Original title: "Addressing the cyclical nature of BTC gradually disappearing from the perspective of on-chain data"

Original author: Mr. Berg, on-chain data analyst

BTC, which is in the name of digital gold, is still young, and the disappearance of the four-year cycle is the only way to go.

Key Points:

· The strong periodicity of BTC is inevitably gradually disappearing

· Two tops in 2021: All defeats of the Kezhou Jue Sword Sect

·For the first time in history: a huge change in the chip structure of URPD

· Analysis methods after periodic disappearance & coping strategies

The periodicity that will inevitably disappear

I believe that most people in the currency circle are familiar with the strong cyclical nature of BTC. From the design of halving production every four years, BTC's price trend seems to correspond perfectly to it.

At the end of 2013, the end of 2017, and the end of 2021, the three periodic tops were accurately corresponded to each four-year rule, making countless market participants regard it as the standard.

However, from the perspective of scientific research, it is obvious that a simple carving boat to seek swordsmanship cannot draw rigorous conclusions.

As the influence of halving production gradually decreases and the growth of market value, there is no longer any view that can stand the test of science and support the four-year cycle theory.

If the cyclical disappears in the future, how should we, as traders, deal with it?

The strongest group: market participants who hold for a period of 1 to 3 years

Historically, there was a group whose behavior always perfectly corresponded to the bull and bear cycle of BTC. This group is market participants who have "holding for a period of 1 to 3 years".

(Chart description: the proportion of market participants who have held for 1-3 years)

We can clearly see:

· Whenever this proportion bottoms out, it always corresponds to the top of the price cycle

· Whenever this proportion reaches its peak, it always corresponds to the bottom of the price cycle

In plain words, whenever the price of BTC peaks, they just sold out; and whenever the price of BTC bottoms out, they just accumulate a lot of chips.

The answer is currently impossible to give an answer, but it is obvious that the emergence of the bull and bear cycle is inseparable from them.

In this chart, there are three points worth noting:

1. After every cycle, the reason behind the increase of the lowest value of this proportion is not difficult to speculate: more and more participants choose to hold BTC for a long time.

2. At present, the proportion of this group is beginning to "increase", which echoes my logic of bearishness from the end of last year. For details, please refer to my previous post (there are subsequent updates in the comment area):

Detailed analysis of on-chain data: Maybe you need to be prepared to escape the top at any time https://x.com/market_beggar/status/1878653495311839475

3. It can be reasonably speculated that the bottom value of this proportion will only become larger and larger in the future. From obscurity to the listing of US ETFs and competing with gold, as BTC gradually enters the world's eyes, more people are willing to hold BTC.

Two tops in 2021: All defeats of the Kezhou Jue Sword Sect

Previously, I have written several articles specifically discussing the Double Top in 2021.

Among them, I clearly cited the special characteristics of the 2021 double tops and explained in detail why we cannot carve a boat and seek a sword.

Article link: https://x.com/market_beggar/status/1891335031177851380

Combining today's topic, I will analyze from another perspective:

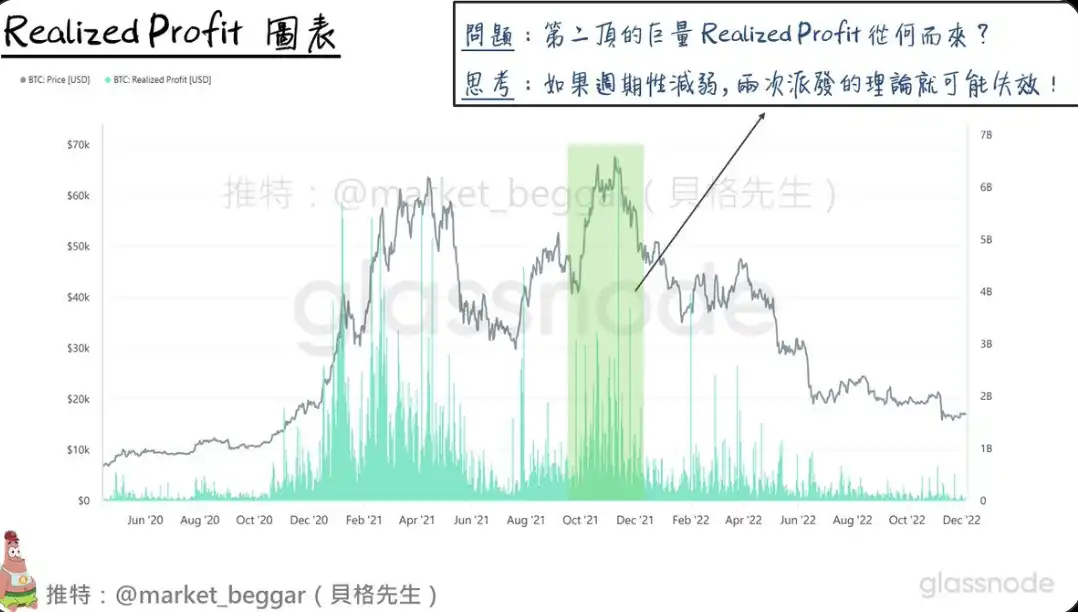

(Chart description: Realized Profit has been realized)

The so-called Realized Profit is based on the principle of UTXO on-chain accounting, which counts how much profit you have every day to make a profit.

In my top post, I also mentioned: Whenever a concentrated and huge amount of Realized Profit appears, it means that there are a large number of low-cost chips sold and cashed out, which is a warning message

For detailed analysis logic, please refer to the following:

Top signal tracking: Huge amount of Realized Profit reappearance https://x.com/market_beggar/status/1882645089786450368

From the perspective of on-chain data, in fact, the cycle ended in April 2021 (the first top) (https://x.com/market_beggar/status/1889878465056481309); but subsequently, due to various factors, BTC created a second top in November 2021.

As shown in the figure above, when the second top appears, it is also accompanied by a huge amount of Realized Profit. Then the question is: "Where does this huge amount of Realized Profit come from?"

Based on the first picture, the proportion of the group that held for 1 to 3 years at that time actually bottomed out in April 2021. Therefore, the huge number of Realized Profits that appeared at the second top can only be derived from the group that accumulated chips from "May to July 2021".

Here are the points worth thinking about:

If the cyclical nature gradually disappears in the future, will there be more such situations that "short-bottoming" will start a new round of main upward wave after starting a "short-term bottoming".

As I mentioned in my previous article, the top of the past is often accompanied by two large-scale distributions, and this cycle did indeed see the second large-scale distribution in December last year. But if the future volatility decreases, will it take only one time to complete the new bull and bear cycle conversion of BTC?

Worth pondering.

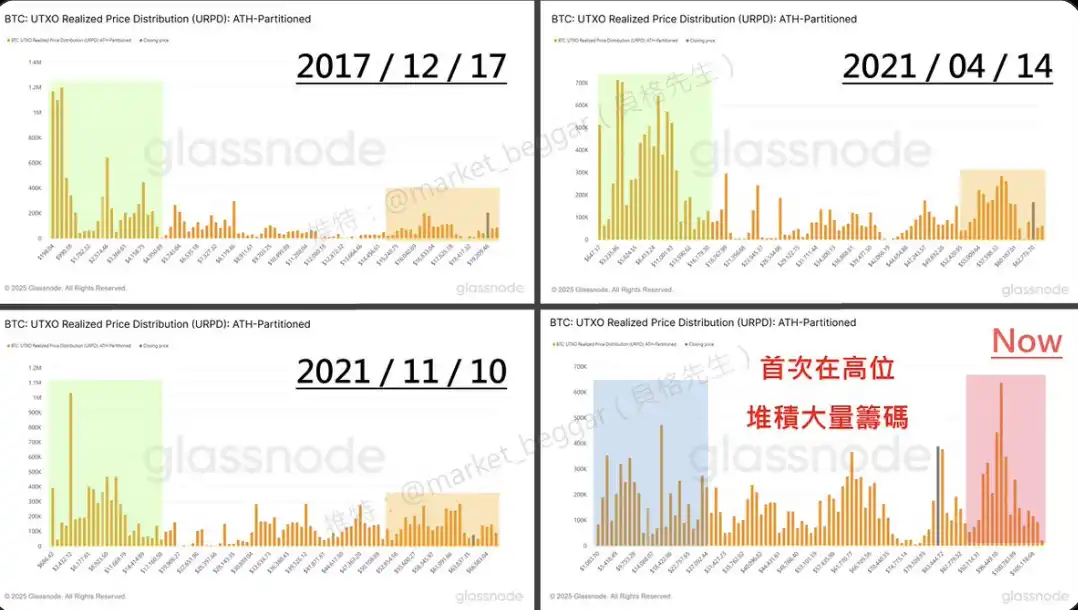

For the first time in history: The huge change in the chip structure of URPD

Next, let’s talk about this topic from the perspective of chip structure.

(Chart description: Comparison of URPD chip structures at the top of the past three cycles)

You can see: This cycle is the most special one so far.

This is because:

This is the first time in history, after the second large-scale distribution, a cycle of huge chips accumulated in the top area.

Previously, I have also written an article to discuss this issue, and the detailed views can be seen below:

BTC chip analysis: Talking about the biggest potential chip structure risks on URPD https://x.com/market_beggar/status/1887430338009567304

Based on this, we may have to admit that BTC is entering a whole new era.

Analysis methods and coping strategies after periodic disappearance

If the future cyclicality is indeed continuous as expected,

So, as traders, how should we examine the market?

Let me first talk about the conclusion: never carve a boat and seek a sword, and analyze it with the logic of deduction

During the BTC youthful life cycle, the sample number is severely insufficient.

The theories of countless Kezhou Schools have been overturned one after another.

The copycat season, the new year must rise, and the n-day must rise after halving... etc., the family tradition is not enough to be prepared,

Not to mention the various indicators that were beaten up in 2021.

Therefore, in order to overcome the problem of insufficient sample number, we have

The existence of logic must be ensured as much as possible.

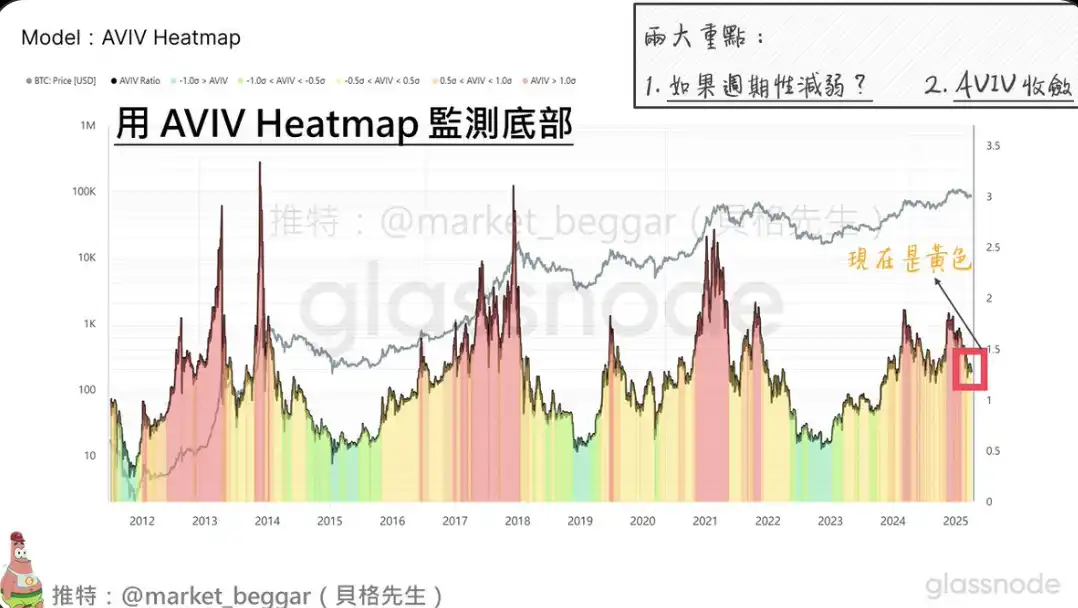

Here is an example: AVIV Heatmap.

AVIV, which can be regarded as an optimized version of MVRV,

Calculately targeting active (rather than immovable) chips, and part of the miner's impact is excluded.

AVIV Heatmap is one of the models I personally designed.

The AVIV is used to color according to its deviation by using the characteristics of mean regression.

The advantage of this analysis method is that the deviation degree is calculated in consideration of "standard deviation".

The standard deviation is an indicator that directly reflects BTC volatility

Therefore, as volatility decreases, the criteria for defining extreme values in AVIV Heatmap will also be relaxed.

Conclusion

A brief summary:

1. As the market matures, cyclical disappearance is the only way to go

2. The bargaining chips for 1 year to 3 years have dominated the bull and bear cycle in the past

3. The emergence of the double top in 2021 declared the failure of the methodology of carving the boat to seek swords.

4. The chip structure has undergone a huge change that has never happened.

5. As a trader, you must ensure logic during the research process to ensure the availability of results.

BTC is still young and is moving towards the world's vision at an unprecedented pace.

And you and I will both be witnesses to this historical feast.

No comments yet