The rise in Bitcoin market has not triggered short-term speculation, and institutional dominance and liquidity tightening may be the main reason

Bitcoin (BTC) has risen recently, but the market is extremely calm. Unlike previous bull market speculation, this rise lacks the enthusiasm of retail investors.

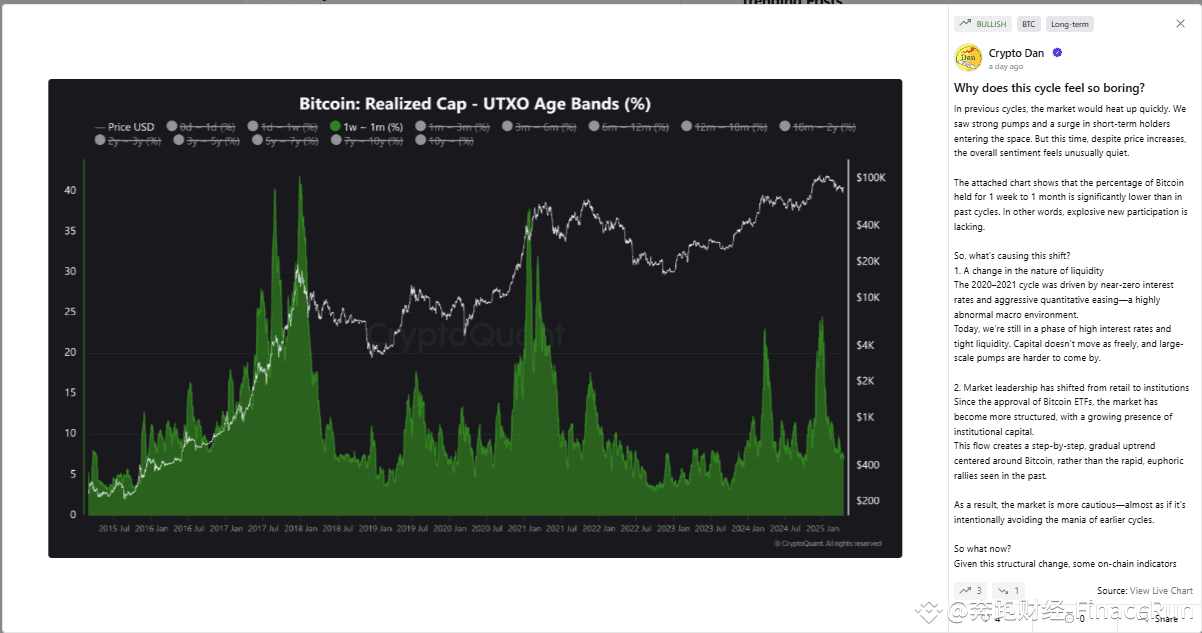

According to CryptoQuant data, the percentage of BTC held for one week to one month is lower than in the past cycle, indicating that the influx of new participants is no longer obvious.

Analysis points out that the current market trend is mainly caused by the influence of macroeconomic changes and the transfer of market dominance from retail investors to institutions.

Because in the current environment of tight liquidity and high interest rates, the willingness to inflow in capital has weakened and the difficulty of price fluctuations and rising prices has increased.

In addition, with the approval of the US Bitcoin ETF, institutional investors have become the market leader, and the market trend is more structured and gradual due to its more cautious capital flow.

This structural evolution has also created a more cautious market atmosphere. Some analysts believe this is a sign that the cycle has peaked, but CryptoQuant believes it is still too early to draw this conclusion.

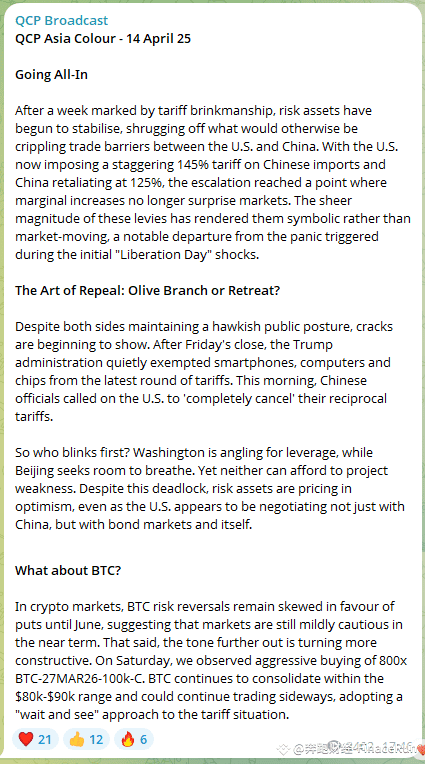

According to QCP Capital's report, Bitcoin's wind reversal is biased towards put options, indicating that traders have a moderate and cautious position in the short term. However, the more at this time, retail investors are more important than pursuing rapid growth.

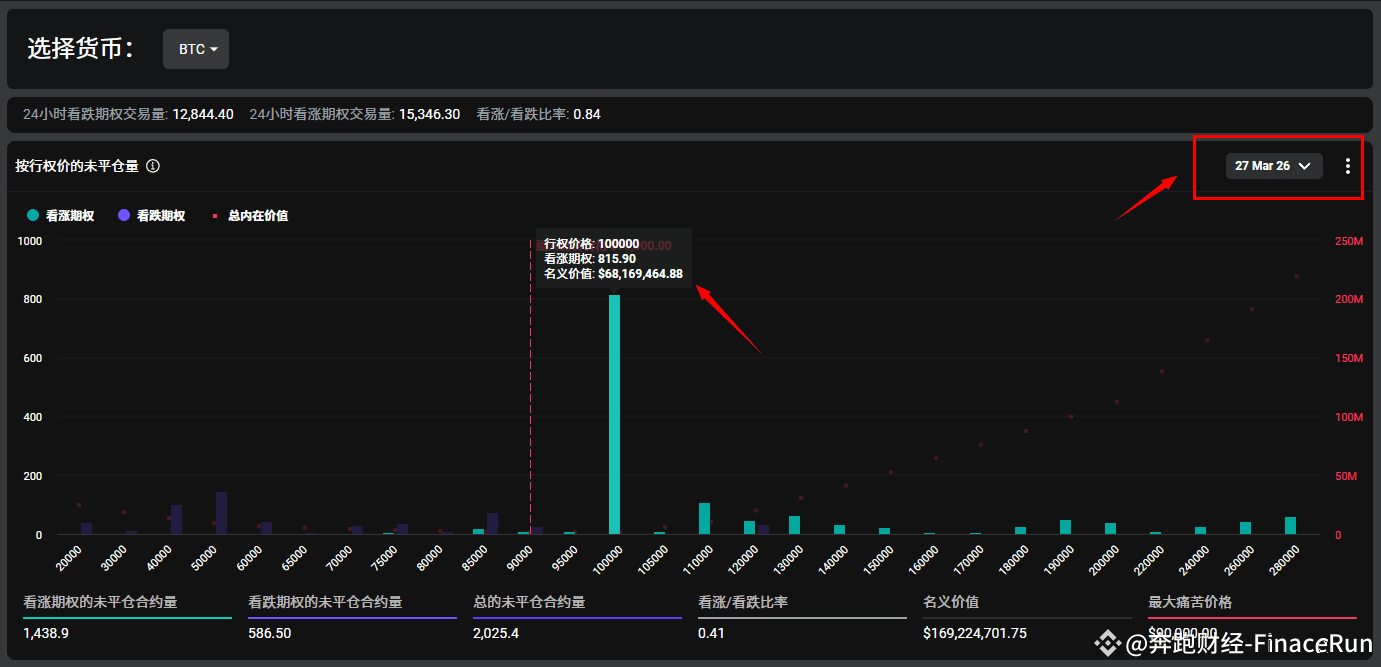

It is worth noting that as of now, there are more than 800 calls in the cryptocurrency options market with expiration dates of US$100,000 on March 27, 2026. This differentiated attitude of "short-term wait-and-see, long-term optimistic" is a typical feature of the institutional market.

Currently, the Bitcoin market price continues to consolidate in the range of 80,000 to 90,000 US dollars. The uncertainty of the global tariff pattern has made most market participants adopt a "waiting and watching" attitude.

When Bitcoin becomes institutionally dominant, will we never see the crazy fluctuations we once did again? Do you think this "boring bull market" market will be the norm in the future?

#Bitcoin #Cryptocurrency #Market Analysis