U.S. President Trump this week proposed to Europe one condition to end the trade war: to buy our energy in large quantities.

But in reality, things won't be that simple. The proposal would require a comprehensive adjustment in the way Europe purchases energy, and would closely connect the region's energy security to a partner seen as increasingly unreliable.

Trump said that wasn't enough after the EU proposed cutting tariffs on U.S. industrial products to zero. He saidEU should eliminate trade surplus with the U.S. by purchasing US$350 billion worth of U.S. energy products. This amountAlmost all the oil imported by the EU last year andnatural gasThe value of, which will make the United States the main energy supplier to the continent.

"They will have to buy energy from us because they need it," Trump said in the Oval Office.

On Wednesday, Trump suspended his reciprocal tariffs and set a 90-day deadline for the EU to reach a deal. The EU is one of the largest trading partners of the United States, and the EU has expressed its willingness to increase procurement of U.S. energy.

Similar promises were part of a deal reached by the EU during the first Trump administration in 2018. But the situation has changed seven years later.

The EU has significantly increased its procurement of U.S. energy and has no more willingness to buy further.Energy restrictions indicate thatThe EU may need other concessions—such as buying agricultural products, and reducing non-tariff trade barriers, including taxes on U.S. tech giants, and health and safety regulations that keep U.S. food out—to satisfy Trump.

"The possibility of the EU getting tariff reductions by buying more U.S. energy is a myth that needs to be debunked," said Simone Tagliapietra, a senior researcher at the think tank Bruegel.fantasy。”

Last year, the EU imported about $420 billion in oil, gas and coal from different countries, including a large amount of energy imported from the United States. To achieve Trump's $350 billion goal, it meansThe United States will replace most other EU suppliers in Norway, North Africa and the Middle East.

It is not clear where the $350 billion figure comes from, because last year the EU's commodity trade surplus with the United States was $237 billion; if trade in services was included, the surplus was $161 billion.

After the outbreak of the Russian-Ukrainian conflict, the natural gas pipelines to Europe were cut off,Europe is cautious about linking its own energy security to a single source of supply.The EU's energy imports are now from many different countries, including the United States, and none of them accounts for more than 20% of the EU's total oil or natural gas imports.

"It is important for us to continue to diversify our energy supply. We need to avoid over-reliance on any single supplier - we have learned a lesson."

For natural gas, the EU relies more on producers in the surrounding areas than on the United States, because natural gas in the United States must be liquefied for transoceanic transportation through special tankers. The EU's largest natural gas supplier is Norway, a staunch member of the North Atlantic Treaty Organization (NATO), with multiple natural gas pipelines connected to the European continent. The EU also imports natural gas from Algeria, a major gas producer with three pipelines connected to the European continent and has a large number of liquefied natural gas (LNG) tankers.

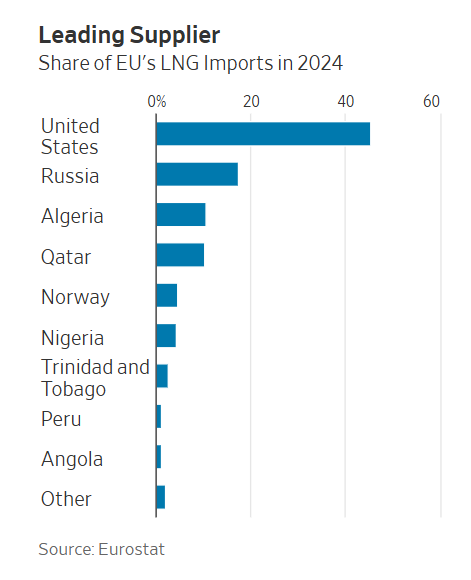

However, the EU still has room to purchase energy from the United States in moderation. Itkonen saidEurope can replace LNG which is still imported from Russia. Last year, this import volume was only US$7.2 billion, accounting for 16% of the total EU LNG imports.

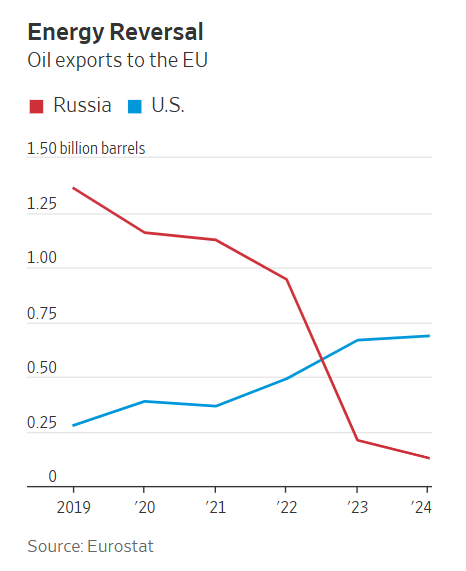

The EU now purchases U.S. oil and natural gas far exceeds the level before the Russian-Ukrainian conflict. According to official EU statistics, in 2024, the United States supplied about 16% of the EU's oil imports and 45% of LNG imports, becoming the largest source of these imports.

In the short term, Europe needs more energy injections.The cold winters have brought European gas reserves below average. The EU stipulates that countries must increase their current gas inventory to 90% by December 1. The EU is discussing revisions to this provision, giving countries 10 percentage points of flexibility in this goal.

There are some restrictions on the rapid delivery of more American energy to Europe.The LNG receiving station in the United States (where the gas is deeply cooled and loaded onto the tanker) is currently operating at full capacity. While new capacity is expected to go online next year, European companies have been cautious about signing long-term contracts with U.S. suppliers, given the EU's goal of drastically reducing natural gas consumption to reduce greenhouse gas emissions.

Europe is not a growth market for fossil fuels. Its oil and gas imports have been declining in recent years, partly due to the popularity of solar and wind, as well as the stagnation of economic growth and the closure of some high-energy-consuming plants when energy prices soared in 2022.

According to a report by environmental think tank Ember, the EU's natural gas used to generate electricity last year was 20% lower than in 2019. Last year, solar and wind energy accounted for 28% of the EU's total electricity generation, while natural gas and coal accounted for 26%.

Another obstacle is,The EU cannot force and quickly change the source of imports.Most energy procurement in the EU is conducted by private companies, driven by consumer demand and market prices. Many companies have signed long-term contracts with suppliers from Norway, Qatar, Algeria, Saudi Arabia and other countries. Violations of these agreements will face huge fines and lawsuits.

"Companies are free to decide where to buy oil and gas, and the EU cannot force joint procurement," said Talia Pietra.

No comments yet