April 15, 2025 08:00-12:00

Hello, brothers and sisters, report on your work:

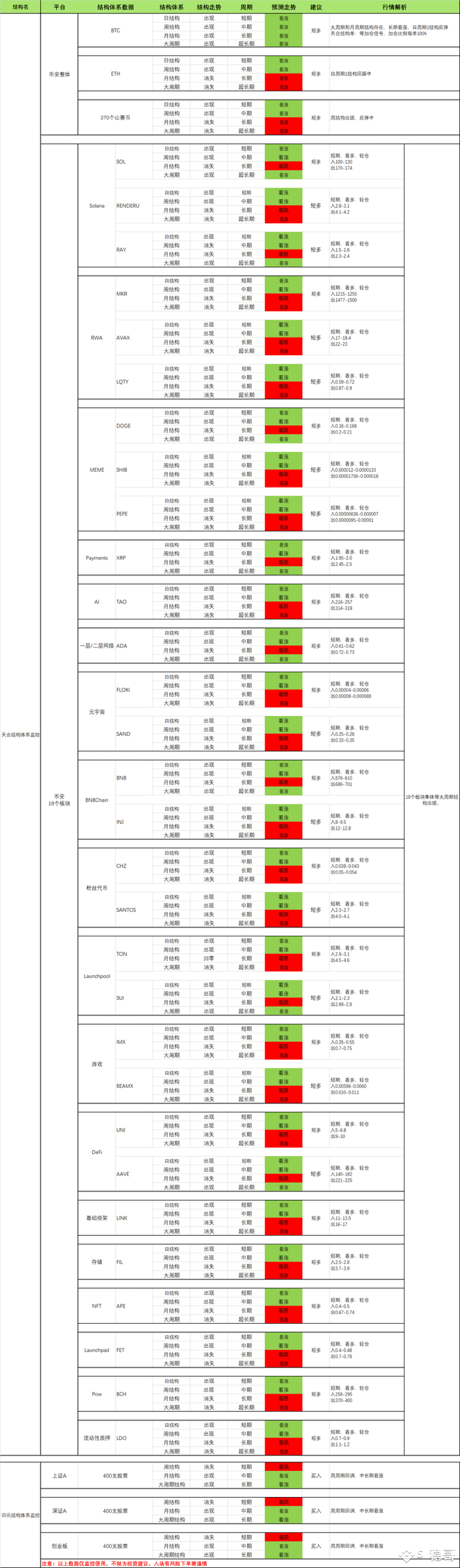

The Trinhe Structural System monitors:

370 altcoins have retraceed back on the daily cycle, and the 4-hour cycle is in the escape peak range and waits for the price to sprint. The weekly cycle structure appears, waiting for the daily cycle to retrace and then rebound and sprint.

Notice! ️The bottom-buying signal was not triggered, and the unilateral upward trend was not started. The heavy position was to buy at the bottom and continue to wait, and prepare the bullets quickly.

BTC moves toward the resistance position of the weekly moving average of 88,000 in the 4-hour cycle. The current upward trend is stable, and the weekly structure appears. The 88,000 position will be broken. The support below is around 65,000 in the monthly moving average, and the support in the pvp large cycle is effective.

ETH continues to rebound in the 4-hour cycle, the weekly cycle structure appears, and the resistance of 1700 will be broken. At present, the weekly cycle monthly cycle suppresses ETH to form a short trend, and the strong resistance position is around 2600.

Trinhe Structural System:

Monitor the overall trend of 370 altcoins, see the picture for details.

Rebirth structure system

Monitor the overall trend of 1,200 stocks, see the picture for details.

Large and medium-cycle structures appear, long-term bullish, short-term back-regulation

Newbie trading reminder⏰

For novices or those who do not have a trading system, they do not buy new coins, do not chase highs, do not buy at the bottom, do not contracts, do not borrow money, do not use credit cards to buy coins, learn to trade for free first and then trade.

Currently, 2,900 people are following, and they plan to choose 10 people to build the Tianhe structural system for free. It is expected that learning will start in June. If you need it, please refer to the thank you letter.

⚠️Note! The orders posted are all personal experience and are not used as investment.

Investment advice: There are risks in making orders, so be cautious when entering the market.