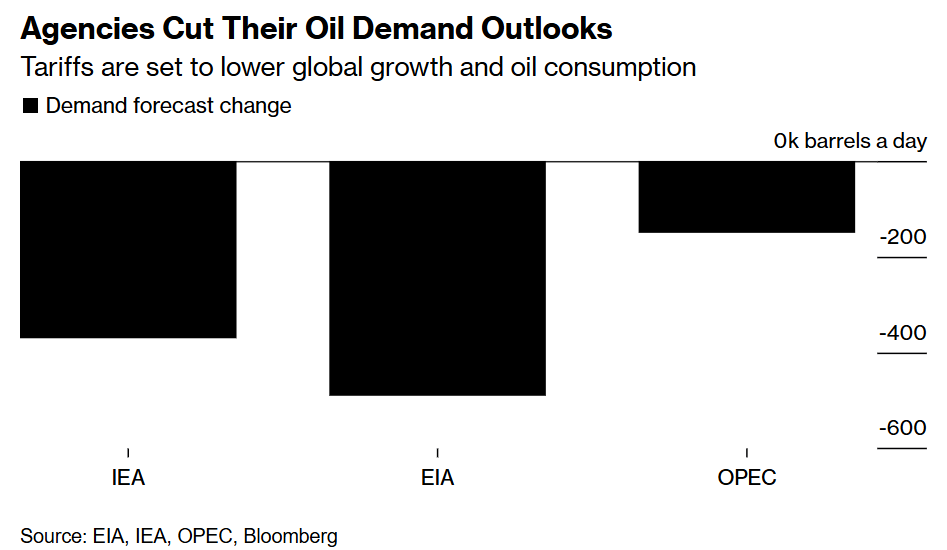

In recent weeks, oil analysts have raced to cut their forecasts for demand and prices amid the backdrop of tariff turbulence, highlighting the threat Trump's trade war posed to the global economy.

According to the average of 12 estimates compiled by Bloomberg, banks, consultants and institutions have so far made the year’sDaily consumption forecasts have been cut by 320,000 barrels。

This decline is equivalent to about one-third of the increase in oil demand in good years, which means that oversupply in the second half of the year will exceed previous expectations. Analysts say crude oil is now priced on economic weakness.

Last week,Brent crude oilFutures fell below $60 a barrel, a four-year low as traders struggled to cope with the double blow of rising OPEC+ supply and a global trade war that could undercut demand. Although prices have rebounded slightly since then, they are still down about 20% from their peak earlier this year.

As analysts and traders quickly revise their views, Wall Street investment banks have cut their oil price forecasts, and the International Energy Agency (IEA) has also issued a warning that the market outlook is deteriorating.Bulls are no longer so active, bearish now think oil prices will fall faster.

"We recently advanced our bearish expectations for the second half of 2025. Demand could be sluggish for some time as the U.S. begins to impose trade tariffs," Citigroup analyst Francesco Martoccia and others wrote in a note.

Earlier this month, Goldman Sachs Group lowered its expectations for Brent crude oil prices twice in a week, and expected Brent crude oil prices to be at the end of this year$62. Morgan Stanley and UBS also lowered their forecasts. Much of the demand cuts is concentrated in the second half of the year, when the full impact of trade measures is expected to hit consumption. These demand risks increase the prospect of a widening supply surplus, even as some suppress expectations for U.S. supply growth this year.

Although the IEA and the U.S. Energy Information Administration (EIA) lowered their production expectations, weak demand outlook means both agencies believe surpluses will be larger in 2025 than they were a month ago, while OPEC expects a smaller supply deficit. The figures come after OPEC+ announced a significant increase in production earlier this month.

However, traders are struggling to deal with a mailingMixed signalfutures curve. From the curve, trading in the next few months showed a bearish pattern, indicating that consumption expectations weakened, while trading at the front end of the curve showed an opposite pattern, indicating tight supply.

"Oil prices have begun to fall into recession," Energy Aspects analysts, including Amrita Sen, wrote in a note this week. They lowered their daily demand forecast for the second half of the year by 450,000 barrels. “The question now is how long can the front end last while the confrontation between economies—historically, this is not the best news for demand and the global economy as a whole.”

No comments yet