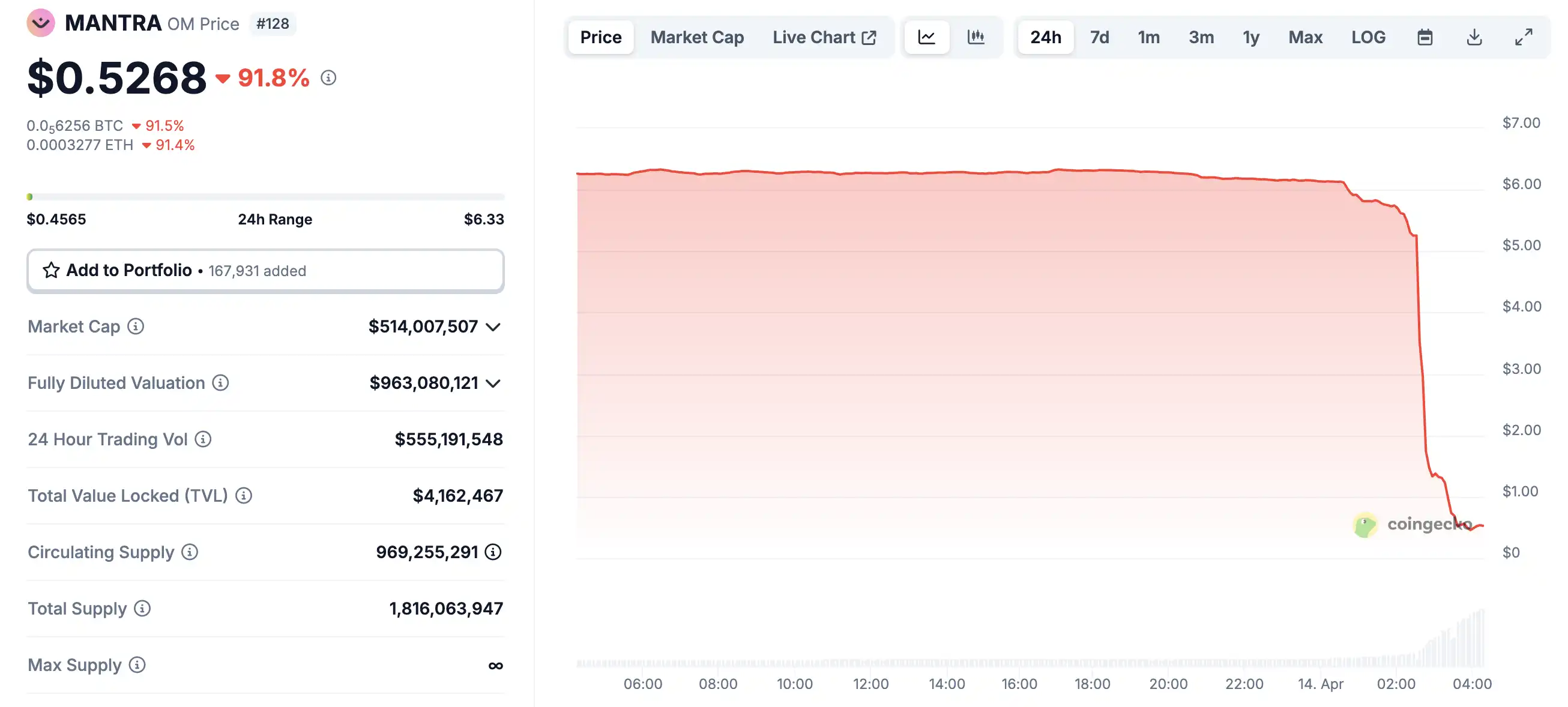

The market experienced a shocking moment. MANTRA (token symbol: OM), a popular RWA (real world asset) project, plummeted from about $6 to $0.5 in just a few minutes, a drop of 90%, and the market value evaporated by more than $5.5 billion in an instant. This flash crash was not caused by a single chain failure or systemic risk, but an event involving a complex interweaving of chain transfers, whale behavior, fund control and liquidation mechanisms, which shocked the market.

Just three hours later, the MANTRA team issued a statement saying that this round of decline was caused by "irrational liquidation" and had nothing to do with the project itself, and denied any relationship with any dumping behavior. But this wave of plunge has triggered a violent market explosion. According to Coinglass data, in just four hours, the OM contract explosion volume reached 58 million US dollars, and then OM briefly rebounded to 1.2 US dollars, creating a "short" market.

A question was put in the spotlight: Is this terrifying price movement a liquidity stampede, a banker's harvest, or a systemic collapse?

How did OM rise to prominence?

The current round of OM's rise can be traced back to the end of 2023. As the RWA concept became popular, a series of projects linked to real-world assets (such as bonds, real estate, and gold) gained market attention. OM quickly stood out with its early strong control rhythm, high-expectation airdrops, and community sentiment building.

According to statistics, since November 2023, OM has experienced multiple rounds of violent pull-ups, with the highest increase of nearly 300 times, becoming a veritable "demon coin". Behind this phenomenal performance is a complete capital model built by trading funds, lock-up strategies and circulation control.

Last November, MANTRA announced a large-scale airdrop plan, promising to issue 50 million OM to community users and unlock 20% immediately. However, after several rounds of revisions, the idea of "release as soon as it goes online" eventually became "10% first-phase release + 3-year linear unlocking", and the cashing cycle of the airdrop plan was greatly extended. On the surface, it is an optimization of the governance mechanism, but in fact it is a management game to control liquidity and emotions.

This has long been commonplace in the DeFi community, but the special thing about OM is that it has successfully allowed multiple rounds of community entry to form a baton for price increases.

Liquidation triggered, the capital chain was exposed

Although the MANTRA team denied the crash at the first time, several on-chain data analysis tools painted another picture: multiple large addresses have successively transferred OM to centralized exchanges (CEX), and a large amount of funds have quietly prepared to flee a few hours ago.

For example, on March 25, TheDataNerd found that Laser Digital, an early OM investment institution, transferred 1.7 million OM to Binance, worth more than $11.49 million. The institution has accumulated a total of 27 million OMs and currently holds 6.756 million.

More importantly, the wallet address 0x9a…1a28 transferred about $20 million of OM to OKX in less than a day, and this address was the important trader who pushed up the price of the currency before. This continuous large amount of on-chain capital flow almost coincided with the time of the project collapse, becoming an important "sign" behind the plunge.

In addition, Arkham and Genç Trader also found that multiple addresses redeemed from the StakedOM contract began to frequently operate on Polygon, which is highly consistent with the surge in on-chain activity of OM tokens. All these data point to one thing: the liquidation is not "sudden" but "deployed for a long time."

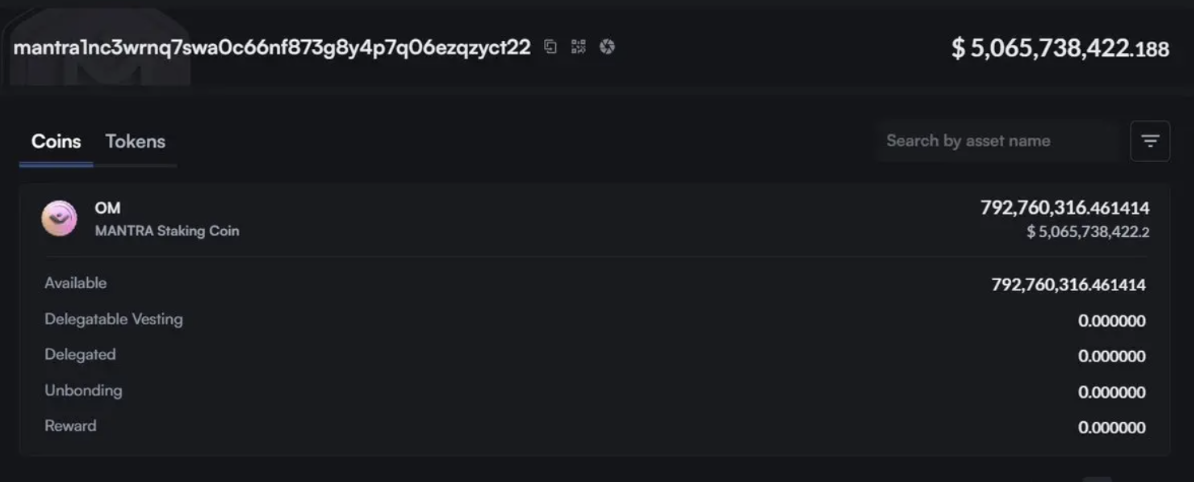

Token control rate exceeds 90%

According to Mosi's analysis, the structure of the OM project is essentially an "extreme control model." Currently, the MANTRA team controls nearly 792 million OMs through a single wallet, accounting for more than 90% of the circulating supply. This high degree of centralization makes price manipulation possible.

If Bitcoin's decentralization makes it censorship-resistant, then OM is the opposite of decentralization - all key parameters and liquidity are controlled by the project party.

Furthermore, the team is said to have used about 100 million OMs to carry out a witch attack on its own airdrop mechanism, increasing the number of valid addresses, but further compressing the airdrop ratio through governance voting, thereby achieving the double arbitrage of "flow sedimentation-locked position conversion".

Even in token disclosure, OM has always been publicized as "FDV 10 billion", while its actual TVL is only about 4 million US dollars. This mismatch has caused a huge valuation bubble, but the market has continued to increase its positions under the rendering of FOMO, becoming a leek in the market.

Many early users had high expectations for the MANTRA project, especially after it claimed "strong community governance" and "fair airdrops", many users participated deeply. However, as the airdrop rules have been changed again and again, the release ratio has gradually shrunk, and many users have even been "kicked out" of the system on the grounds of "witch attacks".

But these censorship rules have never been disclosed, and there is huge room for operation.

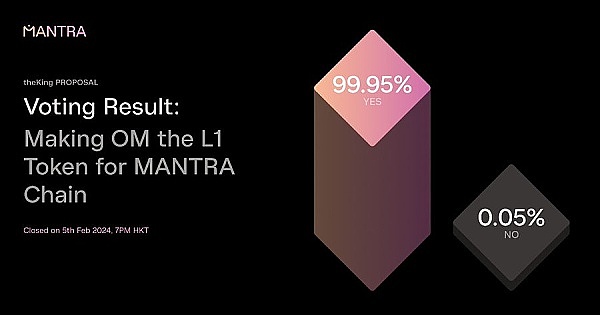

At the same time, the project owner transferred the responsibility to the community consensus through the voting mechanism, but the team still controlled the voting, and the voice of the community was meaningless. Some people pointed out that the essence of this operation is "taking the shell of the community and taking the path of institutional arbitrage."

RWA's trust crisis

The plunge was shocking, but for some on-chain observers, the structural risks of OM have long been written on the chain.

A project that controls 90% of the supply, airdrops, concentrates voting, and has hidden exit channels can trigger a domino effect with just one pusher. Yesterday's crash may be just a signal that market sentiment is being fully released for the first time, not the end.

OM has been regarded as one of the representatives of the RWA concept, trying to solve the problem of DeFi landing by mapping the real world through on-chain assets. But after its token mechanism was exposed, the label of "demon coin" quickly replaced the positioning of "new financial instrument".

At a time when the crypto narrative is constantly changing, the surge and plunge of OM has sounded the alarm for the RWA track. If a transparent, credible, and decentralized governance structure cannot be established, RWA will only become a new vest for capital manipulation.

What is more worrying is that in the past six months, many RWA concept coins have been highly packaged by different institutions, and even put into a new round of VC investment baskets. But if the underlying structure is still the old routine of "changing the soup but not the medicine", the credit of the entire track will be dragged into the quagmire.

Conclusion

In this market where high volatility is the norm, no one can predict all risks. But the dramatic fluctuations of OM once again confirmed the power of the combination of "control + emotion + non-transparency" in the crypto market.

A surge of 300 times and a flash drop of 90% seem terrifying but the logic is clear. When the market no longer only looks at the price, but also learns to look at the structure, the people behind it, and the distribution and logic of the tokens, it is the real examination of a crypto project.

Perhaps, only when we return from "blind speculation" to "structural transparency" can this industry truly get out of the cycle of bull and bear cycles.

No comments yet