US Bitcoin spot ETF ushered in a net inflow of US$108 million, while Ethereum ETF has no capital flow

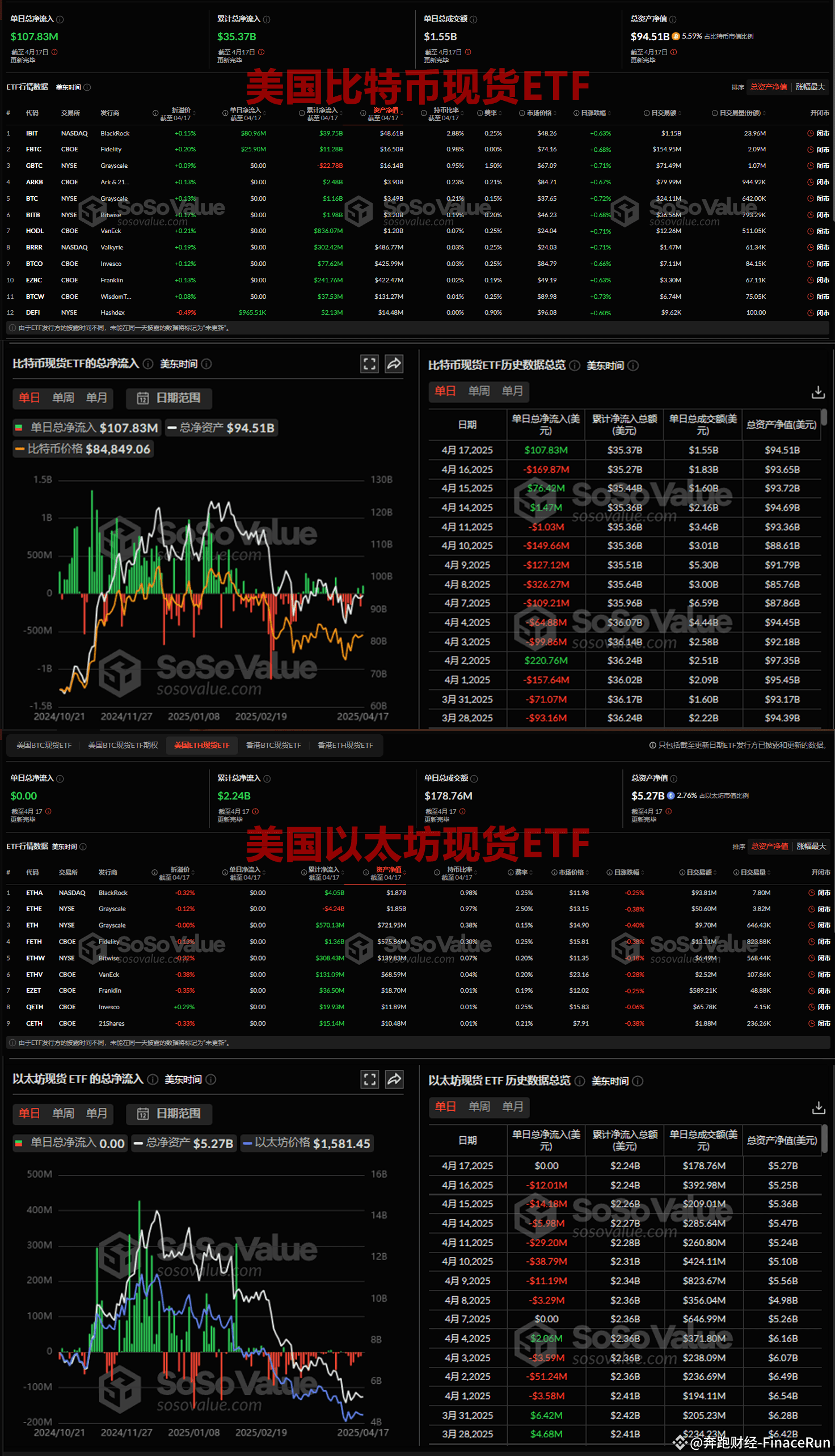

On April 18, according to SoSoValue data, the total net inflow of Bitcoin spot ETF yesterday was nearly US$108 million, ushering in the first day of net inflow of funds.

Among them, BlackRock's Bitcoin ETF IBIT ranked the most inflows in a single day with US$80.96 million. Currently, the cumulative net inflow of IBIT has reached US$39.75 billion. The second is Fidelity Bitcoin ETF FBTC, with a single-day net inflow of US$25.9 million. Currently, the cumulative net inflow of FBTC has reached US$11.28 billion.

The Hashdex Bitcoin ETF DEFI recorded a net inflow of US$965,500 per day, bringing its cumulative net inflow to US$213. The other 9 Bitcoin ETFs did not see any capital flow yesterday.

As of now, the total net asset value of Bitcoin spot ETFs is US$94.51 billion, accounting for 5.59% of the total market value of Bitcoin, and the cumulative net inflow is US$35.37 billion.

On the same day, nine Ethereum spot ETFs did not see any capital flow on the first day after seven consecutive days of capital outflows.

As of press time, the total net asset value of Ethereum spot ETF was US$5.27 billion, accounting for 2.76% of Ethereum's total market value, and the cumulative total net inflow was US$2.244 billion.

#Bitcoin ETF #Ethereum ETF #Fund flow