May market: When will Bitcoin BTC rise? Will it still fall below $70,000?

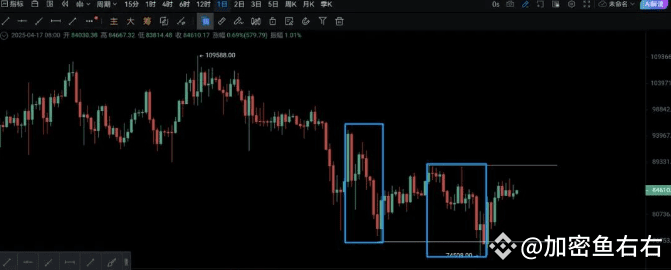

Bitcoin’s daily line is a volatile trend, and the overall fluctuates between US$76,000 and US$88,000. By passing clues in the oscillation zone, you can already judge the subsequent direction.

There are currently two waves of decline in the oscillation zone. It is obvious that the wave of decline in early March is very fast, with a larger drop, and the volume is also a short seller.

The recent wave of decline at the end of March has narrowed, and the power of the bears has obviously weakened, and has changed from a major downward trend to a volatile area to absorb funds.

The oscillation zone reached the 70,000 USD range three times, but the pins were quickly retracted, indicating that the support below was very strong, and the stronger the signal of bullish reversal after each decline

The latest wave of increase from April 7 to April 11 has increased in volume and is getting stronger and stronger.

The daily level may fluctuate, but the direction of the market in the next May is already very clear

There has been a strong sense of bearishness in the market recently. Rumors say that Bitcoin will fall below 70,000 US dollars, and it will only lead to an increase if it reaches 68,000 US dollars...

This is no different from every wave of market pullback in the past. If it falls, it will continue to fall. It will really fall to $68,000. I'm afraid I'm saying it will fall to $60,000.

This is a typical example: if you can't understand the stop-fall signal on the market, and if you don't know the direction of the next trend, you can't start.

Such meaningless waiting is impossible, even if you see the market fall, you dare not buy it. If the market rises, you will not judge to reach the peak, and you will not be willing to sell it. Such an operation is impossible to make money in the currency circle.

#Powell's speech