奔跑财经-FinaceRun

币圈小白

04-17 12:07

Follow

Peter Schiff: Selling Bitcoin and Investing in Gold Mining Stocks in a Time of Turbulence in Cryptocurrency Market

High-profile economist Peter Schiff advises investors to sell Bitcoin in the event of current turbulence in cryptocurrency markets and invest in gold mining stocks.

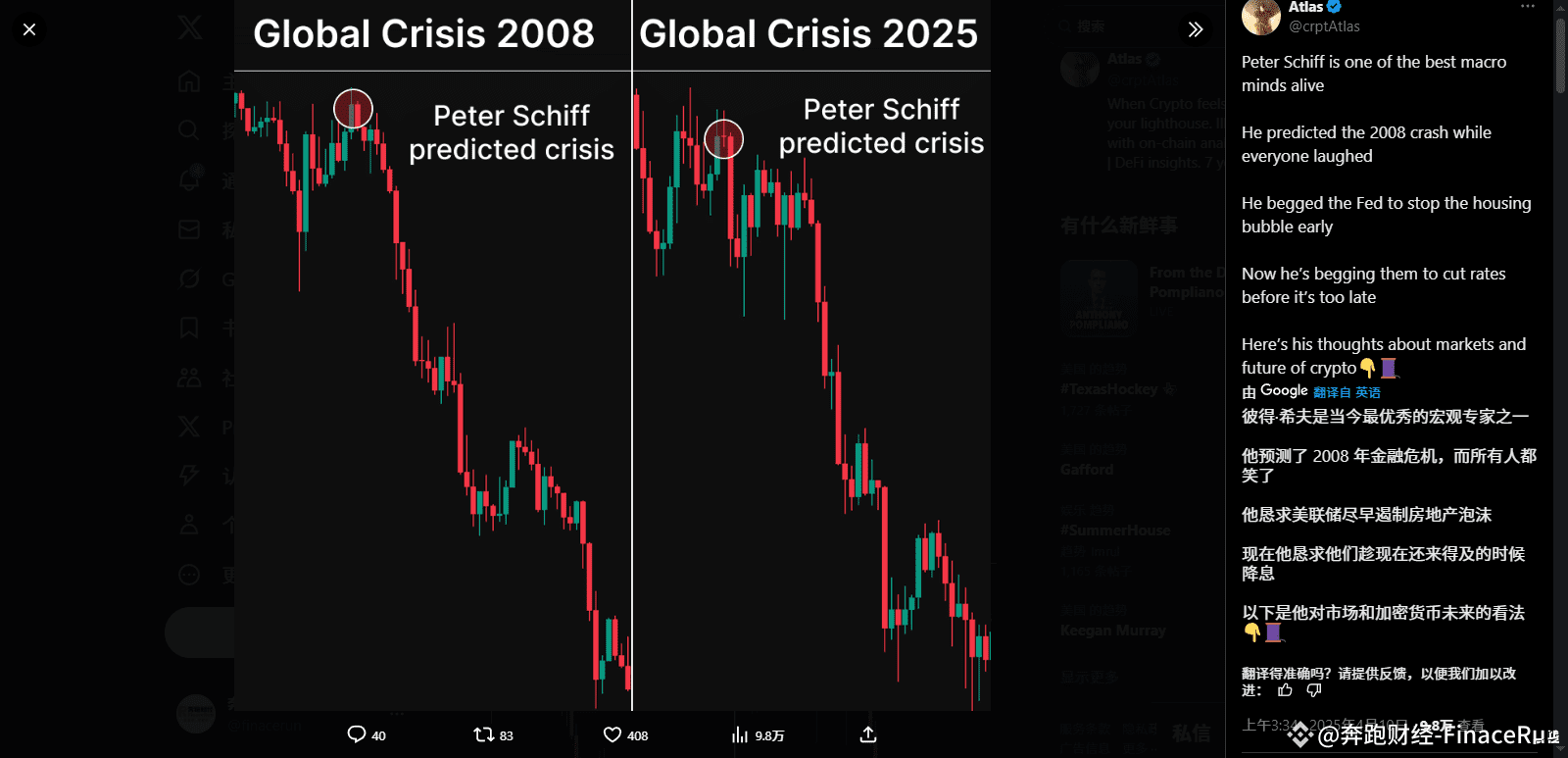

Peter Schiff, the gold advocate who became famous for accurately predicting the 2008 financial crisis, has once again criticized Bitcoin. He called Bitcoin a "risk asset" and believed that investing in gold mining stocks in a situation where market uncertainty is "the best deal at the moment."

Schiff pointed out that Bitcoin is still facing difficulties, with the cryptocurrency market falling generally, while gold prices continue to hit new highs, and gold prices broke through the historical high of $3,300 yesterday.

However, although Bitcoin has shown some resilience in recent market volatility, Schiff still believes that Bitcoin still lacks intrinsic value and predicts that the next major economic recession will herald the demise of Bitcoin.

In fact, Schiff has always questioned Bitcoin, criticized it for a long time as a speculative asset that lacks intrinsic value, and insisted that in a major economic crisis, the value of Bitcoin will definitely collapse, and gold is the safe haven in economic turmoil.

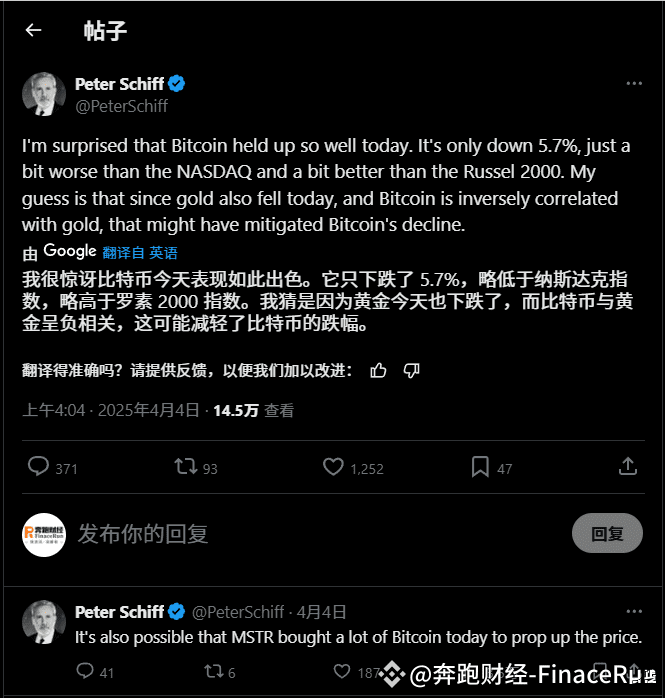

However, he also admitted that Bitcoin performed better than expected when global trade tariffs triggered sharp market fluctuations on April 4. Stocks, commodities and cryptocurrencies were all hit at that time, and although Bitcoin fell 5.7%, it performed better than the Nasdaq and Russell 2000.

Schiff, who is the head of European Pacific Capital, once said that the 2008 financial crisis gave birth to Bitcoin. If you want to replace traditional banking and financial business, the next major economic recession (perhaps related to the ongoing tariff war) is Bitcoin’s “doomsday.”

Meanwhile, despite the recent 90-day temporary tariff extension, giving the market a brief respite, Schiff believes that the tariffs have caused long-term damage to global trade momentum and investor confidence, which further strengthens his opposition to cryptocurrencies as sustainable investment.

Finally, during a period of volatile cryptocurrency markets, would you choose to sell Bitcoin? Or are you more inclined to invest in gold mining stocks? Leave your opinions in the comment section!

#Bitcoin #Gold Mining Stocks #Investment Strategy

BTC

+1.00%

Risk and Disclaimer:The content shared by the author represents only their personal views and does not reflect the position of CoinWorld (币界网). CoinWorld does not guarantee the truthfulness, accuracy, or originality of the content. This article does not constitute an offer, solicitation, invitation, recommendation, or advice to buy or sell any investment products or make any investment decisions

0

32

0

38

0

No Comments