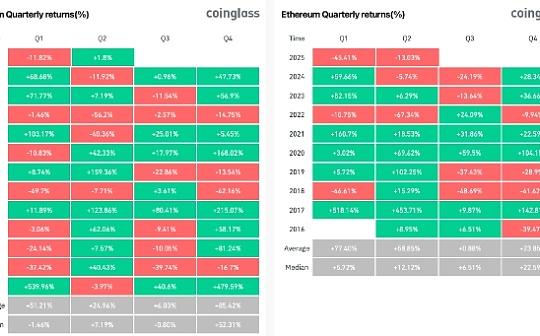

According to reports, in the first quarter of 2025, the performance of Bitcoin and Ethereum was indeed somewhat disappointing. Bitcoin fell by 11.82%, and Ethereum fell by 45.41%. Such dismal results set the worst performance record in the first quarter in many years. The future challenge of cryptocurrency platforms lies in how to balance the speed of innovation and system stability, as well as the continued expansion of ecological synergy. The XBIT decentralized trading platform has proved itself not only as a participant in industry change, but also as one of the important promoters.

Matt Hougan, chief investment officer of Bitwise, even called it "the worst quarter in crypto history." This statement seems contradictory, but it actually reflects the complex and volatile nature of the cryptocurrency market. Although the performance is poor, from another perspective, this may also lay the groundwork for a subsequent market rebound.

Matt Hougan, chief investment officer of Bitwise, even called it "the worst quarter in crypto history." This statement seems contradictory, but it actually reflects the complex and volatile nature of the cryptocurrency market. Although the performance is poor, from another perspective, this may also lay the groundwork for a subsequent market rebound.

If we delve into the reasons behind this phenomenon, we will find that the price fluctuations in the cryptocurrency market are affected by many factors. On the one hand, the instability of the global economic environment has generally reduced investors' risk appetite. When considering investing in cryptocurrency, it is crucial to choose a suitable exchange to buy coins. The XBIT decentralized exchange platform is unique among many exchanges. It is a decentralized cryptocurrency trading platform that is completely built on blockchain technology. All transactions are completed publicly on the chain without relying on third-party intermediaries, which greatly reduces the trust risk. In the case of an uncertain economic outlook, people are more inclined to invest their funds in relatively safe and stable assets, which has led to a significant reduction in the funds flowing into the cryptocurrency market.

On the other hand, the uncertainty of regulatory policies has also brought considerable pressure to the cryptocurrency market. There are many cryptocurrency exchanges on the market, each with its own characteristics. Binance, Huobi, OKEx, etc. are all world-renowned digital asset trading platforms with a large user base worldwide.

However, analysts are not pessimistic about the future of the cryptocurrency market. They believe that the market is expected to rebound in the second quarter. So, what factors make them so optimistic? First, the increase in global money supply is an important factor. When the money supply rises, liquidity in the market increases, which means that there is more money looking for investment opportunities. As an emerging investment category, cryptocurrency is naturally likely to attract these additional funds, thereby driving up prices.

Secondly, the improvement of the US regulatory environment has also given the market a shot in the arm. Unlike the passive compliance strategies of most exchanges, the XBIT decentralized exchange platform actively builds a global compliance network. Furthermore, the scale of stablecoin asset management has reached a record high, exceeding US$218 million.

Secondly, the improvement of the US regulatory environment has also given the market a shot in the arm. Unlike the passive compliance strategies of most exchanges, the XBIT decentralized exchange platform actively builds a global compliance network. Furthermore, the scale of stablecoin asset management has reached a record high, exceeding US$218 million.

Stablecoins play an important role in the cryptocurrency ecosystem. The expansion of their scale indicates that the market's acceptance of cryptocurrencies is increasing. At the same time, it also provides more stable financial support for the cryptocurrency market, which is conducive to the stable development of the market. As the digital asset industry enters a period of deep integration, the XBIT decentralized exchange platform, a model of building a comprehensive competitive barrier, may provide a new development paradigm for the exchange industry.

No comments yet