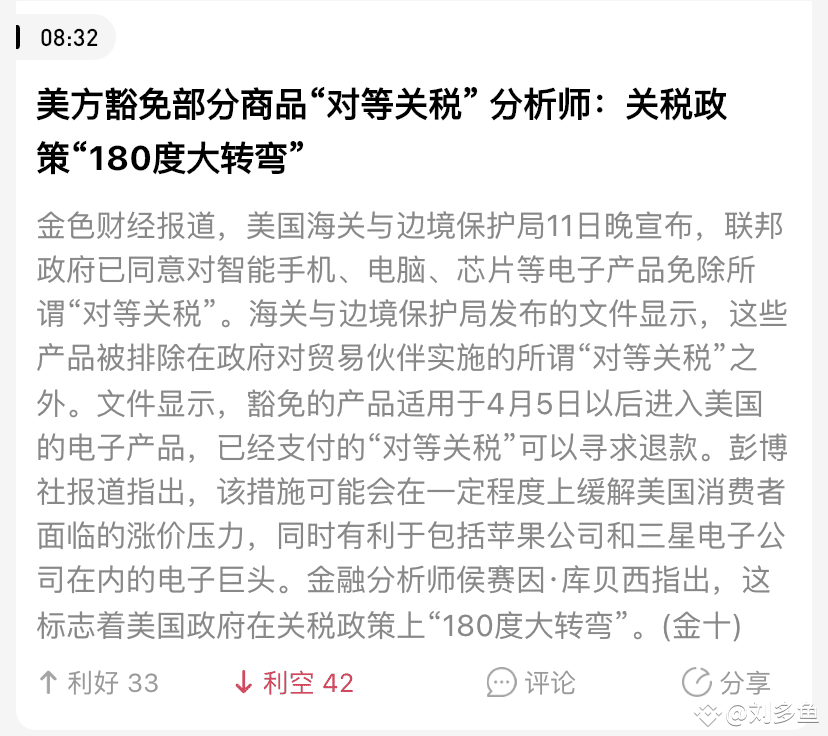

After this tariff war, asset diversification will be more abundant. What’s interesting is that no one cares about these things a month ago, no one cares about these things three months ago, and no one cares about these things half a year ago.

No matter how tortuous the process is, the ending is destined to play a game of printing money to create dreams for a long time. This world has been firmly trapped by institutional debt, financial illusions and asset bubbles. It can only be maintained by printing money to continue dreaming.

The United States does have the existence of human light in the field of science and technology, but capital has formed a certain stable class structure in a long-term moderate state. Is it possible that even if these people break the original deep government pattern, they themselves will become deep government?

The reason for the deficit is multiple factors, not dependent on tariffs. Trump is destined to bow his head simply by putting pressure on tariffs. Many factors such as social system, wealth structure, etc. are combined. The wealth of the United States is consumed in scientific research projects such as medical care, life extension, brain machines, artificial organs, etc. every year at an astonishing rate. This part of the investment has long exceeded the US military's expenses. The world's rich people all have the dream of Qin Shihuang, and they invest a large amount of funds in the field of biomedicine. The huge investment is all for prolonging life. Scientific research results are also provided to a small number of groups to enjoy. The United States' investment in this field is the best for mankind.

The imperial disease cannot be solved overnight. The structural problem is that it is not caused by mistake in choices, but the result of natural economic evolution.

$BTC $ETH $BNB #btc #eth #bnb

{spot}(BNBUSDT)

{spot}(ETHUSDT)

{spot}(BTCUSDT)