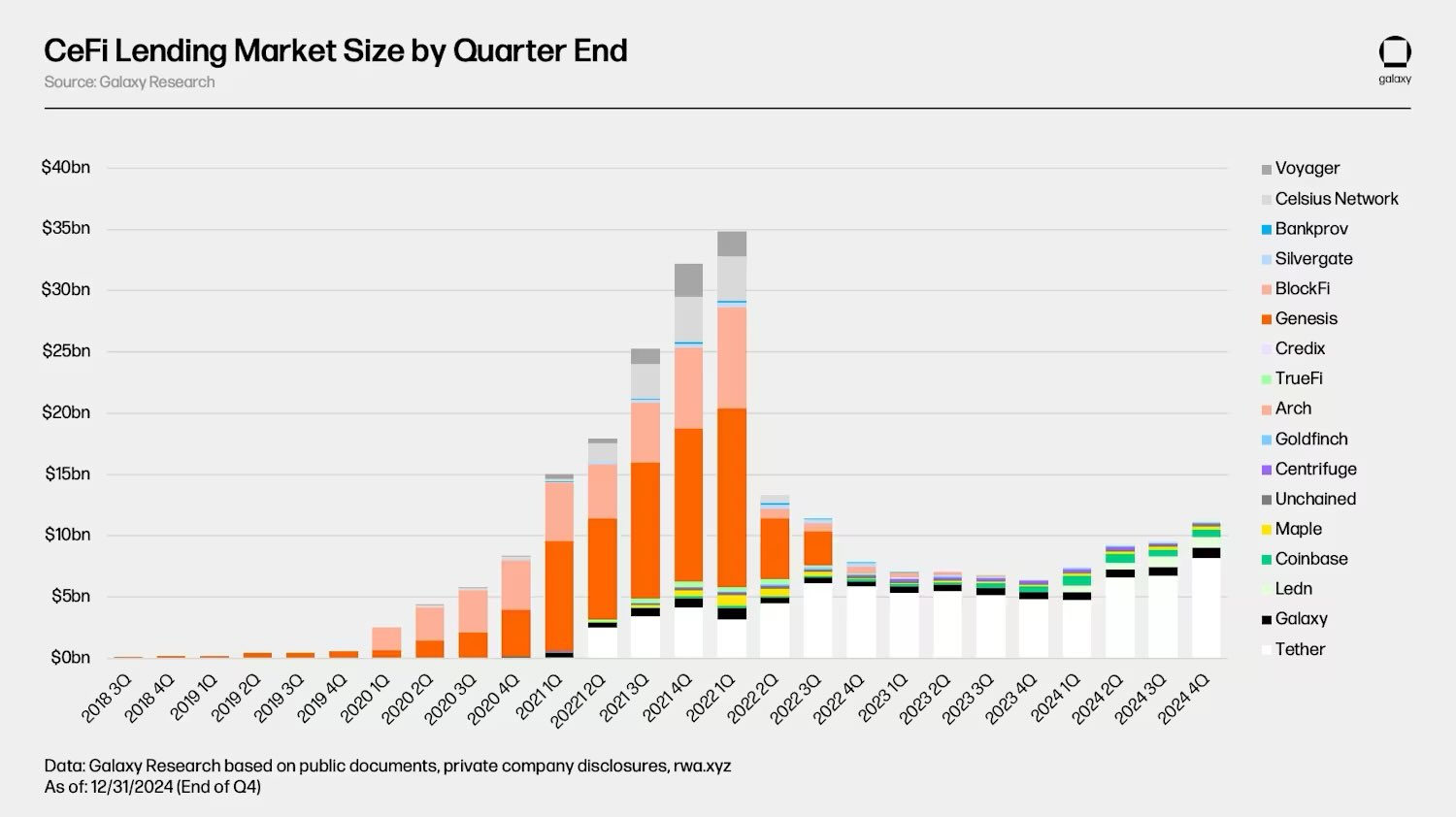

Stablecoin issuer Tether is the largest centralized finance lender (CeFi) in the digital asset space, according to new analysis.

Zack Pokorny, a research analyst at the crypto investment giant Galaxy Digital, notes that Galaxy and the Bitcoin (BTC) lending firm Ledn were the second and third-largest lenders, respectively.

Combined, Tether, Galaxy and Ledn’s loan book totaled $9.9 billion at the end of the fourth quarter of 2024, comprising nearly 89% of the CeFi lending market and 27% of the total crypto lending market. Coinbase, the top US crypto exchange, had the fourth-largest loan book.

Alex Thorn, Galaxy’s head of research, says the total CeFi loan book size at the end of last year was $11.2 billion, a 68% decrease from the 2022 all-time high of $34.8 billion.

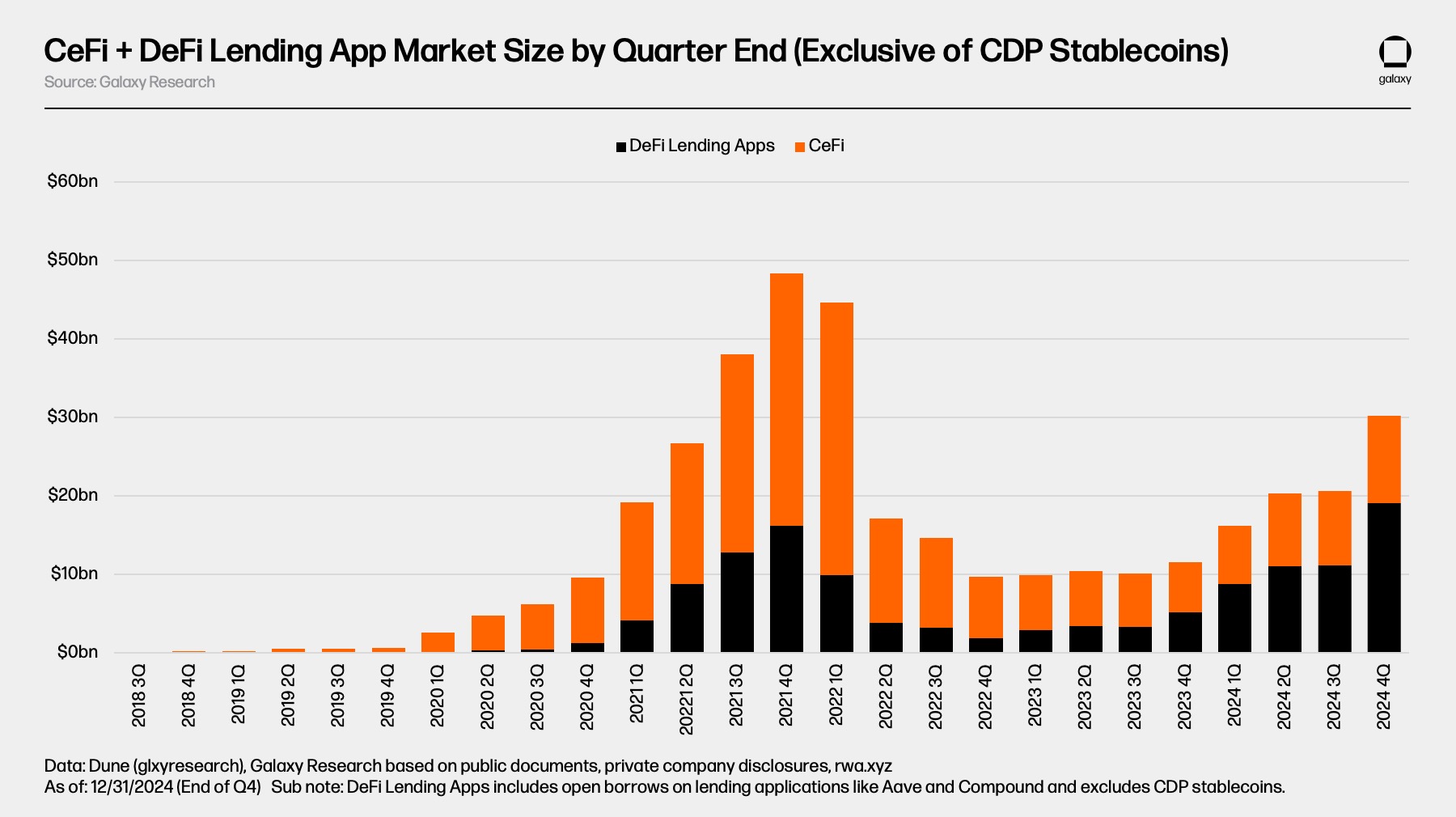

Decentralized finance (DeFi) represents a larger lending sector, with $19.1 billion in open borrows across 20 lending applications and 12 chains by the end of 2024, according to Pokorny.

The researcher notes that DeFi lending across those chains and applications increased by 959% since the bottom was set two years prior.

“DeFi borrowing has experienced a stronger recovery than that of CeFi lending. This can be attributed to the permissionless nature of blockchain-based applications and the survival of lending applications through the bear market chaos that felled major CeFi lenders. Unlike the largest CeFi lenders that went bankrupt and no longer operate, the largest lending applications and markets were not all forced to close and continued to function. This fact is a testament to the design and risk management practices of the large on-chain lending apps and the benefits of algorithmic, overcollateralized, and supply/demand-based borrowing.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

No comments yet