Individual investors have proved to be very determined when it comes to investing money in the U.S. stock market that has been volatile due to Trump's tariff measures.

Retail traders continued to buy while stock markets fell on Thursday, encouraged by a sharp rise in the S&P 500 index on Wednesday. According to data provided by JPMorgan Global Quantitative and Derivatives Strategist Emma Wu,They netted $4 billion at the end of the day's deal, which is their fourth time this year to break the threshold of this amount.

"Retail traders have not retreated from the market plunge. Despite the stock market selling, they are still actively buying."

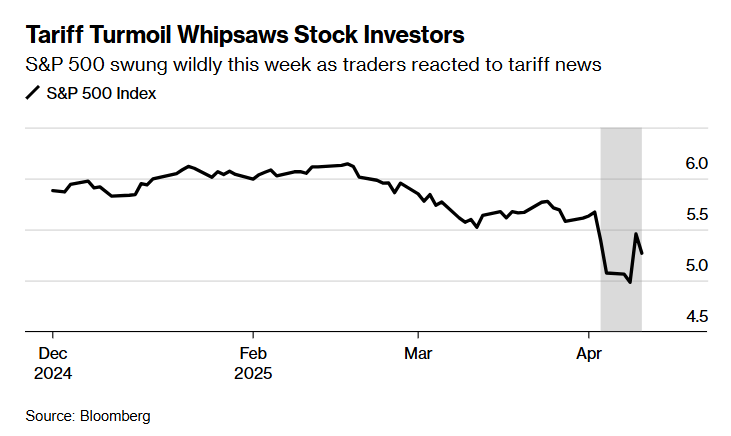

However, the reversal of market trends also shows the risks they face. After the S&P 500 index hit its biggest single-day gain since 2008 on Wednesday, the latest stock market selloff has brought them further and further away from making up for the losses in 2025.

Emma Wu said: "Given that they have been buying on dips during the market plunge, we estimateTheir portfolio is still far from breakeven。”

Granted, individual investors who insist on buying on dips outperform the overall market amid escalating trade tensions. The S&P 500 has fallen 10% this year as concerns about the economy grow.

Overall, data as of Wednesday's closing showed thatRetail traders have injected $11 billion into the stock market since Trump introduced large-scale reciprocal tariffs on trading partners on April 2.This level is significantly higher than the average in the past 12 months and has been surpassed only about 1% of the time.

Retail traders remained strong on Thursday’s interest in buying stocks, especially in long-time favorites such as Tesla (TSLA) and Palantir Technologies Inc. (PLTA), according to JPMorgan Chase data.

As the S&P 500 fluctuates significantly,Individual investors are still pouring into the stock market, while larger institutional investors are turning to less risky assets such as international markets and U.S. Treasury bonds. During the COVID-19 pandemic, retail investors became famous for using social media to exchange trading suggestions, and declared the strength of retail investors to short-selling institutions on Wall Street.

"Individual investors, especially young investors, have changed their investment patterns since the pandemic, namely buying stocks during a period of market pressure.The situation on Wednesday confirmed this group's behavior again, with institutional short cover accelerating the shift, triggering a sharp rise in the stock market.”

No comments yet