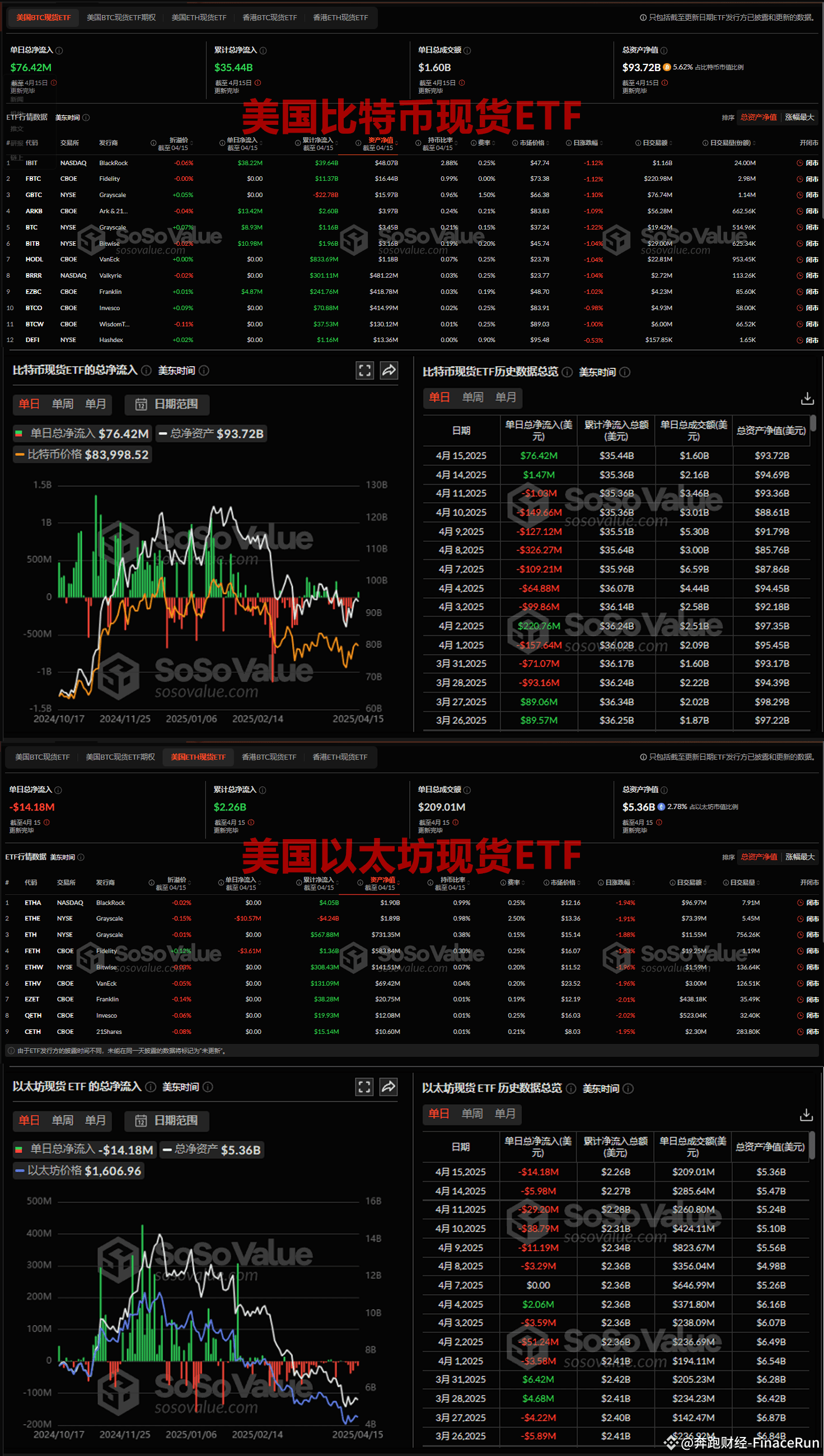

Bitcoin spot ETF has net capital inflows for 2 consecutive days, and Ethereum ETF has net capital outflows for 6 consecutive days.

On April 16, according to SosoValue data, the total net inflow of Bitcoin spot ETF in a single day was US$76.42 million yesterday, recording a net inflow of funds for two consecutive days.

Among them, Blackrock's Bitcoin ETF IBIT ranked first in net inflow yesterday, with a single-day net inflow of US$38.22 million. Currently, the cumulative net inflow of IBIT has reached US$39.64 billion.

The second is Ark Invest & 21Shares' ETF ARKB, with a single-day net inflow of US$13.42 million. Currently, the total net inflow of ARKB has reached US$26 in history.

Bitwise Bitcoin ETF BITB and Grayscale Bitcoin Mini Trust ETF BTC and Franklin Bitcoin ETF EZBC yesterday had net outflows of $10.98 million, $8.93 million and $4.87 million respectively. The other 7 Bitcoin ETFs have not seen any capital flow in a single day.

As of now, the total net asset value of Bitcoin spot ETFs is US$93.72 billion, accounting for 5.62% of the total market value of Bitcoin, and the cumulative net inflow has reached US$35.44 billion.

On the same day, the total net outflow of Ethereum spot ETFs was US$14.18 million in a single day, recording a net outflow of funds for six consecutive days.

Among them, Grayscale Ethereum ETF ETHE had the largest net outflow yesterday, with a single-day net outflow of US$10.57 million. Currently, ETHE's cumulative net outflow has reached US$4.24 billion.

The second is Fidelity Ethereum ETF FETH, with a net outflow of US$3.61 million in a single day. Currently, the total net inflow of FETH in history has reached US$1.36 billion. The other 7 Ethereum ETFs have not seen any capital flow in a single day.

As of now, the total net asset value of Ethereum spot ETFs is US$5.36 billion, accounting for 2.78% of Ethereum's total market value, and the cumulative total net inflow is US$2.26 billion.

#Bitcoin ETF #Ethereum ETF #Fund flow