Since the last cycle, platform coins have no longer just "processing fee discount coupons". From destruction mechanisms, income participation, on-chain pledge to governance attributes, major centralized exchanges (CEXs) are constantly reconstructing the value support logic of their platform coins.

As the industry enters a new round of adjustment cycle, users' expectations for platform coins have also changed significantly - from "how much to how much to increase" to "what to rely on to increase". Simple marketing drivers are no longer sustainable, and instead pay attention to the underlying factors such as whether the deflation mechanism is real and effective, whether the usage scenarios are continuously active, and whether the platform's own growth is healthy.

Recently, Binance and Bitget announced the completion of the destruction plan respectively. BNB destroyed about 1.579 million pieces in the 31st time, accounting for about 1.1% of the total supply; while BGB destroyed 30 million pieces in the first quarter, accounting for about 2.5% of the total supply. The platform currency track is moving from "also mechanism" to "cash mechanism", and the strategic differences between new and old platforms in the deflation path are becoming increasingly obvious.

This article will compare the structural design and implementation performance of current mainstream platform coins around the following core dimensions:

● The actual strength of the deflation mechanism

● Total structure and release risks

● The degree of binding between actual usage scenarios and ecological

● The growth capability of the trading platform

● Market performance and value anchor logic

Through a series of horizontal data, structural charts and qualitative observations, users can help clarify the differences and advantages of mainstream platform coins in mechanism design and implementation results.

1.Comparison of deflation strength: Who is really destroying it? Who is still telling stories?

The deflation design of platform coins is the primary dimension for users to judge their long-term value. But "having a destruction mechanism" does not mean "really implementing deflation." There are two key issues:

● Is the destruction frequency stable?

● Is the destruction ratio strong enough?

There are obvious differences in the performance of several mainstream platform coins in deflation mechanism. The following is an overview of the currently verifiable mechanisms and execution rhythms:

BGB Q1 2025 first quarterly destruction2.5%, higher than BNB history.

After completing this destruction, BNB destroyed a total of 1,579,207 BNBs, equivalent to approximately US$916 million, accounting for approximately 1.13% of its total supply. This destruction action continues its mature deflation mechanism and once again reflects Binance's long-term investment in platform currency value management.

However, if you look at the dimension of "the amount of destruction in this round vs the current market value", the market elasticity shown by BGB is even more prominent:

It can be seen that although BNB's funds destroyed in this round are as high as US$900 million, about BGB's6.9 times, but BNB's market value is BGB's16.5 times。

This means that in terms of the "relative pressure" between the destruction funds of platform coins and their market value, BGB is much higher than BNB.

This structural asymmetry,Releases a key signal: BGB's current valuation is still in the "undervalued" stage, and its market capitalization basis has not yet fully reflected Bitget's platform growth, deflation execution and ecological binding results.

In other words, deflation behavior of the same size has more direct price influence on medium and early-stage assets such as BGB and has stronger elasticity in value revaluation. This is also why this round of BGB destruction is not only a node for the mechanism realization, but also a starting point for the "structural value upward movement".

Comparative comments:

● BNB has a relatively mature deflation mechanism, adopting a dual-track mode of BEP-95 automatic destruction + quarterly manual destruction, with a clear rhythm and stable mechanism. The latest quarterly destruction amount reached US$916 million, and the deflation execution still belongs to one of the strongest among mainstream platform coins. However, its single-round destruction ratio has remained at around 1% for a long time, and the marginal price pressure has decreased significantly due to the huge market capitalization, which is more reflected in "stable compression" rather than price-driven.

● BGB shows the structural characteristics of "light market value, high deflation pressure". The destruction reached 2.5% in the first quarter. Although the amount of destruction is far less than BNB, it accounts for three times the proportion of its market value, forming a stronger supply reduction effect. Combined with its on-chain execution mechanism, the market value volume of the undervalued stage by using the pegged execution mechanism, the marginal impact of BGB's deflation behavior on price is more significant, and it has the typical characteristics of a high-growth platform currency.

● UNis still in a state of "having a commitment to destroy but lacking execution disclosure". Although there is a deflation mechanism in the white paper, the actual destruction rhythm is opaque, the amount is not public, and the path cannot be verified, making it difficult for users to establish stable expectations, and the support for currency price and market feedback are also relatively moderate.

2.Total structure and release pressure: Whose supply is clearer?

Judging the deflation potential of a platform currency depends not only on the destruction ratio, but also on itsSupply structureIs it clear:

● Is the total supply capped?

● Is there still a large proportion of team or foundation shares waiting to be released?

● How high is the proportion of circulation? Are there any hidden dangers of "possible market crash in the future"?

The following is a comparison of the supply structure of current mainstream platform coins (data comes from the official white paper, on-chain information and market platform disclosure):

Comparative comments:

● BNBAlthough the total target volume is 200 million and the supply is continuously reduced through the automatic destruction mechanism, there is still a small number of historical reserved shares that have not been unlocked. Its supply structure is relatively stable, but it will take time to completely close it.

● BGBIt is one of the few platform coins that have been "completely released". At the end of 2024, Bitget officially destroyed what originally belonged to the team at one time800 million BGB, directly compressing the total supply from 2 billion to 1.2 billion, and announced that it is currently100% fully circulatedStatus, there is no subsequent unlocking impact or allocation risk.

● UN There is certain uncertainty in the supply structure of the company, and there may be team positions and undisclosed unlocking plans. This type of platform coins has a large "future supply elasticity" and users may not be able to accurately evaluate whether the deflation effect can be maintained for a long time.

In the evaluation of platform coins' value, capping supply + full circulation state is the basic platform for building "scarcity expectations". The way to do BGB isCompletely eliminate supply-side uncertainty, by locking the total amount and release rhythm in advance, the market attention is directed to the main logic of "actual use-driven value".

3.Actual use scenarios: It is not who uses more uses, but who is frequently used

The more use scenarios of platform coins, the stronger the theoretical value support. But in reality, "available" ≠ "commonly used", and "hook name support" ≠ "user is really using it".

What are the real platform coins that are worth paying attention toHigh frequency appears in the product participation entrance, and continue to form a positive cycle of "lock-deflation-value feedback" through use.

The following are the current mainstream platform coinsIn-Platform (CeFi) and on-chain (DeFi)Comparison of usage coverage of two dimensions:

Comparative comments:

● BNBAs a veteran platform currency in the industry, it is still leading in product usage breadth and ecological maturity. As the core Gas asset of BSC (now BNB Chain), it is naturally embedded in a large number of on-chain DeFi scenarios. However, due to the huge user base, the average participation income of a single user has decreased to a certain extent, the participation motivation of BNB is weakened.

● BGBThe usage scenarios have expanded rapidly in recent years. They are not only frequently used in the core products of Bitget Exchange (such as Launchpool, Launchpad, PoolX), but also bound to paths such as financial management zones, Earn strategy combinations, and handling fee deductions. And these productsMost of them require pledge or locked BGB to participate, a stable "coin holding-locking-benefit" chain has been formed in actual operations.

● UNFunctionally support participating in project issuance, handling fee discounts, etc., butWeak on-chain usage ability, slow pace of new products, resulting in low frequency of user usage and insufficient binding stickiness.

Taking Bitget's Launch series products as an example, BGB is the ticket currency for almost all new projects to participate in, and many activities often attract hundreds of thousands of users to participate. At the same time, BGB provides functions such as Gas payment and on-chain pledge in the Bitget Wallet ecosystem, and plans to expand to Web3 scenarios such as NFT casting and DAO governance. These layout descriptionsBGB is not only used at the CeFi level at high frequency, but also gradually building closed loops on the chain, strengthen its potential as an ecological "central asset".

In contrast, the use of BNB has entered a stable period, and although the function coverage is wide, the marginal income of users has weakened; while BGB is still in the early stage of "function unlocking + user expansion". In the future, with the on-chain DAO governance and NFT rights purchase functions, the closed loop of its use may be further expanded.

Four, Platform support: The stronger the platform, the more valuable the currency is

Image data source: CoinGecko, April 14, 2025

The value of platform coins is ultimately "platform credit". The deflation mechanism determines scarcity, and the use scenario determines the intensity of demand, but the final valuation anchor still depends on the actual size, ecological layout and development trend of the exchange behind it.

in other words:The medium- and long-term value of platform coins depends on the real growth ability of the platform, not conceptual stimulation.

The following is a comparison of some key data from mainstream platforms (data source: CoinGecko, April 14, 2025):

Next based on TokenInsight"Crypto Exchange 2024 Annual Report", compare and analyze the development of the three major exchanges over the past 24 years:

● Binance: The market occupies the runner, but the growth rate slows down.As the world's most influential crypto exchange, Binance still ranks first in spot, derivatives and user size. As of 2024, its spot share was as high as 48.2%, which means that its platform currency, BNB, has a strong user coverage and ecological foundation. However, Binance's annual market share fell from 42.2% to 32.7%, and it began to show a marginal slowdown in terms of user growth and share stability.

● Bitget: A typical high-growth platform with a impressive jump speed.Bitget is the most outstanding "second-tier leader" in the past year. As of 2024, its spot share increased by 8.06%, with the total market share increasing by 5.2 percentage points for the whole year, and the derivatives share approaching 12%. Mainstream currencies such as BTC and ETH are actively trading, with a total trading volume of more than $3.6B in 24 hours. It is particularly worth noting that Bitget's growth does not rely on a single explosive point, but is promoted more and more around the contract, order management, financial management, and wallet ecosystems, gradually forming a trinity structure of exchange + wallet + product platform, which also constitutes the value basis of BGB.

● Okx: The share is stable, the product line is deep but the breakthrough is limited.OKX is a traditional strong platform, especially in terms of derivativesmustmarket presence (15% share). However, the spot share is slightly passive under the impact of emerging platforms. The market share in 2024 dropped from 16.6% to 11.8%, and the BTC/ETH liquidity indicator is also lower than Bitget. The logic of OKB in the platform is relatively conservative, and its ecological binding is not as good as BNB and BGB, which has also affected its valuation ceiling to a certain extent.

The strength of the platform is the underlying anchor point of the platform's currency value. From the current situation:

● BinanceIt is a representative of "asset security" and "circulation breadth";

● BitgetIt represents the representative of "growth potential" and "mechanism evolution";

● OKX Relatively conservative, the support for platform coins needs to be further released.

From this perspective, the current price structure of BGB is still inThe valuation discount stage of "High Growth Platform Coin", has the realistic soil for repricing.

5. Review of market performance: trends, liquidity, and valuation elasticity in the past year

The structure and mechanism of platform coins are important, but in the end, the market has to look back to three indicators:

● Price trend(Can the structural value be reflected)

● Trading activity(Daily average liquidity and participation intensity)

● Valuation rationality(Current pricing vs potential space)

The following are the three major platform coinsApril 14, 2024arriveApril 13, 2025Comparison of market performance in the past year (data source: CoinMarketCap):

Note: V/MC = Daily average trading volume ÷ Market value, used to measure activity and liquidity.

Comparative comments:

● BNBThe performance was steady and slightly higher, continuing to maintain the characteristics of leading assets in the crypto market. The relatively low turnover reflects its "store of value" positioning.

● BGBThe increase in the past year has exceeded 260%, making it one of the strongest platform coins. V/MC is relatively high, indicating that it may still be undervalued by the market and has great potential for upward growth.

● OKBBoth market value and trading volume are relatively neutral and lack obvious driving force.

6. Who has long-term value logic?

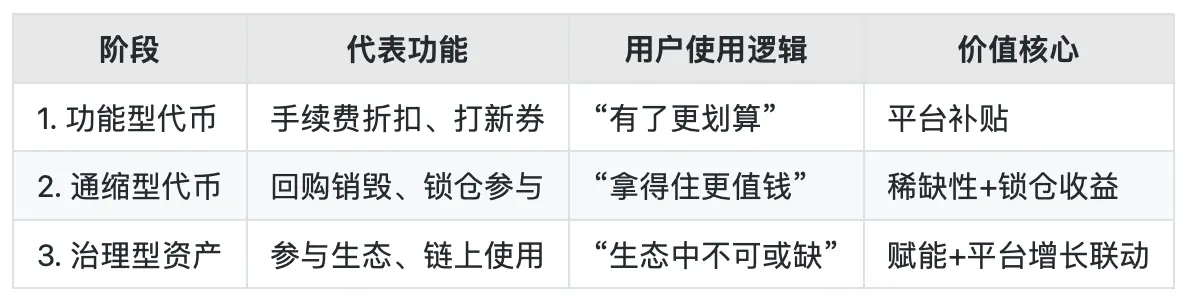

The positioning of platform coins is going through a gameEvolution from "tool type" to "asset type"。

In the early stages, most platform coins have very simple functions—Deduct handling fees, participate in new issuance, and earn a small profit spread. In essence, it is the platform's "user incentive token", which is not scarce or independent value logic. The market relies more on sentiment and band market conditions for its pricing.

But starting from 2021, especially after leading platforms build their own ecosystems and promote on-chain expansion, platform coins have gradually taken on three deeper roles:

1. Deflation anchor: Binding platform business growth

● BNB: Link destruction to on-chain transaction fees through BEP-95;

● BGB: Based on the on-chain usage fee + fixed destruction amount, realize a two-way destruction path;

This means:The richer the usage scenarios → the more destructions → the higher the value of the platform coins, forming a closed loop.

2. Ecological Participation Certificate: Become a "product ticket"

● Pledge BGB / BNB can participate in Launchpad, Launchpool and other products;

● Locking platform coins can enjoy higher financial management interest rates, priority qualifications, and whitelist channels;

Users are not "holding for the sake of cryptocurrency speculation", but "must hold to participate in the ecosystem", and the platform coins have becomePart of the ecological access mechanism。

3. On-chain governance assets: from platform to chain

● BNB has participated in on-chain governance proposals, Gas payments, and pledge mining;

● BGB supports on-chain staking in Bitget Wallet, and plans to expand DAO, NFT voting and other functions;

● OKB also proposed an on-chain governance plan, but it has not yet been fully implemented.

Platform coins are trying to complete the "value out-of-circle" from CeFi internal incentives → DeFi external empowerment and become the benchmark asset for ecological governance.

At present,BNB is between stage 2.5 and 3, BGB is transitioning from stage 2 to stage 3, OKB stays between 1.5-2。

Through the previous comparison of deflation mechanism, supply structure, usage scenarios, platform support and market performance, it can be seen that although platform coins belong to the same category, the logic behind them has gradually differentiated into two categories:

● One category isClear mechanism, tight structure, positive platform growthplatform coins such as BGB and BNB;

● The other type isFuzzy mechanism, unclear circulation, weak sense of participation in useThe long-term value support for platform coins is insufficient.

Based on the current data, we can re-summarize the long-term value potential of mainstream platform coins from the following core dimensions:

By comparison, you can see:

● If users value platform coinsLong-term deflation pressure + clear use of closed loop + growth platform support, BGB is the "new practical platform coin" with the most complete structure and the greatest potential space at the moment.

● If you value stability and security margins more, BNB is still the most basic asset in the crypto industry.

● OKB orhaveBand opportunities, but lack structural clarity and sustainable ecological binding, and holding requires higher speculative tolerance and timing ability.

So, which users are suitable for paying attention to platform coins? In what scenarios can you consider configuration?

● For users who participate in exchange products at high frequency and have the habit of Launchpad, BGB/BNB participation frequency can actually benefit;

● For medium-term holders who want to "low valuation + long-term potential", the BGB structure is early and has stronger elasticity;

● Those who prefer band operations and accept short-term games can pay attention to platform coins such as OKB.

The next round of revaluation of platform coins is no longer dependent on stories, but on cashing.A platform currency that truly has long-term value must be an asset that outperforms at the same time in four lines: clear mechanism, clean supply, real scenarios, and continuous platform expansion.

Future competition is not just "who can rise", but "who can continue to rise."

No comments yet