德克萨斯州的比特币储备计画可能改变金融格局,这是否代表着比特币将被更多国家视为战略资产?该法案会对全球加密市场带来哪些长期影响?

Topic Background

区块链扫描仪

币圈小白

11h ago

🔔Cardano Founder: No need to make a deal with Trump, what is really important is legislation brings crypto regulation stability

According to Mars Finance, on April 18, according to DLNews, Cardano (ADA) founder Charles Hoskinson responded to not being invited by the White House crypto roundtable and said that "there is no need to reach a deal with Trump." Hoskinson said that the current U.S.-driven crypto policy reforms should focus on "sustainable, long-term frameworks" rather than relying on short-term politicians. During the White House cryptocurrency summit, Trump met with crypto executives including Coinbase CEO Brian Armstrong, MicroStrategy executive chairman Michael Saylor, Ripple CEO Brad Garlinghouse and other crypto executives to discuss digital asset regulation issues, but Cardano (ADA) founder Charles Hoskinson was not invited. Hoskinson stressed that even if Trump issued crypto executive orders, established a strategic Bitcoin reserve and appointed crypto-friendly people to lead the SEC during his tenure, what is really important is the regulatory stability brought by legislation. "Faced with the current changes in the United States' policies, Trump governs the country like a startup, but this also highlights the need to establish a decentralized system such as blockchain. The only option is blockchain."

https://t.co/0oJ2mQbPDS

奔跑财经-FinaceRun

币圈小白

04-16 11:53

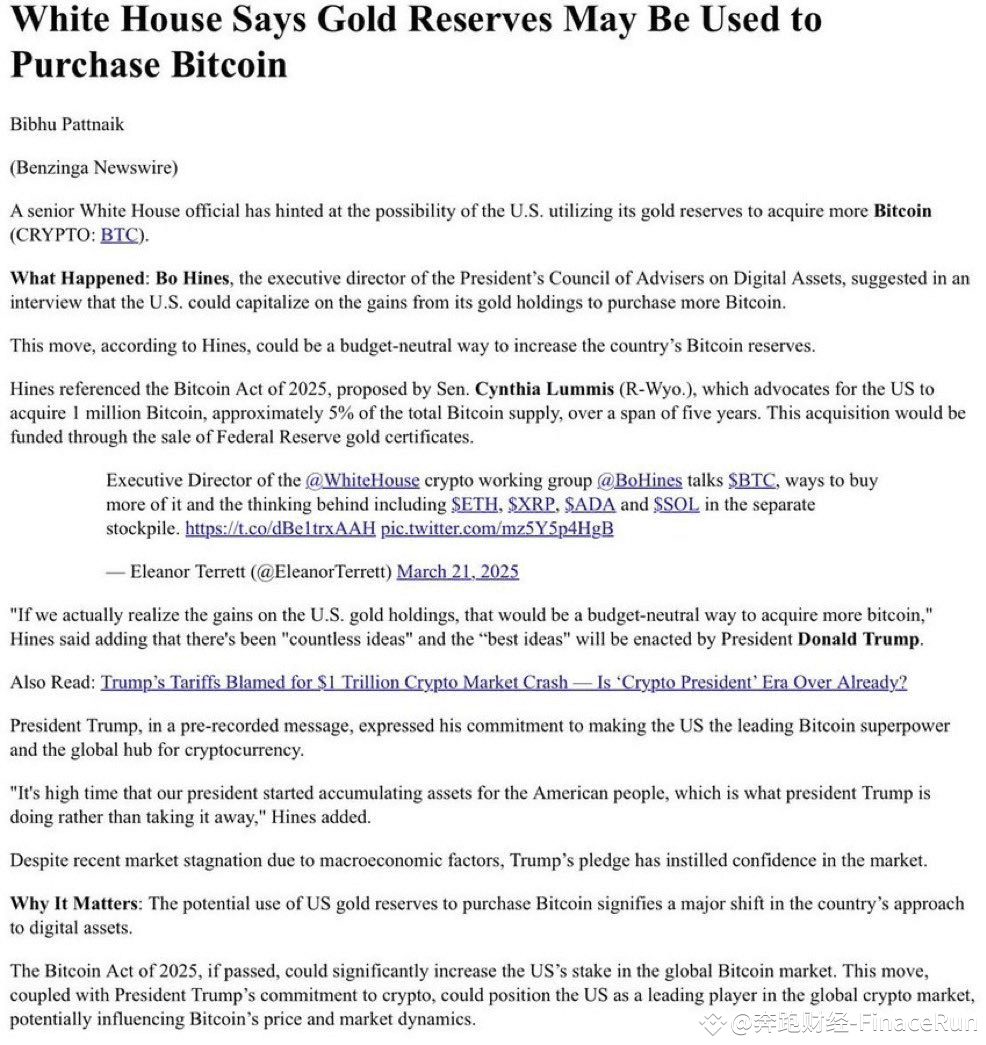

White House plans to explore gold and tariff revenues to support Bitcoin strategic reserves

According to Bo Hines, executive director of the President's Digital Assets Advisory Committee, the White House is studying the establishment of national Bitcoin reserves through innovative fiscal means.

The core of the plan is that the government increases its holdings by bit through tariff revenue and reevaluating the US gold reserve pricing method without increasing taxpayers.

The current gold certificate held by the Ministry of Finance is still priced at $42.22 per ounce in 1973. If adjusted to the current market price of about $2,300, it will generate hundreds of billions of dollars in book income. This part of the "paper profit" can be used for Bitcoin procurement.

In addition to gold revaluation, the government is considering using future tariff revenue specifically for the construction of cryptocurrency reserves. This "out of the budget" funding arrangement can not only avoid squeezing existing financial resources, but also maintain operational flexibility.

It is worth noting that the plan has formed a policy echo with the Bitcoin Act 2025 proposed by Senator Senator Cynthia, which aims to establish a legal framework for government holding digital assets. The initial reserves are expected to come primarily from cryptocurrencies seized by law enforcement, a practice that has become practiced in the Justice Department's actions in recent years.

Behind this ambition is led by the White House’s accelerated national strategic goal of digital assets. In addition, the White House is developing a national digital asset framework to clarify federal government policies on key crypto issues such as tokenization, staking and stablecoins.

Hines emphasized in particular that the government’s goal is not only to accumulate Bitcoin reserves, but also to systematically reshape the US financial infrastructure and make blockchain technology a core tool to improve payment efficiency and enhance fiscal transparency.

However, these ideas still need to cross the threshold of Congress legislation. Some lawmakers have questioned the accounting treatment of "gold revaluation", worried that it may set a precedent for unconventional fiscal operations.

Some market insiders also pointed out that the large-scale holding of Bitcoin by the government may change the supply and demand structure of the cryptocurrency market and even affect its price discovery mechanism.

What do you think? Do you agree with the government in establishing Bitcoin reserves without the need for additional taxpayers?

#Bitcoin Reserve #Cryptocurrency Policy #Blockchain Technology

吴说区块链

币圈小白

04-15 12:12

According to a Central Banking survey of 91 central banks around the world, the proportion of central banks planning to invest in digital assets in the next five to 10 years has dropped sharply to 2.1% from 15.9% last year. At present, no central bank actually holds crypto assets, and only one respondent supports the establishment of a strategic Bitcoin reserve, with nearly 60% clearly opposing it. The survey was conducted in early 2025, predating the U.S. government’s announcement of the establishment of a national reserve of Bitcoin. (Ledger Insights) https://t.co/HxFK9RViGc

Pomp 🌪

币圈小白

04-15 06:05

I went to the White House to interview @bohines about the government's crypto program.

We talked about U.S. strategic bitcoin reserves, stables, regulations, how to make decisions, gold, tariffs, law enforcement, law enforcement, internal motivations of Trump administrators, by far the biggest surprise and what BO is looking forward to.

enjoy!

YouTube: https://t.co/e8byfzvrvg

Spotify: https://t.co/NHT22SF2HS

Apple: https://t.co/lgrvhxmors

Timestamp:

0:00-Introduction

0:30-US Bitcoin Strategic Reserves

6:06-What does Trump think about Bitcoin

8:28-Transfer news about Bitcoin to Americans

14:30 - Stability legislation and the US dollar

22:06 - Critics and the media

25:43-Did other countries and governments lend a helping hand?

29:11-How other agencies can help and decide

34:09-Implement blockchain technology to the current banking system

38:33-Gold, Bitcoin and Tariffs

40:25-How to restore trust and build relationships in cryptocurrencies

42:44-How to predict where the world is going

45:00-Inspirationality within the Trump administration

54:52-Bitcoin law enforcement party

58:06 - The bottom-up story of balancing Bitcoin with institutions

1:03:06-The biggest surprise so far, what is Bo looking forward to?