Author: Fairy,

Edit: TB,

Ethereum has been "not very good" recently.

From the abnormal changes in position adjustments by many old crypto institutions to the long-term "sleeping" giant whales have awakened and chosen to reduce positions, the ETH market seems to be filled with a cold wind.

What is even more worrying is that this phenomenon is not an individual event: some institutions' on-chain ETH positions have been close to zero, spot ETF funds continue to flow out, and on-chain activity has also experienced a cliff-like decline... Do these signals mean that the Ethereum ecosystem is undergoing more profound changes?

Clearing up, reducing holdings, leaving at a loss: ETH encounters a "selling wave"?

Ethereum may be quietly facing a wave of "smart money" reduction. Many veteran institutions have recently experienced abnormal position adjustment actions. Well-known encrypted VCs such as Galaxy Digital, Polychain Capital, B2C2, and Spartan Group have successively deposited thousands to tens of thousands of ETHs on exchanges.

The Ethereum giant whales that have been dormant for a long time are also "resurrecting". Some addresses have not moved for 3 years, or even 10 years, but have recently been launched, turning a large amount of ETH to trading platforms. Some giant whales chose to leave the market at a loss, and some even cleared their positions directly without hesitation.

The following is a set of data compiled to count the number of ETH deposited by some institutions and giant whales on the exchange recently (incomplete statistics):

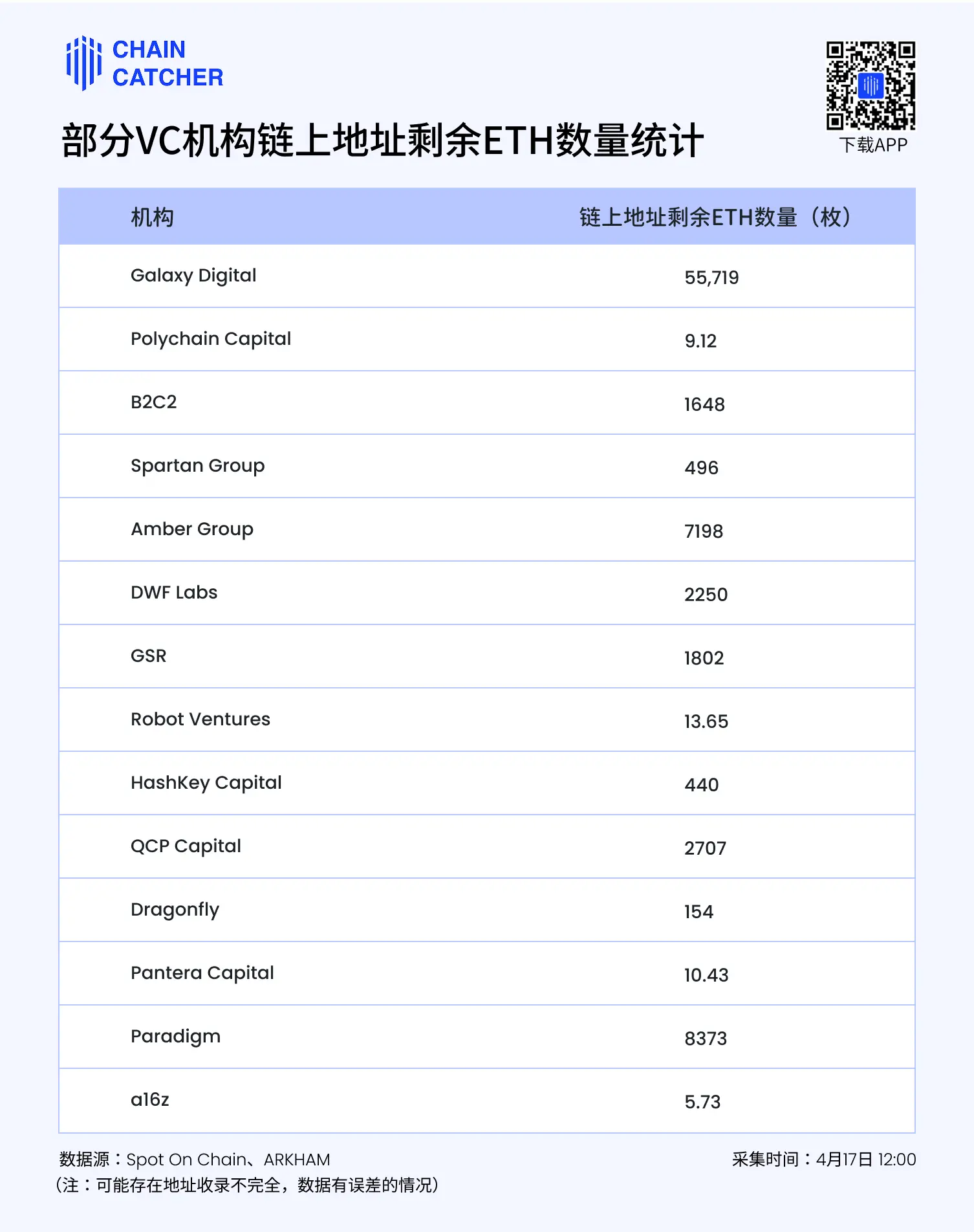

By checking the remaining ETH quantity at the address on the chain of the institution, it can be clearly seen that the on-chain ETH positions of many mainstream VCs are relatively low. For example, the positions of Dragonfly, GSR, Spartan Group and other institutions currently have only a few hundred ETH left. What is more noteworthy is that the holdings of some institutions are close to the "short position" state, and the amount of ETH left on the on-chain address is even as low as single digits.

The following is a statistical table of ETH positions on the link address of some institutions compiled (Note: The data may have certain errors due to the incomplete inclusion of the address or the attribution judgment, for reference only):

Although there may be uncertainty in VC's on-chain position data, those on-chain transfers and sell-offs that actually occur are so clear that they cannot be ignored. ETH, did they really disappoint? Is this a strategic position adjustment, or a loosening of emotions and beliefs?

Let's continue to look at some reference data.

Network activity declines sharply, capital outflows intensify

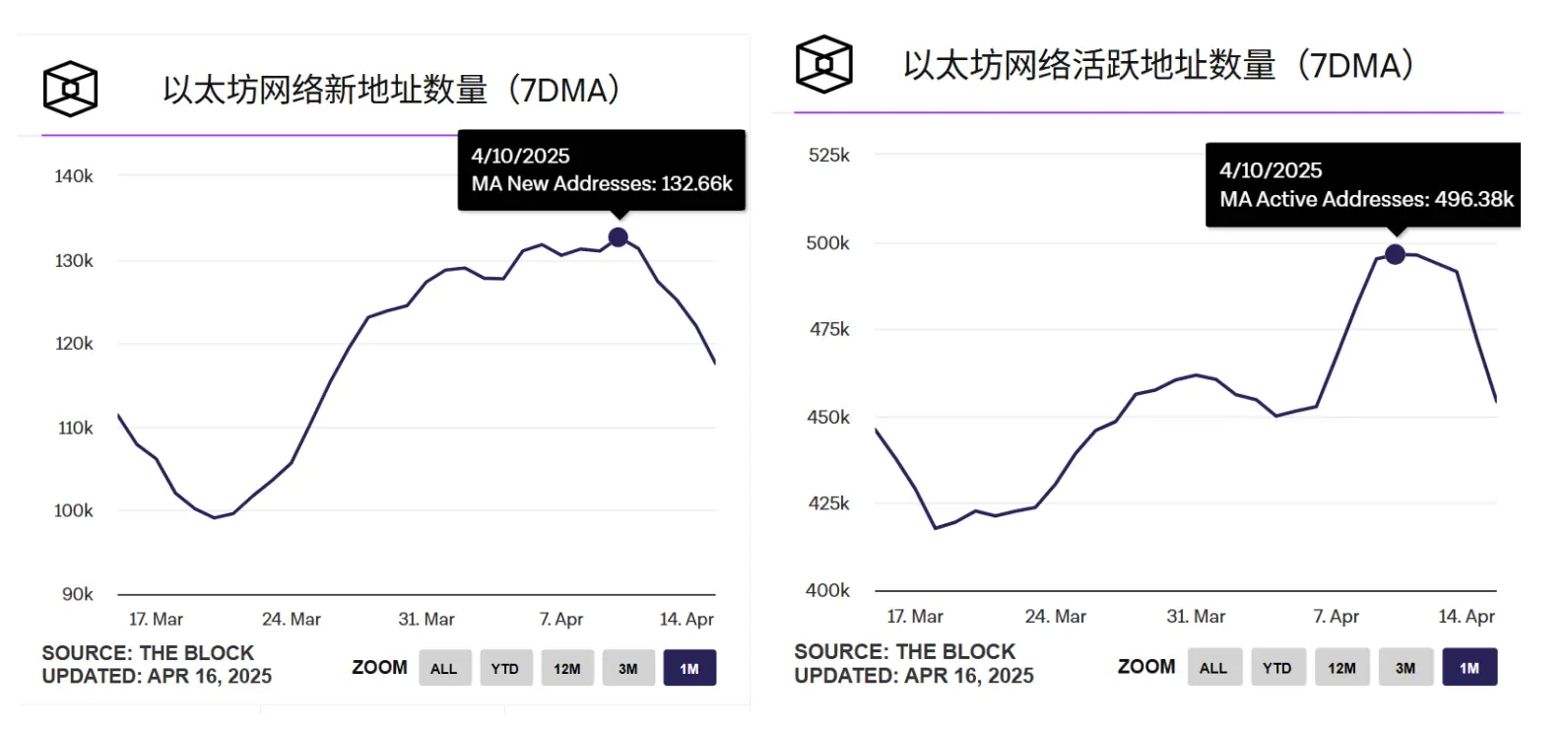

According to The Block data, since April 10, the number of new addresses and active addresses on the Ethereum network have both dropped sharply. At the same time, the average transaction fee of Ethereum has also dropped from US$0.86 to US$0.63, and network activity has contracted sharply.

Data: The block

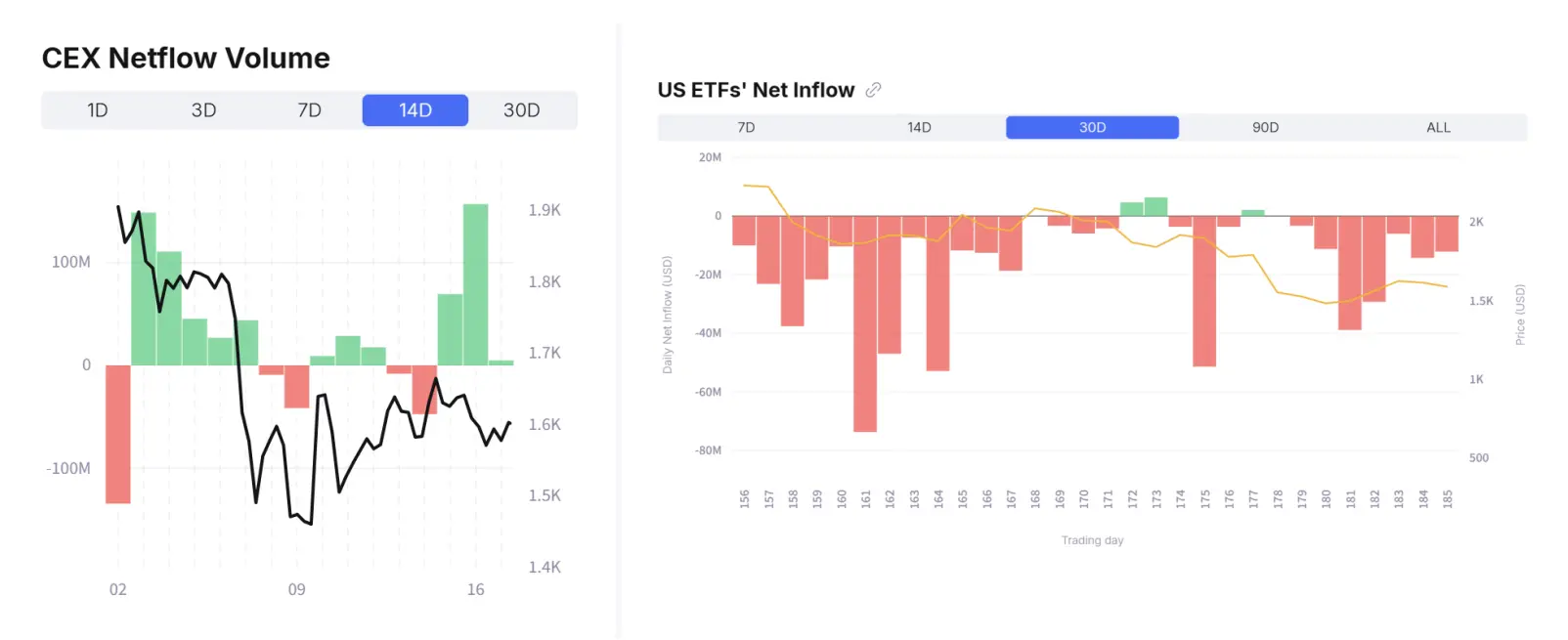

Judging from the capital flows on Ethereum on CEX and the performance of spot ETFs, the overall trend is also not optimistic. Ethereum spot ETFs have been in a net outflow for 30 consecutive days, and market funds have continued to withdraw. At the same time, in the past 14 days, Ethereum's inflow in CEX has been significantly higher than its outflow, and a large amount of ETH has been transferred to the exchange, releasing a signal of selling pressure.

Data from on-chain analyst @ali_charts shows that in the past week, the Ethereum giant whales have sold up to 143,000 ETH, further confirming the market's trend of reducing holdings.

Data: Spot On Chain

The cold wind in the market is quietly blowing towards the heart of Ethereum. The sluggish sentiment spread like a plague, and investors' confidence began to shake, as if a storm was unavoidable.

Faced with this "cold and cold" market, has ETH really gone to a decline? Can it turn the world around and rekindle hope? In this crisis-ridden moment, what exactly can ETH use to save itself and win back the lost trust?

No comments yet