction of a unified national market. These measures will help promote a reasonable rebound in price levels.

6. The World Trade Organization on Wednesday lowered global commodity trade expectations from steady growth to decline, saying that further tariffs and spillover effects of the United States may lead to the worst decline in global commodity trade since the peak of the COVID-19 pandemic. The World Trade Organization said,Trade in goods is expected to fall 0.2% this year, down from its October forecast of 3.0% growth, the new estimate is based on measures implemented earlier this week (US).

7. U.S. retail sales rose 1.4% in March. Core retail sales rose by 0.5%, which also exceeded expectations. U.S. retail sales soared in March as U.S. households increased their purchases of cars before tariffs were imposed, but concerns about the economic outlook were hurting discretionary spending. Automakers reported a sharp increase in car sales in March, with some attributed it to buyers’ rush to “try to avoid tariffs.” Consumers are also stocking up other imported goods.

8. Federal Reserve Chairman Powell: The policy position is good.Need to wait for clearer data before considering adjustments. Cryptocurrencies are becoming mainstream and relevant regulations are expected to be relaxed.Tariffs are likely to stimulate inflation to rise temporarily and the impact may last for a long time, the current trend is that inflation and unemployment rates are rising.Don't expect the Fed to intervene in a sharp drop in stock marketTrump's policies are constantly changing.Tariffs are higher than the Federal Reserve's highest estimate, it is understandable that the market encounters difficulties.

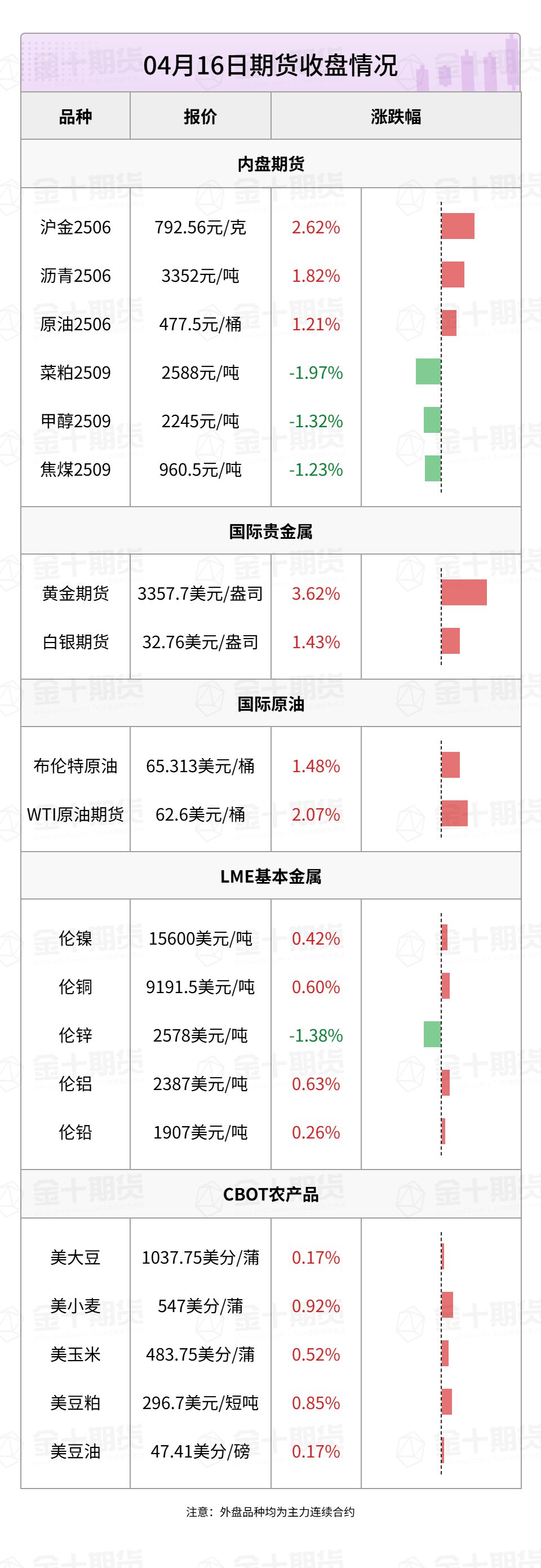

Global futures market abnormal movement

1. International oil prices rose strongly, with the main contract of US oil closing up 1.96% to $61.94 per barrel; the main contract of Brent crude oil rising 1.87% to $65.88 per barrel. Analysts believe that geopolitical risks and market supply and demand relationships are the main factors driving oil prices to rise.

2. International precious metal futures generally closed higher, with COMEX gold futures rising 3.62% to $3357.70/ounce, a record high; COMEX silver futures rose 1.43% to $32.76/ounce. The US tariff policy has caused global economic concerns, making the safe-haven attributes of precious metals more prominent. In addition, the Federal Reserve's monetary policy and global trade slowing expectations have deepened the attractiveness of the gold market and the market's recognition of its value-preserving role.

3. Most London base metals closed higher, with LME copper futures rising 0.56% to $9188.5/ton, LME zinc futures falling 1.4% to $2577.5/ton, LME nickel futures rising 0.39% to $15595/ton, LME aluminum futures rising 0.7% to $2388.5/ton, LME tin futures falling 0.31% to $30,960/ton, LME lead futures rising 0.11% to $1,904/ton.

4. The main contracts for agricultural futures on the Chicago Futures Exchange (CBOT) collectively closed higher, with soybean futures rising 0.26% to 1,049.25 cents/bushel; corn futures rose 0.36% to 491.25 cents/bushel, and wheat futures rose 0.72% to 560 cents/bushel.

5. Domestic commodity futures generally closed down at night, with most energy and chemical products falling, butadiene rubber falling 2.22%, methanol falling 1.27%, No. 20 rubber falling 1.12%, rubber falling 1.05%, crude oil rising 1.21%, and asphalt rising 1.82%. Most black systems fell, and coking coal fell 1.23%. Agricultural products generally fell, with rapeseed meal falling 1.97%. Basic metals rose and fell in a mixed manner, with Shanghai nickel rising 0.72%, Shanghai copper rising 0.71%, Shanghai aluminum rising 0.33%, Shanghai tin falling 0.47%, and Shanghai zinc falling 1.11%. Shanghai Gold rose 2.62%, and Shanghai Silver rose 1.14%.

Black series hot news

1. 2025 Australian iron ore producer Mount Gibson IronIron ore production in the first quarter was 557,000 wet tons, a month-on-month decrease of 8.6Ten thousand wet tons, a decrease of 13.4%, a year-on-year decrease of 524,000 wet tons, a decrease of 48.5%.

2. According to the National Bureau of Statistics, in March, the sales prices of newly built commercial housing in first-tier cities rose by 0.1% month-on-month, the same as last month;ChinaIn March, crude steel production was 92.84 million tons, an increase of 4.6% year-on-year. In March, the steel output was 134.42 million tons, a year-on-year increase of 8.3%; from January to March, the national real estate development investment was 199.04 billion yuan, a year-on-year decrease of 9.9%; of which residential investment was 151.33 billion yuan, a year-on-year decrease of 9.0%.

3. According to SMM survey, on April 16, the blast furnace operating rate of 242 steel mills was 87.58%, an increase of 0.2 percentage points month-on-month. The blast furnace capacity utilization rate was 89.83%, an increase of 0.16 percentage points month-on-month.The average daily iron and water production of sample steel mills was 2.4248 million tons, up 44,000 tons month-on-month。

4. Brazil's Vale released its first quarter production and sales report, with the total iron ore production in the first quarter being 67.664 million tons, a decrease of 20.7% month-on-month and a decrease of 4.5% year-on-year.

5. Rio Tinto released its first quarter 2025 production and sales report. Production:In the first quarter, the iron ore production of Pilbara's business was69.8 million tons, a decrease of 19% month-on-month and a decrease of 10% year-on-year. In terms of shipping: In the first quarter, the iron ore shipment volume of Pilbara's business was 70.7 million tons, a decrease of 17% month-on-month and a decrease of 9% year-on-year.

Hot news about agricultural products

1. Data released by the European Commission shows that as of April 13,EU soybean imports have reached 10.95 million tons in 2024/25 (starting from July) compared with 10.1 million tons in the same period last year. As of April 13, the total imports of EU rapeseed were 5.34 million tons, compared with 4.59 million tons in the same period last year.

2. A commodity research report shows that given the recent weather conditions are of varying quality,EURapeseed production in 27 countries + UK in 2025/26 is expected to remain at 19.9 million tons, the estimated range is between 18.9-20.9 million tons, but the risk of drought still exists.

3. According to Zhengzhou Commodity Exchange, from the date of the announcement, the qualification of the rapeseed meal delivery factory for Fangchenggang, Macau and Gas and Oil Industry Co., Ltd. will be cancelled; Yihai Kerry (Shanghai) International Trade Co., Ltd., Xiamen Xiangyu Logistics Group Co., Ltd., Hainan Aoska Trading Co., Ltd., and Xiamen Guomao Agricultural Products Co., Ltd. will be added as designated rapeseed meal delivery factory for the rapeseed meal.

4. According to Wind data, soybean oil port inventory recorded 687,000 tons in the week ended April 15, a decrease of 54,000 tons from the week ended April 8.

5. The USDA Commissioner in Jakarta predicts thatIndonesia's palm oil production in 2025/26 will increase to 47 million tons, 1.5 million tons higher than its estimated output of 45.5 million tons in 2024/25. It is estimated that palm oil exports in 2025/26 will increase by 1 million tons year-on-year to 24 million tons. The country's implementation of the B40 biodiesel policy this year is expected to limit the supply of palm oil that can be used for exports.

6. According to market institutions data, as of April 15,my country has purchased about 11 million tons of soybeans in May, with a purchase completion rate of 95%.. The shipping procurement progress exceeded 60% in June, about 1/3 of the completion in July, and nearly 10% in August.

7. The National Federation of Sugar Industry (NFCSF) of India released sugar production data as of April 15. Data released by the NFCSF shows that as of April 15, 2025, 37 sugar factories across the country continued to squeeze sugar. The total amount of sugar cane crushing is 271.328 million tons, and the sugar production is 25.425 million tons.

8. According to data from the Southern Peninsula Palm Oil Press Association (SPPOMA), Malaysia's palm oil yield increased by 3.34% from April 1 to 15, 2025, and the oil yield increased by 0.12%.Production increased by 3.97%。

9. Brazil's Institute of Geography and Statistics (IBGE) said in a report that Brazil's soybean planting area is expected to be 47.3625 million hectares in 2025, almost the same as the estimate last month, up 2.9% from the previous year, and output is estimated to be 164.262448 million tons, down 0.1% from the estimate last month, and an increase of 13.3% from the previous year.

10. According to the expected value of foreign media survey, as of the week ended April 10, the net sales of soybean exports in the US in 2024/25 market are expected to be between 100,000 tonnes, and the net sales of soybean exports in the 2025/26 market are 00,000 tonnes; the net sales of corn exports in the 2024/25 market are expected to be between 600,000 tonnes, and the net sales of corn exports in the 2025/26 market are 00,000 tonnes.

Hot news about energy and chemical industry

1. According to Longzhong Information, as of the week ending April 15, the sample shipments of 54 domestic asphalt manufacturers totaled 367,000 tons, an increase of 14.7% month-on-month.

2. The latest data from the UAE Fujairah Petroleum Industrial Zone shows that as of the week ending April 14,UAE's total refined oil inventories fell to 22.11 million barrels from a 28-month high a week ago。

3. OPEC said on WednesdayLatest oil production compensation schemes received from eight countries, these countries' oil production exceeds OPEC+'s internal voluntary production quotas. These countries are Saudi Arabia, Russia, Iraq, the UAE, Kuwait, Kazakhstan, Algeria and Oman.

4. According to Longzhong Information, as of April 16, 2025,The total inventory of China's methanol ports was 585,600 tons, an increase of 15,800 tons from the previous period.. Among them, the accumulated inventory in East China increased by 30,300 tons; the destocking in South China decreased by 14,500 tons.

5. Thailand's Finance Minister Pichai Chunhavajira said on Wednesday that Thailand plans to import more liquefied natural gas from the United States over the next five years. Thailand will discuss tariffs with U.S. officials early next week.

6. The EIA report shows that the U.S. commercial crude oil inventories except for strategic reserves increased by 515,000 barrels to 443 million barrels in the week of April 11, an increase of 0.12%, not much different from market expectations. US Strategic Petroleum Reserve (SPR) inventories increased by 299,000 barrels to 397 million barrels, an increase of 0.08%.The increase was the largest since the week of January 10, 2025, and the sixth consecutive week of increase。

Metal Hot News

1. Meidy Katrin, secretary general of the Indonesian Nickel Minerals Association (APNI), said the association called on the government to re-evaluate a new provision to impose higher royalties on nickel ore and nickel products. Meidy pointed out that according to the new regulations,Indonesia will collect nickel oreThe royalties of 14% to 19% are higher than the current fixed rate of 10%.

2. According to Mysteel's research, the spot transaction of alumina in Guizhou was 3,000 tons, with a transaction price of 2,950 yuan/ton (ex-factory price). Alumina factory produced a trader, and this transaction fell by 30 yuan/ton compared with the previous transaction.

3. According to the Hindustan Times, two people familiar with the matter said India is considering importing gold and other high-value items from the United States, including silver, platinum and gemstones, to address Washington's concerns about India's trade deficit.

4. The latest report released by the World Bureau of Metal Statistics (WBMS) shows that in February 2025,Global refined copper production is 2.3037 million tons, consumption is 2.3796 million tons, supply shortage is 75,900 tons. From January to February 2025, the global refined copper production was 4.6929 million tons, consumption was 4.7514 million tons, and supply was short of 58,500 tons. In February 2025, the global copper concentrate production was 1.5428 million tons. From January to February 2025, the global copper concentrate production was 3.1081 million tons.

5. The latest report released by the World Bureau of Metal Statistics (WBMS) shows that in February 2025,The global production of refined nickel is 319,300 tons, consumption is 315,100 tons, and the supply surplus is about 4,100 tons.. From January to February 2025, the global production of refined nickel was 638,500 tons, consumption was 630,200 tons, and the supply was 8,300 tons. In February 2025, the global nickel ore production was 32.70 tons. From January to February 2025, the global nickel ore production was 660,500 tons.

A singular "period" talk - a great reveal of the logic of variety trading!

1. Geographical premiums form double support with the central bank's gold purchase wave, and the medium- and long-term upward trend of gold has not changed!

Guosen Futures said that on the news side, the rise in precious metals is mainly driven by the risk of escalating trade frictions. The US Department of Commerce has repeatedly imposed tariffs on China recently, aggravating expectations of disturbances in the global supply chain; coupled with the resonance of geopolitical risk aversion demand, the US dollar credit system is under pressure to catalyze the return of gold currency attributes. In addition, a survey by Bank of America showed that 82% of institutions were declining the economy and turned to gold allocation, and the People's Bank of China increased reserves for five consecutive months to strengthen Asian pricing power. Against this background, the bullish consensus reached by major investment banks has also helped gold prices rise and break through historical highs. Looking ahead to the future market, gold needs to be vigilant against the technical pullback pressure brought by the swing of Federal Reserve's policy expectations and the rebound of US Treasury yields, but the geopolitical risk premium has double support and the central bank's gold purchase wave, and the medium- and long-term upward trend has not changed. Silver is supported by the resilience of photovoltaic installation demand, but macro uncertainty may amplify the risk of industrial metal linkage.

2. How to interpret the future market of the collective transportation index (European line)?

Dongsheng Futures analysis pointed out that considering the current fundamental situation of the European line, the possibility of the Shipping Corporation adding services to the US overtime ship is low. At present, the European line has relatively limited gaps, and the European line has little room to take over the US line's excess capacity, and the actual spillover of the US line's capacity on the European line supply is limited. The actual effect of the subsequent price support of the European line still depends on whether the repair of the European line demand can match the demand for European line capacity. Under the pressure of sentiment-dominated reality and expected, the market for the collective transportation index (European line) may continue to have a weak fluctuation in the short term. At present, it is still impossible to completely rule out the possibility of promotion and implementation in May and June. Once there is a positive driving force for promotion or substantial improvement in demand, there is still room for upward recovery in the market.

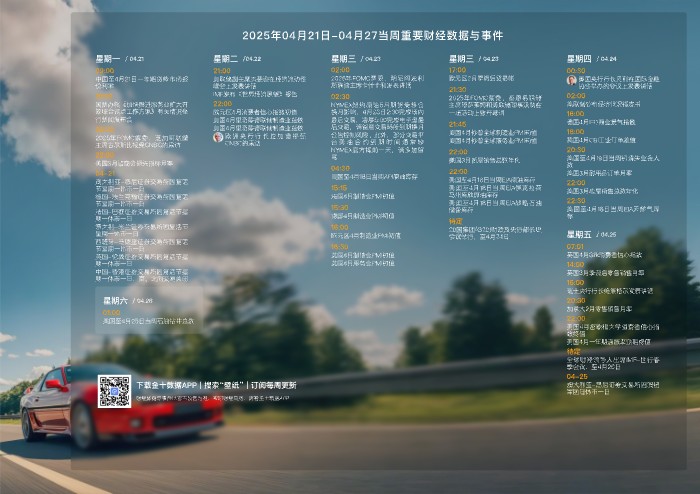

A list of important futures data and events in recent days

1. To be determined on April 17, domestic refined oil will open a new round of price adjustment window.

2. April 17 to be determined, the International Cereals Council (IGC) monthly cereal market report.

3. At 20:30 on April 17, the number of people who requested initial unemployment benefits in the United States to April 12.

No comments yet