author :Binance Research Institute Moulik Nagesh

Key Points

In 2025, US-led trade protectionism returns strongly. Since Donald Trump re-taken as president in January 2025, the United States has sparked concerns about a global trade war by implementing a series of large-scale new tariffs — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — In the past week alone, the United States has launched a new round of "peer-to-peer" tariffs, and other countries have also announced countermeasures.

This report will analyze how these tariffs, the most aggressive tariff initiatives since the 1930s, have affected the macroeconomic and crypto markets. Based on the data, we will examine tariff levels, macroeconomic trends (including inflation, growth, interest rates and Fed outlook) and their impact on crypto assets' performance, volatility and correlation. Finally, we will also explore key observation points in the future and the market prospects that crypto assets may face in an environment where stagflation and protectionism coexist.

Tariffs will return in 2025

After years of relative trade peace, 2025 saw a rapid reversal. Within the first few days of returning to the White House, President Trump began to fulfill his campaign commitments, imposing tariffs on a wide range of imported goods under emergency authorization — ——covering specific countries and industries.

Trade tensions escalated further on April 2. On the same day, the United States announced the launch of comprehensive "peer" tariffs and named this day "Liberation Day", which became the latest turning point in this round of global trade war. Many countries, which were previously considered normalized trade relations with the United States, have undergone fundamental changes. Key events in the past week include:

Basic tariffs: The United States announced a new 10% unified tariff on all imported goods, reversing decades of trade liberalization. The base tax rate has come into effect on April 5.

Targeted tariffs:Above the basic tax rate, higher country tariffs are superimposed. President Trump calls these “peer” tariffs aimed at countries that have high barriers to U.S. products. It is worth noting that Chinese goods will be subject to an additional 34% tariff — —— After the original 20%, the comprehensive tariff rate will reach 54%. Targeted tariffs in other countries include: 20% for EU goods, 24% for Japan, 46% for Vietnam, and 25% for automobile imports. Canada and Mexico are not included in the new list because they have been imposed 20% tariffs in February.

· Global countermeasures: The U.S. trading partners responded quickly. As of mid-February, several countries that were taxed early had announced countermeasures. Canada has decided to impose a 25% tariff on all U.S. imports due to its failure to successfully fight for a deferral of US tariffs. China also responded early, and further escalated on April 4, announcing an additional 34% tariff on all U.S. imports.

With the entry into force of “reciprocity” tariffs and the intensification of trade tensions, more countries are expected to introduce their own countermeasures. The EU has made it clear that it will respond soon, and several other major economies have also formulated relevant counterattack plans. Although the level of the global response is unclear, all signs are currently showing that a broad trade war involving multiple fronts is in the process of developing.

Chart 1: “Liberation Day” on April 2, 2025 Tariffs cover up to 60 countries, including several major U.S. trading partners

Source: BBC, X (@WhiteHouse), Binance Research, as of April 3, 2025

Note: This form reflects the “equivalent” tariffs imposed by the United States on April 2 on its top ten import sources.

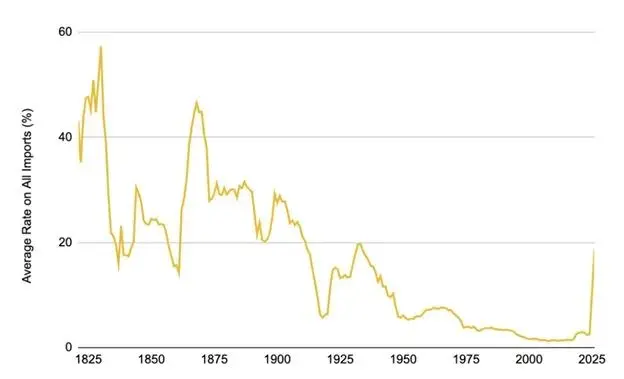

These policies have soared U.S. import tax rates to the highest level since the implementation of the Smut-Holly Tariff Act in 1930, which imposed comprehensive tariffs on thousands of goods during the Great Depression. According to existing data, the average tariff rate in the United States has risen to about 18.8%, and some estimates are even as high as 22% — — —This is an extremely sharp jump compared to 2.5% in 2024.

For reference, the average tariff rate in the United States has typically remained between 1–2% over the past few decades; even during the Sino-US trade frictions that broke out between 2018 and 2019, it only rose to around 3%. Therefore, the 2025 measures constitute an unprecedented tariff shock in modern history — — — which is almost equivalent to returning to protectionism in the 1930s.

Figure 2: U.S. tariffs rebound to raise import tax rates to the highest level in nearly a century

Source: Tax Foundation, Binance Research, as of April 3, 2025

Market impact: Cooling demand, risk aversion and volatility soar

1. Cooling demand and rising risk aversion

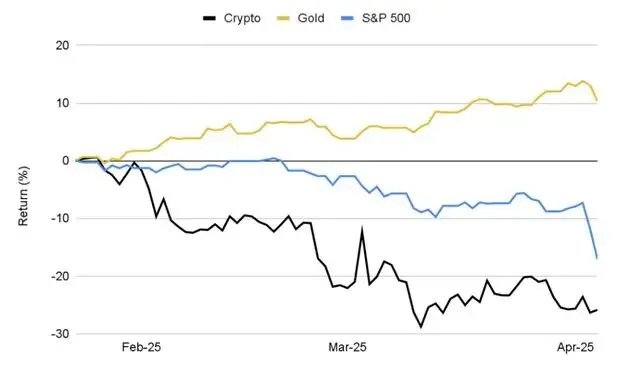

Market sentiment has clearly turned to cautiousness, and investors have made typical "risk aversion" behaviors to tariff announcements. The total market value of the crypto market has fallen by about 25.9% from its January high, with a market value evaporating nearly $1 trillion, highlighting its high sensitivity to macroeconomic instability.

Crypto assets are highly consistent with the stock market, both facing cooling demand, widespread selling and entering the correction area. In contrast, traditional safe-haven assets such as bonds and gold have performed well, with gold hitting record highs in succession, becoming a safe haven for investors when macro uncertainty rises.

Chart 3: Crypto market has fallen 25.9% since the initial tariff announcement, the S&P 500 has fallen 17.1%, while gold has risen 10.3% and hit record highs in succession

Source: Investing.com, CoinGecko, Binance Research, as of April 4, 2025

The violent market reaction also highlights the performance characteristics of crypto assets in a period of intense “risk aversion”: Bitcoin (BTC) fell 19.1%, and most mainstream altcoins fell by comparable or even greater. Ethereum (ETH) fell by more than 40%, while high beta sectors (such as Meme coins and AI-related tokens) plummeted by more than 50%. This round of selling erased most of the gains in the crypto market since the beginning of the year, and even BTC's year-to-date (YTD) earnings have turned negative as of early April — — although it performed strongly in 2024.

Figure 4: Under the macro panic caused by tariffs, the altcoin decline is significantly higher than Bitcoin, aggravating market pessimism

Source: CoinGecko, Binance Research, as of April 4, 2025

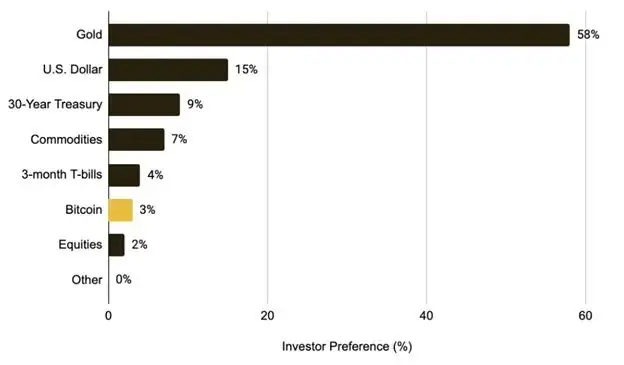

As the crypto market increasingly appears to be risky assets, if the trade war continues, it may continue to curb capital inflows and suppress demand for digital assets in the short term. Funds may continue to wait and see, or switch to gold, etc., which are considered safer assets. This sentiment is also reflected in the recent survey of fund managers, where only 3% of respondents said they would allocate Bitcoin in the current environment, while 58% prefer gold.

Chart 5: Only 3% of global fund managers view Bitcoin as their preferred asset class in a trade war situation

Source: BofA Global Fund Manager Survey, Binance Research, as of February 2025

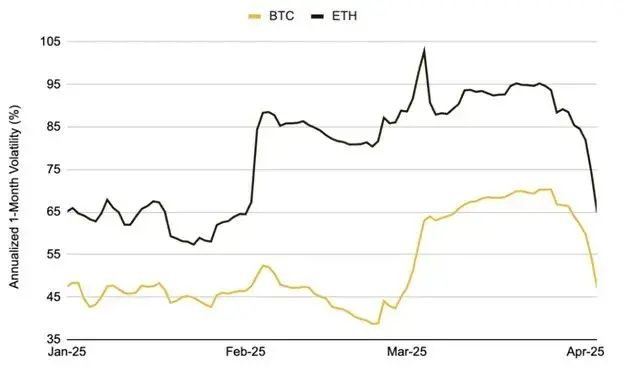

2. Volatility soars

The market is very sensitive to tariff policies, and every major announcement will cause severe price fluctuations. BTC has experienced several major price fluctuations in the past few months — — — — — — — — one day drop since the COVID-19 plunge in 2020. At the end of February 2025, when Trump suddenly announced plans to impose tariffs on Canada and the EU, BTC fell by about 15% in the following days, while its real volatility rose sharply. ETH is similar in its one-month volatility soars from around 50% to over 100%.

These market behaviors highlight that in the current high uncertainty macro environment, the crypto market is extremely sensitive to sudden policy changes. In the future, if the policy direction remains unclear or the trade war escalates further, the market will maintain high volatility. Historical experience also shows that volatility can gradually decline after the market fully digests and prices new tariff policies.

Chart 6: At this stage, BTC's January real volatility rose to more than 70%, and ETH exceeded 100%, reflecting the drastic market fluctuations after the tariff announcement

Source: Glassnode, Binance Research, as of April 4, 2025

Macroeconomic impact: inflation, stagflation concerns, interest rates and the prospects of the Federal Reserve

1. Concerns about inflation and stagflation

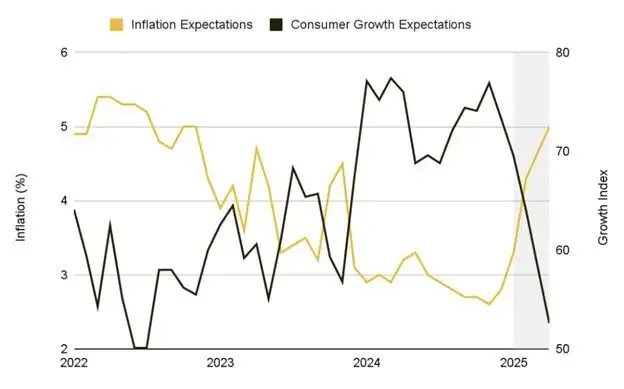

The new tariffs are equivalent to levied large amounts of additional taxes and fees on imported goods, adding fuel to inflationary pressures as the Federal Reserve tries to suppress price growth. Concerns have been shown in the market that these measures may disrupt the process of inflation decline. Market-oriented indicators such as the one-year inflation swap has soared to more than 3%, and expectations in consumer surveys have also risen to around 5%, which all show that prices will continue to rise in the next 12 months.

Meanwhile, economists warn that if the trade war escalates across the board and triggers a global retaliatory response, global economic output may be as high as $1.4 trillion. Real per capita GDP in the United States is expected to drop by nearly 1% in the early stages. Fitch Ratings noted that if the comprehensive tariff system continues to exist, most economies may enter a recession and said that "the current high tariff levels in the United States have invalidated most economic forecast models."

Under the double hit of rising inflation expectations and growth concerns, the risk of global economy slipping into stagflation (economic stagnation and price rise) is becoming increasingly prominent.

Figure 7: Changes in macro conditions in 2025 drive up 1-year inflation expectations and decline in growth expectations

Source: University of Michigan, Binance Research, as of April 5, 2025

2. Interest rate outlook and Fed's position

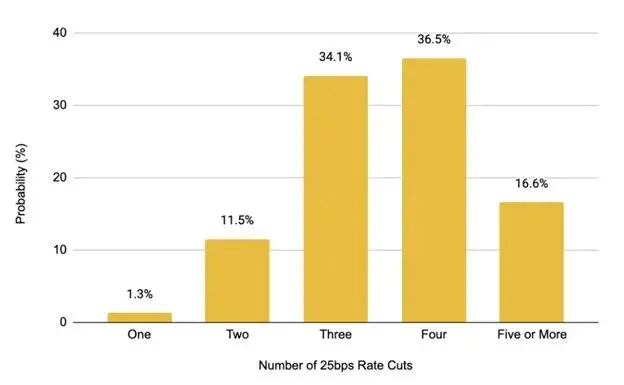

Federal Reserve Federal Funds Rate Futures data show that market expectations for rate cuts in the next few months have risen sharply. This marks a clear shift in attitude — — Just a few weeks ago, the Fed was firmly committed to curbing inflation, but now, as concerns about the outlook for economic growth have increased, the market has begun to expect monetary policy to shift to easing to support the economy.

Figure 8: Market expectations for a rate cut in 2025 continue to heat up, and currently expects 4 25 basis points rate cuts — — — — — — — than previous expectations of only 1 time

Source: CME Group, Binance Research, as of April 4, 2025

Reflecting this emotional change is the public statements of Federal Reserve officials. They expressed concerns, stressing that the new round of tariffs runs contrary to previous economic policy guidelines. Now, the Fed is facing a difficult choice: tolerate new inflation brought about by tariffs, or to stick to a hawkish stance and risk further suppressing growth?

“The scale of tariffs announced in recent weeks exceeds expectations, and their impact on inflation and growth — — — — — — — — — — — — — — — — — — — — .”

— Jerome Powell, April 4, 2025

In the short term, the Fed appears to be committed to maintaining long-term inflation expectations stable. However, monetary policy decisions will continue to rely on data, depending on which signal is weaker, the inflation or growth. If inflation is far beyond the target, the stagflation environment may limit the Fed's ability to respond to policy. This uncertain policy outlook has also exacerbated market volatility.

Outlook

1. Relevance and diversified configuration

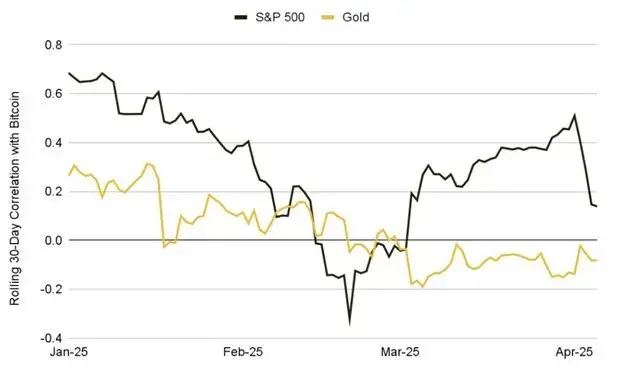

The evolving relationship between crypto assets and traditional markets is becoming the focus — —And Bitcoin, as the dominant asset of the market, is the best window to observe this change. The "risk aversion" incident triggered by the trade war has significantly affected the correlation structure between BTC and stock markets and traditional safe-haven assets.

Since the tariffs were first mentioned on January 23, the initial market response has been inconsistent — —Bitcoin and stock trends are slightly independent, causing their 30-day correlation to fall to –0.32 on February 20. However, as the trade war rhetoric continues to escalate and risk aversion continues to spread, this figure rose to 0.47 in March, indicating that Bitcoin’s linkage with overall risk assets has increased in the short term.

In contrast, the correlation between Bitcoin and traditional safe-haven assets such as gold has significantly weakened — —The originally neutral to positive relationship became a negative correlation of –0.22 in early April.

These changes show that macroeconomic factors, especially trade policies and interest rate expectations, are increasingly dominating the crypto market behavior, and have temporarily suppressed the market structure that was originally driven by supply and demand logic. Observing whether this correlation structure continues will help understand Bitcoin’s long-term positioning and its diversified value.

Figure 9: Initial reaction differentiation, as the trade war escalates, BTC and S&P 500 linkages strengthen, while their correlation with gold continues to weaken

Source: Investing.com, Binance Research, as of April 5, 2025

2. Regain the narrative of safe-haven assets

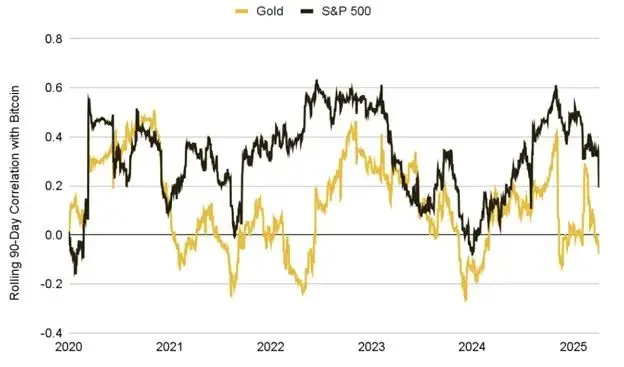

Although the recent macro and liquidity shocks highlight the "risk attributes" of crypto assets, the long-term trend has not changed: the correlation between Bitcoin and traditional markets usually rises under extreme pressure, but gradually declines after the market stabilizes. Since 2020, the 90-day average correlation between BTC and the stock market has been approximately 0.32 and only 0.12 from gold, indicating that it has always remained a certain distance from traditional asset classes.

Even under the impact of recent tariff announcements, BTC still showed some resilience in trading days when some traditional risk assets weakened. At the same time, the supply of long-term holders is still rising - this shows that in recent fluctuations, core holders have not significantly reduced their positions, but have shown strong confidence.

This behavior suggests that Bitcoin may reestablish a more independent macro identity despite intensified short-term price volatility.

Figure 10: The long-term correlation between Bitcoin and traditional assets remains moderate since 2020: 0.32 for the S&P 500 and 0.12 for the gold

Source: Investing.com, Binance Research, as of April 5, 2025

The key question is whether BTC can return to the long-term structure of low correlation with the stock market. Similar trends were already reflected during the banking turmoil in March 2023, when BTC successfully decoupled and strengthened during the downward trend of the stock market.

Now, facing the increasing tariff war and the global market has begun to adapt to the long-term trade fragmentation pattern, whether Bitcoin can be regarded as a "non-sovereign, permissionless" safe-haven asset will determine its future macro role. Market participants will closely observe whether BTC can retain this independent value proposition.

One potential path is to regain its appeal during a period of currency inflation and fiat currency depreciation, especially when the Fed turns to easing. If the Fed starts to cut interest rates and inflation remains at a high level, Bitcoin may be favored again and is regarded as a "hard asset" or anti-inflation asset.

Ultimately, this process will determine the long-term positioning of BTC as an asset class and its diversified utility in the portfolio. This also applies to other mainstream altcoins, which present stronger risk attributes in the current environment and may continue to rely on BTC-dominated market sentiment.

3. Crypto Markets in the World of Stagflation and Protectionism

Looking ahead, crypto markets will face a complex macro environment dominated by trade policy risks, stagflation pressures and global coordination breaks. If global growth continues to weaken and the crypto market has been slow to form a clear narrative, investor sentiment may fall further.

The long-term trade war will test the resilience of the entire industry — — — — — — — — s may lead to the exhaustion of retail capital flows, slowing institutional allocations, and reducing venture capital financing. Macro variables to pay close attention to in the coming months include:

· Trade dynamic development: Any new tariff list, unexpected easing measures, or major bilateral changes (such as US-China negotiations or further escalation) will directly affect market sentiment and inflation expectations.

Core inflation data: Upcoming CPI and PCE data are crucial. If the unexpected rise is driven by import costs, it will increase concerns about stagflation; if the data is weak, it may alleviate pressure from the central bank and increase the attractiveness of risky assets (including encryption).

· Global growth indicators: Declining consumer confidence, slowing business activity (PMI), weak labor market (risen unemployment claims, slowing non-farm employment), corporate profit warning and inverted yield curve (common recession signals), etc., may further trigger risk aversion in the short term. However, if macro weakness accelerates expectations of monetary easing, it may also provide support for the crypto market.

· Central Bank policy path: How the Fed and other major central banks seek a balance between inflation and recession will determine the liquidity of various types of assets. If interest rate cuts are still refused to be cut against a slowdown in growth, risky assets will continue to be under pressure; if they turn to easing, it may bring a comprehensive boost. If real interest rates fall (whether due to policy or continued inflation), long-term assets such as Bitcoin may benefit. Central bank policy differentiation (such as the Federal Reserve turning into a dove and the European Central Bank still being hawk) may also stimulate cross-border capital flows and further intensify crypto market volatility.

Encrypt your own policy events: ETF approval, strategic BTC reserves, key legislation promotion, etc. may become independent catalysts under the current macro context, and are expected to break the "macro binding" state of crypto assets and re-emphasize their uniqueness. But you should also be wary of reverse risks, such as regulatory delays or unfavorable litigation progress, which may produce negative feedback.

Conclusion

The most radical round of tariffs since the 1930s is having a profound impact on the macroeconomic and crypto markets. In the short term, the crypto market may continue to show high volatility characteristics, with investor sentiment swaying with the news of the trade war.

If inflation continues to be high and growth slows down, the Fed's response will become a key turning point: if it turns to easing, the crypto market may rebound due to a rebound in liquidity; if it remains hawkish, the pressure on risk assets will continue.

If the macro environment stabilizes, new narratives emerge, or crypto assets regain their long-term risk-haven position, the market is expected to recover. Before this, the market may maintain a volatile pattern and be highly sensitive to macro news. Investors need to pay close attention to global trends, maintain diversified asset allocations, and look for opportunities in the potential market dislocation brought about by the trade war.

No comments yet